Proactive Investors -

- FTSE 100 hit session high at 7,950.46

- Dow Jones pokes higher ahead of ISM data

- BoE governor says 'nothing is decided' yet on interest rates

Eurozone inflation stubborn

After releases on Tuesday showed inflation in France and Spain accelerated unexpectedly in February, a German flash estimate on Wednesday put that country's inflation rate harmonized with the rest of the EU at 9.3% last month, which would be an increase from 9.2% in January.

Overall eurozone inflation figures are due out on Thursday.

In other data from the region, Italy’s statistics office reported full-year GDP growth of 6.8%, and PMI figures showed French manufacturing output declined after a strong performance in January, but the picture was brighter in Italy and Spain.

JLR looks to charge

Jaguar Land Rover’s owner has reportedly asked the UK government for more than £500mln in state subsidies to build a battery factory in Somerset, according to newspaper reports.

Tata Motors, part of the Indian conglomerate that owns Jaguar Land Rover (JLR), has asked for the money in the form of grants and support packages such as assistance for energy costs and research funding, the Guardian understands.

The carmaker is choosing between a potential site in Somerset and another in Spain, according to the Financial Times, which first reported the £500mln figure.

Spain has been offering large grants to companies considering battery production, in the hopes that it can attract the new industry with the potential for cheap solar power.

Reds on the block

Liverpool Football Club and owner FSG are said to be looking at major media companies as potential investors, according to reports.

Last week, FSG’s principal owner John W Henry confirmed to the Boston Globe that he would be seeking investment for Liverpool, distancing themselves from talks of a potential sale of the club.

Rumours have since circulated on where this investment would come from, with Singapore’s sovereign wealth fund and RedBird Capital, which bought a 10% stake in FSG in 2021, said to be attracted to the idea of a stake in the Premier League club.

According to the Telegraph, however, one interested party could be US media giant Liberty Media, which began life in 1991 as a spin-off from cable television group TCI.

Here’s a quick recap on the biggest risers and fallers of the day so far

Aston Martin Lagonda Global Holdings PLC (LSE:AML) shares revved 18% higher as results for 2022 were boosted by a strong fourth quarter.

While results from the luxury British carmaker did not really blow the doors off, delivered in the final months of th year were up 22% and the outlook for 2023 was solidified.

ValiRx PLC shares jumped higher in early trade after the company announced the incorporation of Inaphaea BioLabs Limited, a new wholly-owned subsidiary which will be the cornerstone of ValiRx's translational Contract Research Organisation (tCRO).

Around 9.00am, ValiRx shares were trading 6.7% higher at 12.00p.

Accrol Group Holdings PLC has signed a deal with Unilever PLC (LON:ULVR) to exclusively produce and sell a kitchen towel product under its Lifebuoy brand.

The company said the exclusive deal was part of its stated strategy to expand into higher margin, third-party licensed brands and the news sent shares up 4.8% to 48.5p on Wednesday in early exchanges.

International Personal Finance, the home credit business, shot up 12% to 108.2p after reporting an uptick in full-year pre-tax profits.

Profit before tax jumped 14.3% to £77.4mln, with a 6.5p final dividend, up 15% from 2021.

Inland Homes PLC (AIM:INL) shares tumbled more than 25% lower after it announced that its chair Simon Bennett and the group's other non-executive directors Carol Duncumb and Brian Johnson have resigned with immediate effect.

Artemis Resources Ltd shares dropped 10% in morning trading after the AIM and ASX-listed firm announced a capital raise.

Wall Street expected to join global markets merriment

With Asian stocks getting the new month off to a good start (Hong Kong up over 4%!) and Europe continuing the money-making mood (FTSE up 0.9%), US stocks are expected to add to the buoyancy.

Upbeat China data was the spark, following an up-and-down few days, with Wall Street finishing in the red last night.

Now we are in a new month, we are starting to get new data from February, with US manufacturing data later will start to build a picture of how the economy fared last month.

Futures for the Dow Jones are pointing to a 0.2% rise for Wednesday, the same as for the broader S&P 500 index, while contracts for the Nasdaq-100 are up almost 0.4%.

All three major US indices closed out a volatile month in the red on Tuesday, with the Dow losing 4.2% over February, the S&P falling 3.6% and the tech-heavy Nasdaq Composite ending 3.05% lower – compared to a near-1.5% gain for the FTSE.

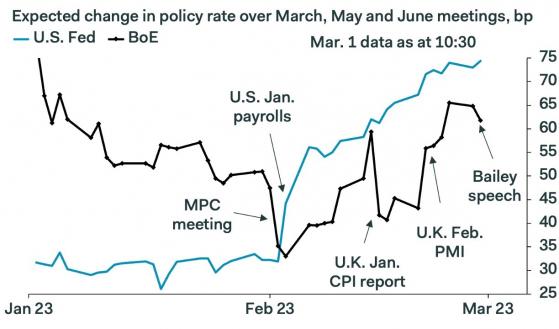

"January economic data generally surprised on the upside leading to a rapid repricing in terminal rate expectation for US rates,” said analyst Patrick Munnelly at TickMill.

"The debate amongst market watchers is the extent to which this bump in activity data was due to milder than usual weather and so February releases are expected to give a cleaner read on the underlying nature of activity in the US."

The ISM manufacturing purchasing managers' index (PMI), coming ahead of its services counterpart on Friday, will be among the first of the February readings and so "are likely to be parsed particularly closely by investors," he added.

Street consensus is looking for a continuation of the sub-50 headline figure, with a slight improvement to -48 from -47.4 in January.

Elsewhere a "potentially ominous development" was reported by Bloomberg, citing data from UBS that showed S&P 500 operating cash flows trailed profits by the most on record and that earnings have "started to expand noticeably faster than cash is coming in the door".

On the corporate earnings front, Salesforce, Lowe’s, Dollar Tree (NASDAQ:DLTR) and Budweiser report today as the fourth-quarter 2022 reporting season draws to a close - while the investor day for Tesla Inc (NASDAQ:TSLA) is highly anticipated at 3pm Central Time (4pm in New York and 9pm in London), with investors looking to hear the new 'Master Plan' from CEO Elon Musk.

Heading lower after results released overnight are another EV maker Rivian Automotive Inc, which is heading for a 9% plunge after falling well short of Q4 revenue expectations, and space tourism company Virgin Galactic Holdings Inc, with a 2% decline in pre-market trading after its losses rocketed ahead of the start of commercial flights in the coming quarter.

Plan for empty supermarket shelves

Following all the recent stories about empty supermarket vegetable aisles, UK farmers have called for more government support and more "fairness" from their customers in the food and supermarket sectors.

A new strategy launched by the National Farmers Union to boost UK horticulture "could be the solution to minimising future supply chain disruption", it said.

NFU president Minette Batters said: "The consequences of undervaluing growers can be seen on supermarket shelves right now. Shelves are empty. This is a reality we’ve been warning government about for many months.

"Without urgent action there are real risks that empty shelves may become more commonplace as British horticulture businesses struggle with unprecedented inflationary pressures, most notably on energy and labour costs."

AB Foods is one of the top risers on the FTSE at the moment, but that's unconnected and more to do with HSBC (LON:HSBA) upgrading its rating to 'buy' with a price target of 2,530p versus the current 2028p.

Other notable broker changes today include Canaccord initiating coverage of publisher Future PLC (LON:FUTR) with a 'sell' rating and a price target of 1,153p versus the last close at 1,402p.

Some investor favourites have seen some changes too, with British Airways (LON:ICAG) owner IAG getting higher price targets from Goldman Sachs (NYSE:GS) upping to 168p from 150p but remaining 'neutral' and similar from JPMorgan (NYSE:JPM), upping its Madrid-listed shares to €2.20 from €2 but still 'neutral' with the shares trading at 154p and €1.75.

Deutsche Bank (ETR:DBKGn) has raised its target for Rolls-Royce Holdings PLC (LON:RR) to 160p from 136p and reiterated a 'buy' on the back of the recent "strong" numbers and expected improvement in the core civil aero business.

"We have raised 2023-2025 sales and operating profit forecasts by an average of 6% and 19% respectively," the DB analysts said, but this does not reflect the impact from the as-yet-unannounced results of the planned transformation programme.

Read more on Proactive Investors UK