Proactive Investors -

- FTSE 100 tumbles, down 58 points

- IMF cuts UK GDP forecast for 2023

- Mortgage lending slumps in December

1.00pm: US markets seen lower as FOMC meeting starts

Wall Street is expected to end the month on the back foot as investors take profit following January’s strong run and await the outcome of the US Federal Reserve’s interest rate decision.

Futures for the Dow Jones Industrial Average fell 0.4% in Tuesday pre-market trading, while those for the broader S&P 500 index dropped 0.5% and contracts for the Nasdaq-100 shed 0.6%.

The major US indexes all finished in the red on Monday, with corporate earnings reports also weighing on the market. At the close, the DJIA was down 0.8% at 33,717, the S&P 500 dropped 1.3% to 4,018 and the Nasdaq lost 2% to 11,394, its biggest daily fall so far for 2023.

Investors are starting to "show some fear" as the Federal Open Market Committee (FOMC) starts its two-day rate-setting meeting today, commented Neil Wilson, chief market analyst at Markets.com.

“There is genuine doubt among bulls here – they know the Fed can drive a horse and coaches through their recovery by pushing back strongly against the loosening in financial conditions we have seen in recent weeks,” he added. “Stocks have had a good run higher this year so some profit-taking ahead of the uncertainty of the Fed makes sense too.”

Wilson noted that the market is currently pricing a 98.6% chance the FOMC votes to raise rates by 25 basis points, and a roughly 85% chance for one last hike in March. This setup creates ample opportunity for a hawkish surprise from the Fed - including how high rates will peak and how long they will stay there, he said.

Companies reporting quarterly earnings today include ExxonMobil (NYSE:XOM), Samsung (LON:0593xq), Pfizer (NYSE:PFE), McDonald's and Caterpillar (NYSE:CAT), among others.

12.50pm: Darktrace PLC (LON:DARK) hits back at short seller

Darktrace PLC has issued a statement to the London Stock Exchange after shares in the cyber security company fell heavily for the second day in a row.

The company was responding to Quintessential Capital Management, which it said recently announced a 0.86% short position, and which today has published a report in relation to Darktrace.

In response, Darktrace commented: ""We have never been contacted by the authors of this report for information.".

"As a UK listed business, our management team and board take our fiduciary responsibilities very seriously and have full confidence in our accounting practices and the integrity of our independently audited financial statements."

"We have rigorous controls in place across our business to ensure we comply fully with IFRS accounting standards. We're proud of the business we have built, which today helps to protect over 8,100 customers around the world from cyber disruption."

Shares were 9% lower.

12.40pm: PWC stares into the crystal ball

PWC has joined in the prediction game forecasting global gross domestic product (GDP) expansion of around 1.6% in 2023, less than half its long-term average of around 3.5%.

“We expect US economic growth will slow to 0.2% as the world's largest economy enters a mild downturn but avoids a technical recession.”

“While the economic outlook in the Eurozone and the UK is bleaker given the reduced supply and higher prices of natural gas” the report said.

Our latest Global Economy Watch report suggests that with COVID-19 restrictions having been lifted in virtually every country, 2023 will be a strong year for air transport and tourism. Download our report to find out more: https://t.co/Qd6hh0hbR6 #GlobalEconomyWatch pic.twitter.com/QF4a3ucEjr— PwC UK (@PwC_UK) January 31, 2023

But PWC said in its Global Economy Watch that it expects the peripheral Eurozone economies to overperform their core counterparts.

India is predicted to be the fastest growing G20 economy and Indonesia the fastest growing Southeast Asian economy.

PWC sees Chinese GDP expanding by around 4.7% although it noted a considerable degree of uncertainty as the country shifts away from its zero-COVID policy.

“This will be one of the big themes we will be monitoring in the first half of 2023” PWC said.

In other predictions for 2023 PWC said inflation will fall sharply but remain above-target, house prices will fall or flatline in most advanced economies, air traffic will near pre-pandemic levels in North America and the Middle East as tourism recovers and crude oil prices will bottom out at around $80/barrel.

It also predicted half of all electric vehicles (EV) on the road globally will be in China.

12.30pm: Brexit costing UK £100bn a year - Bloomberg

Brexit is costing the UK's economy £100bn a year as the split has left British businesses struggling to attract investment and hire workers.

On the third anniversary of Britain leaving the bloc, the nation’s economy is 4% smaller than it might have been according to analysis by Bloomberg Economics.

Business investment in the UK has grown 19% less than the average across G7 economies, it showed.

Economists Ana Andrade and Dan Hanson said: "Did the UK commit an act of economic self-harm when it voted to leave the EU in 2016? The evidence so far still suggests it did.”

"The main takeaway is that the rupture from the single market may have impacted the British economy faster than we, or most other forecasters, expected."

The report comes as the IMF downgraded growth forecasts for the UK and well known businessman, Guy Hands, slammed Brexit calling it a “complete disaster” and a “bunch of total lies.”

12.16pm: Tesco (LON:TSCO) picks up Paperchase

In a fast moving story Tesco PLC has now confirmed it has bought the Paperchase brand and its intellectual property.

The deal comes only shortly after the stationery chain said it had fallen into administration (11.16am update), putting 800 jobs at risk.

While earlier Sky were reporting Tesco's interest (see 9.09am update).

Jan Marchant, managing director of home and clothing at Tesco said: Paperchase is a well-loved brand by so many, and we're proud to bring it to Tesco stores across the UK."

Tesco confirms it has bought Paperchase brand only.Means 800 jobs will lost and all 100 shops will shut.

Greeting cards chain was bought just 4 months ago after private equity firm Permira dumped it, it went through pre-pack in 2021 and a restructuring in 2019.Long suffering. pic.twitter.com/34f0BnqSUF

— Ashley Armstrong (@AArmstrong_says) January 31, 2023

"We have been building out plans to bring more brands and inspiration to the ranges we currently offer, and this will help us to take those plans further."

"We look forward to sharing more with our customers in due course."

12.00pm: Insolvencies in England and Wales at highest levels since 2009

The number of companies collapsing into insolvency in England and Wales has hit its highest level since shortly after the financial crisis, after jumping over 50% last year.

There were 22,109 company insolvencies registered in 2022, official figures show, which is the highest number since 2009 and 57% higher than in 2021.

There was a swift rise in business insolvencies over 2022. ????Overall, ~23k businesses became insolvent, the highest since at least 2012.

❗️ Insolvencies grew faster in retail, with ~2k retail businesses becoming insolvent, almost double last year. pic.twitter.com/Db7xDcukbw

— Harvir Dhillon (@HarvirDhillon) January 31, 2023

The Insolvency Service, which released the data, said: “The increase compared to 2021 was driven by the highest annual number of Creditors’ Voluntary Liquidations (CVLs) since the start of the series in 1960.”

CVLs hit their highest number since records began in 1960, the government's Insolvency Service said. Compulsory liquidations were still below their pre-pandemic level last year.

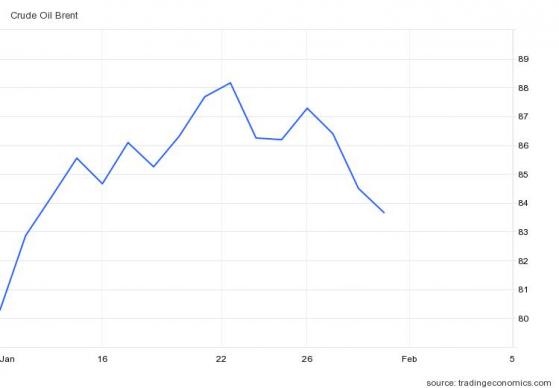

11.45am: OIl price slides

Brent crude futures dropped to near three week lows as signs of robust Russian exports and fears of a global economic slowdown rattled investors.

Russian oil producers have been able to secure export deals despite Western sanctions and price caps, as India and China have continued buying Russian oil sold at a discount.

On top of that, investors fretted about the global economy's health as central banks worldwide moved aggressively to tackle inflation.

As a result Brent crude fell 1.1% late morning to US83.57 pulling shares in BP PLC (LON:BP) and Shell (LON:RDSa) down 1.6% and 1.25% respectively.

This is all adding to the pressures facing the FTSE which is around 70 points lower as we head towards midday.

11.16am: Paperchase appoints administrators - reports

Paperchase has appointed administrators after failing to secure a rescue deal, according to the BBC.

It said its shops would continue running in the "short term", with all stores remaining open and trading as normal.

The chain, which is 50 years old, has 106 stores in the UK and Ireland and 820 staff.

It is the second time since 2021 the firm has fallen into administration.

Begbies Traynor (LON:BEG), who have been appointed as joint administrators, said in a statement: "Unfortunately, despite a comprehensive sales process, no viable offers were received for the company, or its business and assets.

"However, there has been significant interest in the Paperchase brand and attendant intellectual property."

Sky News reported earlier (see 9.09am update) that Tesco (LON:TSCO) was looking into about buying Paperchase's name and other intellectual property

11.01am: Eurozone GDP grows but remains sluggish

John Leiper, chief investment officer at Titan Asset Management said it was “great to see euro zone GDP coming in better than expected at 0.1% in Q4” which he suggested was “quite an achievement given the notable headwinds facing the region.”

But he cautioned that “we think this increases the odds that the ECB follows through with its intended rate hike cycle, meaning the region isn’t out of the woods just yet as we start what is likely to be a tricky 2023.”

Tom Hopkins, portfolio manager at BRI Wealth Management, said while the news made for a positive headline “it is the third consecutive quarter of slowdown in the eurozone economy.”

But he believed “the outlook has brightened in recent weeks, thanks to benign winter weather, which had reduced gas demand coupled with the end of China’s zero-Covid policy.”

“Whilst recession in Europe is still on the cards for some point in 2023, it’s likely to be much shallower than originally feared” he predicted.

Melanie Debono, senior Europe economist, at Pantheon Macroeconomics forecast growth would still decline in quarter one as higher interest rates and tighter lending standards discourage investment while still-high inflation keeps a lid on household spending.

“We look for a 0.2% quarter-on-quarter decline in GDP in Q1” she said, adding “this will embolden the ECB to continue on its steep tightening path to fight inflation.”

ING Economics argued “that the discussion about a recession has become semantics at this point.”

“Growth has slowed to the point of stagnation” while the “worst scenarios have been avoided due to longer than expected pandemic reopening effects, extraordinarily warm weather which has eased the energy crisis substantially and more government support.”

“This means that an economy performing sluggishly, at best, is expected for early 2023 and a dip below zero cannot be ruled out for the first quarter” ING forecast.

10.33am: Hands weighs in on Brexit again on 3rd anninversary

Guy Hands, the founder, chair and chief investment officer of the private equity firm Terra Firma, has called Brexit a “complete disaster” and a “bunch of total lies” that has harmed large parts of the economy.

Speaking to BBC Radio 4’s Today programme on the third anniversary of the UK’s departure from the EU, Hands, slammed the move.

“It’s been a complete disaster. The reality is it’s been a lose-lose situation for us and Europe” he said.

“Europe has lost more [in financial services] but we’ve lost as well. And the reality of Brexit was, it was just was a bunch of complete and total lies.”

“The only way that the Brexit put forward by Boris Johnson was going to work was if there was a complete deregulation of the UK and we moved to a sort of Liz Truss utopia of a Singapore state and that was just never going to happen,” Hands stated.

“The British population was never going to accept a state in which the NHS would be demolished, where free education would be severely limited, where regulation with regard to employment would be thrown apart. It was just complete and total absolute lies.”

He added: “The biggest issue about it, and you can take the Brexit bus as a good example, is the lies that Boris Johnson and the Conservative party told about the NHS. In fact what they did was throw the country and the NHS under the bus.”

10.25am: Eurozone grows 0.1% in quarter four

The eurozone grew by 0.1% in the last quarter of 2022, according to preliminary data just released by Eurostat.

That’s a slowdown on the third quarter of last year, when the euro area expanded by 0.3%, but it beats forecasts of a 0.1% contraction.

Euro area #GDP +0.1% in Q4 2022, +1.9% compared with Q4 2021: preliminary flash estimate from #Eurostat https://t.co/U8NTPUudEJ pic.twitter.com/xYrlTg6HQT— EU_Eurostat (@EU_Eurostat) January 31, 2023

Ireland (+3.5%) recorded the highest quarterly increase in GDP, followed by Latvia (+0.3%), and Spain and Portugal (both +0.2%), while France had earlier reported growth of 0.1%.

On the downside were Lithuania (-1.7%) as well as in Austria (-0.7%) and Sweden (-0.6%). Germany’s economy shrank by 0.2%.

10.13am: Housebuilders under pressure as mortgage approvals tumble in December

Signs of a further slowdown in the housing market in figures released by the Bank of England (BoE).

The data showed that net borrowing of mortgage debt by individuals decreased from £4.3bn to £3.2bn with mortgage approvals for house purchases tumbling to 35,600 in December from 46,200 in November, the lowest since May 2020.

City pundits had expected a fall of 45,000.

This marked the fourth consecutive monthly decrease in mortgage approvals, the BoE said.

The ‘effective’ interest rate, the actual interest rate paid, on newly drawn mortgages increased by 32 basis points, to 3.67% in December, the report said.

Consumers also borrowed an additional £0.5bn in consumer credit, on net, compared with £1.5 billion borrowed in November.

Credit card repayments of £0.5bn were more than offset by £1.0bn of borrowing through other forms of consumer credit.

Shares in leading housebuilders came under pressure with the data adding to downbeat market mood. Persimmon PLC (LSE:LON:PSN), Redrow PLC (LSE:LON:RDW) and Bellway PLC (LSE:LON:BWY) were amongst those heading downwards.

9.40am: BAE's Asian potential undervalued - UBS

BAE Systems (LON:BAES) held in positive territory as the FSE 100 tumbled boosted by an upgrade to ‘buy’ from ‘neutral’ from UBS.

Relaunching its coverage the bank set a 1,050p price target believing consensus forecasts ignore the company’s long-term potential, especially in Asia, despite BAE’s strong position in the region.

The broker sees upside in munitions, Australia and potentially Japan while restocking European munition stockpiles is a central short-term focus for European customers.

As a result, UBS estimated BAE’s growing exposure could drive 15% CAGR between 2021-25 and up to 30% CAGR if supply chain issues ease.

UBS suggested it is not clear that AUKUS is factored in to valuations, given that material revenues are only likely from 2025 onwards while Japan joining Tempest is itself a “large, potentially overlooked, upside.”

UBS thinks the combination of Tempest and its credentials as a US contractor leaves BAE potentially uniquely positioned to benefit in Japan as it evolves to become a 50% larger market than France as soon as 2027.

“We see Q1 as catalyst-rich, as UK, Australia and Japan all announce defence reviews” the bank concluded.

Shares were trading 0.4% higher with the FTSE 100 now down 46 points, or 0.6%.

9.21am: Tesco (LON:TSCO) to cut 2,100 jobs

Like London buses you wait for one Tesco announcement and two come along.

Alongside reports that the food retailer may be looking at Paperchase comes news of a shake-up in management and the closure of hot counters and delis which will impact approximately 2,100 jobs.

Tesco store management shake-up plus other changes including pharmacy closures to hit 2,100 jobs— John-Paul Ford Rojas (@JPFordRojas) January 31, 2023

The reorganisation will also introduce around 1,800 new shift leader roles in stores, the UK's largest supermarket chain said.

The counters and hot delis will close from 26 February, Tesco added.

Jason Tarry, Tesco UK and ROI chief executive officer, said: "These are difficult decisions to make, but they are necessary to ensure we remain focused on delivering value for our customers wherever we can, as well as ensuring our store offer reflects what our customers value the most.

9.09am: Tesco to swoop for Paperchase - reports

Tesco PLC is poised to snap up the Paperchase brand in a surprise swoop according to reports.

Sky News has learnt that Britain's biggest supermarket chain is in advanced talks about buying Paperchase's name and other intellectual property through a pre-pack administration that could take place as early as Tuesday.

Exclusive: Tesco is in advanced talks to buy the Paperchase brand and other intellectual property assets out of administration later today, in a deal that will cast doubt over the future of hundreds of employees and scores of high street shops. Full story on @skynews shortly.— Mark Kleinman (@MarkKleinmanSky) January 31, 2023

But sources close to the situation said Tesco was unlikely to be interested in any of Paperchase's stores, meaning that most of its workforce may face the prospect of losing their jobs.

It was unclear on Tuesday morning whether any other suitors were in talks about a deal, Sky said.

9.05am: Rate anxiety holds equities back

The Footsie has extended its losses, now down 38 points, as investors prefer to remain side-lined ahead of this week’s interest rate calls.

Richard Hunter, head of markets at interactive investor, commented “Nerves got the better of investors as a potentially pivotal week unfolds.”

“Recession remains the single largest concern and for the US, the actions of the Federal Reserve may determine that outcome.”

“While another rate hike of 0.25% is fully expected this week, the accompanying comments will be of equal interest” he suggested.

“There is an increasing throng of optimistic investors who are not only pricing in that the aggressive hiking rate is coming to a close, but also that there is a possibility of interest rate cuts later in the year.”

But Hunter felt this assumption is one for “which they could be sorely disappointed and Federal Reserve Chair Powell is most likely to reiterate the mantra of “higher for longer” until such time as inflation is finally brought under control.”

Asian-focused stocks, which were higher yesterday, slipped today with banking giants Standard Chartered PLC (LON:STAN) and HSBC Holdings PLC (LON:HSBA) heading lower while global growth concerns hit mining companies Endeavour Mining PLC (LON:EDV), Anglo American (LON:AAL) and Fresnillo (LON:FRES).

Oil majors BP PLC (LON:BP) and Shell (LON:RDSa) also fell weighing on the index.

Irn-Bru maker AG Barr PLC fizzed 3.4% higher after saying it was set to deliver full-year profit "slightly ahead" of current market expectations following a strong second-half sales performance and an upgrade by HSBC to ‘buy’ gave a boost to Compass Group (LON:CPG) PLC which rose 2%.

8.48am: IMF cuts UK GDP forecast for 2023

More on the IMF's downgrade to UK GDP forecasts which leave it on course to be the worst performing G7 country in 2023.

The IMF predicted that UK GDP will fall by 0.6% this year, which is a 0.9 percentage point downward revision from October’s forecasts for growth of 0.3%.

Truly grisly assessment for the UK economy from the IMF this morning.- UK to fare worse than any other major economy this year

- worse even than Russia(!)

- Britain's downgrade came as most other countries saw their growth prospects upgraded

Full story:https://t.co/ATahkwWnqr pic.twitter.com/cRYaO5aa4P

— Ed Conway (@EdConwaySky) January 31, 2023

The Washington-based agency blamed the downgrade on tighter government spending policies and higher interest rates and the burden from still-high energy retail prices on household budgets.

But it wasn't all bad news and the IMF nudged up its outlook for UK growth in 2024 to 0.9%, up from the 0.6% expansion previously forecast.

Pierre-Olivier Gourinchas, the IMF’s economic counsellor, said 2023 would be “quite challenging” for the UK as it slipped from top to bottom of the G7 league table.

He added: “There is a sharp correction.”

The UK growth downgrade came in the IMF’s update to its half-yearly World Economic Outlook.

Chancellor, Jeremy Hunt, responded by saying nearly all advanced economies were facing headwinds.

He said: “The governor of the Bank of England recently said that any UK recession this year is likely to be shallower than previously predicted, however these figures confirm we are not immune to the pressures hitting nearly all advanced economies.”

But Rachel Reeves MP, Labour’s shadow chancellor, suggested the forecasts show Britain needs a proper plan for growth.

“Britain has huge potential - but too many signs are pointing towards really difficult times for our economy, leaving us lagging behind our peers” she commented.

8.30am: Food price inflation hits new high

Grocery price inflation hit a record 16.7% in the 4 weeks to 22 January 2023 according to Kantar, the highest level since it started tracking the figure in 2008.

As a result, households will now face an extra £788 on their annual shopping bills if they don’t change their behaviour to cut costs, Kantar said.

Fraser McKevitt, head of retail and consumer insight at Kantar, commented: “Late last year, we saw the rate of grocery price inflation dip slightly, but that small sign of relief for consumers has been short-lived.”

“Grocery price inflation jumped a staggering 2.3 percentage points this month to 16.7%, flying past the previous high we recorded in October 2022.”

McKevitt continued: “Competition in the British grocery sector is as intense as it’s ever been as retailers strive to retain shoppers.”

“The grocers have been doing this by boosting their own-label ranges especially, with sales of these lines growing consistently over the past nine months.”

“January was no exception as own-label lines grew by 9.3%, well ahead of branded alternatives which were up by just 1.0%.”

“Across the market the move is towards everyday low pricing, with many supermarkets offering price matching and using their loyalty schemes to help shoppers save.”

Aldi was the fastest growing grocer for the fourth month in a row this period, with sales 26.9% higher year on year. It now holds 9.2% of the market. Lidl’s sales jumped by 24.1%, putting its market share at 7.1%.

There was little to split Britain’s three largest retailers. Sainsbury’s sales increased by 6.1%, just 0.1 percentage point higher than Asda and Tesco, giving it 15.4% of the market. Tesco remains the largest British retailer with a 27.5% market share while Asda holds 14.2%.

Although its sales fell by 1.9%, Morrisons’ performance has continued to improve for the eleventh month in a row and its market share now stands at 9.1%.

Iceland’s share increased by 0.1 percentage point to 2.5%, driven by an annual sales rise of 10.6%. Ocado (LON:OCDO) matched the market’s growth rate at 7.6%, well above overall online sales which were down 0.7%. Convenience specialist Co-op has a 5.5% share of the market and Waitrose accounts for 4.7% of total sales.

8.15am: FTSE 100 opens lower

The FTSE 100 opened lower on Tuesday following falls in the US and Asia and after another downbeat assessment of the UK’s growth prospects.

Caution ahead of this week’s interest rate calls from the Federal Reserve, ECB and Bank of England added to the cautious mood.

At 8.15am London’s lead index was 15 points at 7,770 while the FTSE 250 fell 52 points to 19,886.

As if investors didn’t need reminding the IMF has weighed in with its assessment of the UK’s economic prospects cutting its 2023 GDP forecast by 0.9 percentage points and now predicting a contraction of 0.6% this year.

This would make it the worst performing G7 country in 2023, the Washington-based agency said.

IMF Growth Projections: 2023USA????????: 1.4%

Germany????????: 0.1%

France????????: 0.7%

Italy????????: 0.6%

Japan????????: 1.8%

UK????????: -0.6%

China????????: 5.2%

India????????: 6.1%

Russia????????: 0.3%

Brazil????????: 1.2%

Mexico????????: 1.7%

KSA????????: 2.6%

Nigeria????????: 3.2%

RSA????????: 1.2% https://t.co/4ifKc9qi4j #WEO pic.twitter.com/qELAmtqXLP

— IMF (@IMFNews) January 31, 2023

Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown (LON:HRGV) said: “Ultimately, the UK has a productivity and demand problem, which when put together creates a very difficult environment.”

“There’s a chance the UK could muster a better performance than the IMF is predicting, given upgrades to expectations from other bodies in recent months.”

“The market will remain very sensitive to interest rate and inflation readings until we have a clear path out of the stagnation.”

High prices were one of the reasons the IMF blamed for the downgrade and they were in evidence today as the monthly survey from Kantar showed grocery price inflation hit another record, rising 16.7% in January, adding a potential extra £788 to annual shopping bills.

Fraser McKevitt, head of retail and consumer insight at Kantar, commented: “Late last year, we saw the rate of grocery price inflation dip slightly, but that small sign of relief for consumers has been short-lived.”

“Grocery price inflation jumped a staggering 2.3 percentage points this month to 16.7%, flying past the previous high we recorded in October 2022.”

In corporate news, Pets at Home Group PLC (LON:PETSP) soared 9.25% after it upped its full-year guidance on the back of a good third quarter.

But British American Tobacco PLC (LON:BATS) was little moved by news of a shake-up of its global operations and Wickes Group PLC (LSE:WIX) slipped 1.4% despite predicting profits in line with guidance.

Peel Hunt noted the statement flagged c.£6mln of additional cost headwinds, £3.5mln of this in the form of pulling forward an additional pay award with the remaining £2.5mln from higher energy costs.

7.48am: BAT in operational rejig

A bit of a shake-up at British American Tobacco PLC which has decided to streamline its operations, cutting the number of business units and restructuring its regional set-up.

Under the plans the number of regions will be reduced from four to three, and the number of business units from 16 to 12, the FTSE 100 cigarette seller said.

The three new regions will be USA, Americas & Europe (AME) and Asia Pacific, Middle East & Africa (APMEA).

“The new structure will increase the efficiency of BAT's geographical footprint, optimise market prioritisation and will be based on fewer, larger business units, enabling even greater collaboration and accelerated decision-making across BAT” the company said in a statement.

Jack Bowles, BAT chief executive said the changes “will drive increased focus, accelerate our transformation and fuel growth as we strengthen the foundations of our future as a category-led enterprise."

Two new board roles will be created in order to ensure clarity of ownership, accountability and focus: chief transformation officer and director, Combustibles, BAT said..

7.32am: Wickes sees profits in line

Kicking us off today is trading news from Wickes PLC which has forecast adjusted pre-tax profits in line with market expectations after reporting strong quarter four trading with sales up 11.5%,

In a trading update, the building materials supplier reported particularly strong growth in its Do It For Me business where sales soared 34.5% on last year although the prior year was hit by the omicron outbreak.

Core like-for-like sales rose 5.2%, continuing the improving trend since the summer.

Local Trade sales again performed strongly, with the digital TradePro customer base ending the year at 746,000 (+18% year-on-year) although DIY sales remained below last year but stabilised towards the end of the quarter supported by sales of energy saving products.

The company also reported an easing in pricing pressures aided by reductions in the cost of timber and inflation, which was 9% in quarter four, “continues to trend lower.”

Wickes said the order book at the end of December was lower than 2021 but still above 2019 levels with orders in the fourth quarter down “moderately” versus last year but on an improving trend from the third quarter.

The company said this trend has continued and orders in quarter one to date are in line with the prior year.

As a result, the company predicted pre-tax profits in line with City forecasts which it put between £72mln to £76mln.

7.00am: Footsie to follow US and Asia lower

FTSE 100 is expected to open lower following losses in the US and Asia and as the IMF posted another gloomy assessment of the UK economy.

Spread betting companies are calling the lead index down by around 28 points.

The IMF has downgraded its UK gross domestic product forecast once again, predicting a contraction of 0.6% against the 0.3% growth pencilled in last October as Britain looks set to suffer more than most from soaring inflation and higher interest rates.

In the US markets ended the Monday nursing heavy losses with the Dow down 260 points, 0.8%, at 33,718, the Nasdaq Composite off 228 points, 2%, to 11,394 and the S&P 500 53 points worse off, 1.3%, to end at 4,018.

Asian equities followed New York’s path, despite new figures showing China's factory activity returned to growth.

In Tokyo, the Nikkei 225 index was down 0.4%. In China, the Shanghai Composite was down 0.4%, while the Hang Seng index in Hong Kong was down 1.6%.

In London, trading updates are expected from Pets at Home PLC and half-year numbers from ITM Power PLC.

On the economic front, consumer credit, mortgage approvals numbers and the latest Nationwide house price index are also due.

Read more on Proactive Investors UK