Proactive Investors - GSK PLC (LON:GSK) welcomes the decision of the British Columbia Supreme Court in Dussiaume v. Sandoz Canada Inc. 2023 BCSC 795, dismissing a proposed class action on behalf of a class of ranitidine users in Canada.

Since 2019 there have been 13 peer-reviewed epidemiological studies conducted looking at human data regarding the use of ranitidine. The decision recognises that after more than three years of extensive study, the scientific consensus is that there is no consistent or reliable evidence that ranitidine increases the risk for any type of cancer.

The Court stated: "Given the uncontroverted evidence that neither ranitidine nor NDMA are reliably associated with increased cancer risk, and the absence of evidence that ranitidine or NDMA cause cancer in humans, the plaintiff has failed to raise a bona fide triable issue regarding injury due to the ingestion and/or purchase of ranitidine."

GSK will continue to vigorously defend proposed class actions by ranitidine users that have been filed in Ontario and Quebec as well as individual actions filed by ranitidine users in Canada.

UK economy posts marginal growth in first quarter

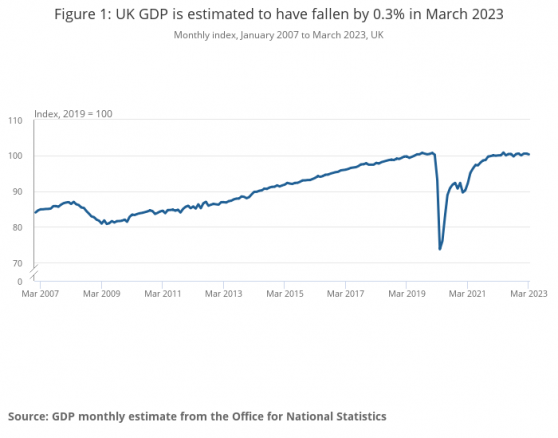

The UK economy grew marginally in the first three months of 2023 despite a contraction in March, according to the Office for National Statistics.

The ONS said in the first quarter GDP rose 0.1%, in line with economists forecasts, while in March the economy contracted by 0.3% after showing no growth in February (unrevised).

The services sector fell by 0.5% in March, after an unrevised fall of 0.1% in February, and was the main contributor to the fall in monthly GDP.

Output in consumer facing services fell by 0.8% in March, after unrevised growth of 0.4% in February.

Production output grew by 0.7% in March, which was its strongest monthly growth since May 2021, following a fall of 0.1% in February (revised up from a 0.2% fall).

The construction sector grew by 0.2% in March after growth of 2.6% in February (revised up from a 2.4% growth).

Services and production both grew by 0.1% in the three months to March 2023, while construction grew by 0.7%.

Bright start seen by FTSE, GDP figures in focus

Good morning. The FTSE 100 is expected to make a bright start on Friday with investors awaiting the latest health check of the UK economy after the Bank of England yesterday said it no longer expects a recession in the UK.

Spread betting companies are calling London’s lead index up by around 23 points.

On Wall Street, the Dow Jones Industrial Average fell 221.82 points, or 0.7% at 33,309.51. The S&P 500 shed 7.02 points, 0.2%, at 4,130.62 points while the Nasdaq Composite bucked the weaker trend once more rising 22.07 points, 0.2%, at 12,328.51.

In Asia, markets were mixed. The Nikkei 225 in Tokyo was up 0.9% in late trading. The Shanghai Composite was down 0.8%, while the Hang Seng in Hong Kong was 0.4% lower.

Back in London and the early focus will be a GDP reading and updates from Beazley and Balfour Beatty (LON:BALF).