Proactive Investors -

- FTSE 100 climbs 0.9%

- UK manufacturing data improves, inflation pressures ease

- Bank of England boss says 'nothing is decided' on interest rates yet

Midday: Optimism returns

The earlier speech from BoE boss Bailey is helping lift market sentiment, says analyst Naeem Aslam, fresh in his new role as chief investment officer at Zaye Capital Markets.

"Market players are a lot more optimistic as the governor of the Bank of England believes that the bank may take a break from hiking rates as things have started to flow in the direction that they desired.

"The fact that is this is good news from the Bank official who has been sending hawkish comments to the market which made many concerned."

London's blue chip benchmark is up almost 71 points or 0.9% at just over 7947.

It's the pre-eminent index in Europe this morning, with the DAX up 0.7% in Germany, CAC 40 up 0.8% in France, IBEX 35 rising 0.55% in Spain.

The overall STOXX 50 is up 0.86% at 4274.62, not far from its recent 18-month highs.

FTSE nearing 8000 again

London's miners and other China-linked blue chips are carrying the index back up towards its recent 8000 milestone, hitting an intraday high of 7950.

The latest Chinese manufacturing data has positive implications in terms of commodities demand, says AJ Bell investment director Russ Mould.

He also saw further evidence of the mining industry’s positive outlook in results from industry services provider Weir which unveiled an impressive increase in its dividend and posted a record order book.

“The strength in resources stocks helped make for a fragile housebuilding sector as Persimmon’s results created a stink and house prices continued to soften in the UK," said Mould.

Later on, US PMI data for the manufacturing sector is likely to be closely watched, he said, as investors "look for a way through recession risks and the implications for interest rates from better-than-expected data".

BoE undecided

Bank of England governor Andrew Bailey has given a speech where he emphasised that "nothing is decided" yet by the monetary policy committee about interest rates, which the market is putting its own spin on.

"At this stage, I would caution against suggesting either that we are done with increasing Bank Rate, or that we will inevitably need to do more.

"Some further increase in Bank Rate may turn out to be appropriate, but nothing is decided."

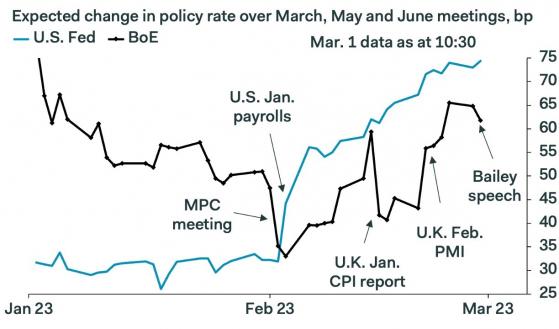

Markets are reducing their expectations for further increases in the base rate, having priced-in a further 65bp increase over the next three meetings before the speech.

"Rightly" so said Sam Tombs at Pantheon Macro, putting forward his firm's view that the meeting on March 23 will see no hike, but with a 40% chance of a 25bp rate rise.

"Either way, it is clear from Mr. Bailey’s speech that [the MPC] is placing more emphasis on the substantial tightening already delivered and would like to call time on its hiking cycle as soon as it feasibly can."

The FTSE just hit 7938, nears its week's high but has backed off a couple of points.

"may turn out" - to me suggests the base case leans towards no further increase.Subtly different to other options like "could" or even just "may". pic.twitter.com/wK4cndsTrO

— Andy Bruce (@BruceReuters) March 1, 2023