Proactive Investors -

- FTSE 100 falls 21 points

- Mixed picture for retailers

- Broker notes provide some support

10.15am: Amazon to shut three UK warehouses

Amazon.com Inc (NASDAQ:AMZN) has announced it is shutting three UK warehouses affecting 1,200 workers, including one in Gourock in Scotland with the loss of 300 jobs.

#Breaking Amazon has said it plans to shut three UK warehouses in a move which will impact 1,200 jobs pic.twitter.com/EaWv0QGlDM— PA Media (@PA) January 10, 2023

Amazon said: "We're always evaluation our network to make sure it fits our business needs.. As part of that effort, we may close older sites, enhance existing facilities, or open new sites, and we've launched a consultation on the proposed closure of three fulfilment centres in 2023..

"We're also planning to open two new fulfilment centres creating 2,500 new jobs over the next three years.

"All employees affecte by site closure consultations will be offered the opportunity to transfer to other company facilities."

9.35am: Retailers face a tough year

The FTSE 100 remains in the doldrums although it has managed to stay above the 7700 level.

The leading index is currently down 21.56 points or 0.28% at 7703.38.

Among the fallers is Scottish Mortgage Investment Trust PLC (LSE:SMT). The US technology investor is down 1.41% on concerns about higher interest rates hitting the sector.

Next PLC (LON:NXT) is 0.9% lower as Investec cut its rating from buy to hold despite last week's upbeat Christmas trading statement from the retailer.

On Friday Credit Suisse (SIX:CSGN) moved from neutral to underperform.

Retails face a tough time in 2023 with rising rates and the cost of living crisis.

According to the British Retail Consortium, total sales rose by 6.9% in December year on year, up from 4.2% in November.

But although there was a boost from World Cup and Christmas spending, much of the rise was due to higher prices, with sales volumes actually weaker.

Victoria Scholar, head of investment at interactive investor said: "Double-digit UK inflation is still sharply outpacing the level of retail spending, highlighting the rising cost burden businesses are having to, at least in part, pass on to consumers. With a looming recession, a softening consumer and ongoing inflationary pressures, the start of 2023 looks set to be challenging for the retail sector after the Christmas cheer fades and the reality of the cost-of-living crisis sets in.”

9.03am: French industrial improvement

Some positive news from the eurozone.

In France, industrial production for November has come in better than expected.

French Industrial Production (M/M) Nov: 2.0% (exp 0.8%; R prev -2.5%)-Industrial Production (Y/Y) Nov: 0.7% (exp -1.0%; prev -2.7%)

— LiveSquawk (@LiveSquawk) January 10, 2023

Meanwhile Goldman Sachs (NYSE:GS) is reportedly no longer forecasting a eurozone recession.

8.48am: Brokers help limit market fall

There are some bright spots among the general downbeat mood, helped by some broker recommendations.

Insurer Admiral Group Plc (LON:ADML) is leading the way in the blue chip index, up 1.36% after Deutsche Bank (ETR:DBKGn) moved from hold to buy.

And British Gas owner Centrica PLC (LON:CNA) has climbed 1.35% after Exane BNP issued an outperform recommendation.

Trading updates have received a mixed reception.

Card Factory (LON:CARDC) is up 5.62% after it brought forward its statement and reported strong Christmas trading despite the postal strikes. It now expects full year earnings to reach at least £106mln.

Electrical retailer AO World PLC (LON:AO) also issued unscheduled report, saying annual earnings would be ahead of expectations at between £30mln and £40mln. Previously it had forecast meeting the top end of a £20mln to £30mln range.

Its shares are 5.6% better.

But recruitent group Robert Walters PLC (LSE:RWA) has disappointed the market, pushing its shares 8.15% lower. Rival PageGroup PLC has fallen 5.91% in sympathy.

Victoria Scholar, head of investment at interactive investor said: “Robert Walters issued a profit warning forecasting full-year earnings to come in slightly below expectations. However annual profit is still expected to hit a record high. Its quarterly net fee income in China slumped by 24% weighed down by the authorities’ covid lockdown restrictions, which have been hampering activity in the world’s second largest economy. Overall headcount peaked in November and declined in December while it forecasts more muted growth across all regions and all forms of recruitment.

"Shares in Robert Walters are extending losses today with shares now down by nearly 40% over a one-year period. On the one hand, the recruitment firm has benefited from labour shortages which have prompted businesses to seek sourcing potential hire and filling key roles. On the other hand, the recruitment firm which in part specialises in technology has suffered amid the slew of job cuts in the sector. Plus the broader global slowdown when combined with China’s covid lockdowns has muted hiring activity as businesses batten down the hatches, putting recruitment plans on hold amid cost inflation pressures and a softening consumer outlook.”

And Games Workshop Group PLC (LON:GAW) is down 5.64% with pretax profit pre-tax slightly lower at £83.6mln.

8.09am: Market heads lower as investors focus on interest rates

Leading shares are on the slide after a bright start to the year, as investors focus again on the prospects for interest rates.

The FTSE 100, which hit its highest levels for more than three years yesterday, is down 23.82 points or 0.31% at 7701.12 in early trading.

Richard Hunter, head of markets at interactive investor, said; "For the first time this year, the index eased from a generally positive direction of travel, although remaining ahead by 3% so far in 2023. Declines were largely driven by weakness in the mining sector, alongside downgrades to the likes of Entain (LON:ENT) and Next which dampened sentiment."

All eyes will be on US Federal Reserve chair Jerome Powell when he speaks later, although it it unclear how much new information will emerge.

Jim Reid at Deutsche Bank said: "[Powell will] be speaking at an event on central bank independence at 14:00 London time. It’s uncertain whether the topic in question will lead to an in-depth policy discussion, but if we do get any, a key question will be whether he entertains the prospect of a further downshift in the pace of rate hikes to 25bps. That’s currently the base case in markets, but clearly the consumer price index release on Thursday will be an influence on this and to future FOMC meetings too."

Powell's speech in Stockholm follows fairly hawkish comments from Fed members yesterday.

Michael Hewson, chief market analyst at CMC Markets UK, said markets expected the Fed to slow the pace of its rate hikes from 50 basis points in December to 25 next month.

But he added: "This reasoning comes despite further comments from Fed officials yesterday, this time from Atlanta Fed President Raphael Bostic who said he still sees a terminal rate of between 5% and 5.25% before pausing and keeping them there for a long time. This reasoning was also echoed by San Francisco Fed President Mary Daly yesterday, although neither of them has a vote this year."

Also today comes the latest outlook for the global economy from the World Bank.

7.55am: USD remains a seller’s market, EUR gains against GBP

There’s a slight disconnect forming in the currency markets between investors and the US Federal Reserve.

On the one hand, traders seem to be factoring in a cheaper US dollar in the wake of last’s week’s non-farm payroll data, which showed an easing up of wage growth; ostensibly a sign of easing inflationary pressures that could herald a more dovish approach to interest rates.

On the other hand, the US Federal Reserve has made few overtures to a lower terminal rate. Rather, Fed minutes released yesterday saw several members warning against loosening monetary policy given their historical experience.

Perhaps Thursday’s US inflation reading will give more clarity to the macro situation.

Against this backdrop, the US Dollar Index (DXY) closed at a seven-month low of 102.79, though it has since seen a small rebound to 102.94 this morning.

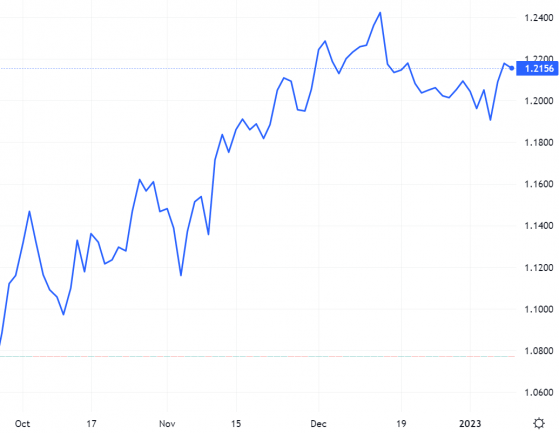

Cable added 60 pips to close the Monday session at 1.218.

GBP/USD cuts back after strong Monday gains – Source: dailyfx.com

Cable but has since shed a third of those pips this morning, bringing the pair back to 1.215, though the pair still remains comfortably above the 20-day moving average.

EUR/USD closed at seven-month highs of 1.073, where it has so far remained this morning.

The euro is also seeing its third straight session of gains against the pound after rebounding off the 20-day moving average on Sunday.

While it was a pretty volatile session, EUR/GBP closed higher at 88.08p and has climbed another 0.2% higher to 88.24p this morning.

6.59am: Markets set for lower start

The FTSE 100 is set to break its winning streak today and head lower at the open following a mixed showing in the US and ahead of a speech by Federal Reserve chairman, Jerome Powell, at a banking conference in Stockholm.

Spread betting companies are calling the lead index down by around 40 points.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank noted “US equity futures are in the negative this morning, as the King of market disappointment, the Fed chair Jerome Powell, will be speaking at an event in Stockholm today, and he will probably not pop the champagne just because the wages grew less than expected last month, especially when you think that the US economy added a near record 4.5 million jobs last year, and that the unemployment rate fell to 3.5%.”

At the close on Monday in the US, the Dow Jones Industrial Average was down 113 points, or 0.33%, to 33,518, the S&P 500 fell 3 points, or 0.08%, to 3,892 but the Nasdaq Composite jumped 66 points, or 0.63%, to 10,636.

Back in London and there was also a warning on UK inflation. The Bank of England's chief economist on Monday said that a "distinctive context" within the UK creates the potential for rampant prices to prove "persistent".

Today, shoe retailer Shoe Zone PLC (AIM:LON:SHOE) and wargame miniatrures manufacturer Games Workshop Group PLC (LON:GAW) are set to report results whilst a trading update is due from recruiter, Robert Walters PLC.

Read more on Proactive Investors UK