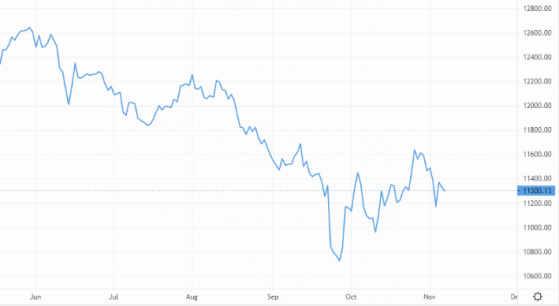

- FTSE 100 little changed, down 6 points

- GSK lower after drug trial disappoints

- Flutter Entertainment rises after claiming victory over Fox

10.50am: Gaming companies higher after US ruling

Flutter Entertainment shares continued to hold firm after it claimed victory in a legal wrangle with Fox Corporation over FanDuel.

The betting group, which owns Paddy Power and Betfair, was 3.5% higher at 11,915p after an arbitration hearing indicated a current valuation of $22bn for Flutter’s US-based sports betting business.

Fox Corporation initiated the proceedings in April 2021, having argued that its 10-year option to acquire an 18.6% stake in FanDuel should be at the same price that Flutter picked up a 37% holding from Fastball Holdings in December 2020.

That deal implied a valuation of $11.2bn but the US tribunal determined a fair market value of $20bn plus a 5% annual carrying value adjustment.

Analysts at Peel Hunt commented: “Flutter’s view has prevailed, that the Fox option exercise price should be based on fair market value for FanDuel at 3 December 2020, deemed to be $20bn (not the $11bn to which we believe Fox aspired).”

Peel Hunt has a sum-of-the-parts valuation for FanDuel of $19bn.

The news pulled shares in fellow gaming company, Entain PLC (LON:ENT) higher as well.

The FTSE 100 listed group operates BetMGM, a a US joint venture with MGM Resorts.

9.48am: Further falls seen in house prices

Today’s fall in house prices will not be the last according to analysts.

Sarah Coles, senior personal finance analyst, Hargreaves Lansdown (LON:HRGV) said: “The housing market doesn’t always move in a straight line, but clearly a downward trend is developing.“

“We’re not getting near the realms of price falls yet, with annual growth still at 8.3%, but given it has fallen back from a peak of 12.5% in June, it would be foolish to rule out significant annual price drops in the coming months.”

“While mortgage rates have eased very slightly as mini-budget measures were rolled back and Trussenomics was consigned to history, the chaos has taken a toll.”

“Of course, the lag in the sales process means we may not see significant falls for a while, and the annual figure may remain positive for months. But it’s increasingly difficult to look ahead and not see a housing market correction as we go into 2023.”

Martin Beck, chief economic advisor to the EY ITEM Club, agreed: “October’s fall is likely to be repeated in coming months.”

“Although mortgage rates have retreated from the highs seen just after the mini-budget, they remain elevated compared to early-mid September” he pointed out.

He expected average property prices to fall further, although forecast the decline is likely to be restricted to around 5%-10%.

9.00am: FTSE back to opening levels

FTSE 100 has shrugged off the early losses and moved into positive territory.

At 9.00am the lead index is now up 1 point at 7,336 while the FTSE 250 is up 75 points to 18,417.

Flutter Entertainment PLC continued to lead the risers after it claimed victory over Fox Corporation in the legal wrangle over FanDuel.

Frases Group was another early riser, up 4%, after announcing plans for a share buy-back of up to £70mln (10mln shares).

Frasers said it aims to reduce share capital via the one-month long buyback which is expected to be completed by 8 December, when it plans to release its half-year results.

On the downside, GSK PLC topped the FTSE 100 fallers after the drugs giant revealed a late-stage study failed to meet its main goal.

Blenrep was deemed no better than the current standard of care in helping people with hard-to-treat multiple myeloma, a type of bone marrow cancer.

GSK shares fell 2.84%, while another prominent company heading lower was Kingfisher PLC (LON:KGF) which slipped 2.4% following a downgrade from Credit Suisse (SIX:CSGN) which lowered its rating to neutral from outperform with a reduced price target of 247p (down from 305p).

Joules Group’s struggles continued as the ailing retailer said that trading has been weaker than expected and that it has advanced talks with a number of strategic investors, including founder Tom Joule, to provide a cash injection for the business.

The clothing retailer said trading overall for the 11 weeks to 30 October has been behind the group’s expectations.

Joules said in a statement: “Whilst dresses, menswear and more formal product categories have performed well, larger core categories such as outerwear, wellies and knitwear have been impacted, in part, by the milder than expected weather.”

Shares fell 27% to 11.34p.

Housebuilders were another weak feature following the Halifax house price figures.

Persimmon PLC (LON:PSN), Taylor Wimpey PLC (LON:TW.) Barratt Developments PLC (LON:BDEV) and Berkeley Group Holdings PLC (LSE:BKG) were all lower in early trading while property website, Rightmove PLC (LSE:RMV), also headed south.

8.15am: FTSE 100 opens lower

London’s blue-chip index made a subdued start to the week giving up some of Friday’s strong gains after Chinese officials poured cold water on speculation that it would relax its strict Covid rules.

At 8.15am the FTSE 100 was down 21 points to 7,314 while the FTSE 250 was little changed, down 3 points at 18,338.

Victoria Scholar, head of investment, interactive investor said: "The FTSE 100 is trading lower this morning after hopes were dashed that China could be set to ease its strict zero-tolerance to Covid approach, pushing the miners into the red. Oil is also under pressure while gold has fallen from a three-week high."

Investors were also mulling the latest reports regarding what is likely to be in the Autumn Statement on 17 November with reports that chancellor, Jeremy Hunt will announce spending cuts of at least £35bn of a total £60bn package with £25bn of tax increases.

Flutter Entertainment PLC (LSE:FLTR) rose after it claimed victory in a legal battle with Fox Corporation over the latter’s plans to take a stake in the US gaming company, FanDuel.

The legal ruling set a valuation on FanDuel which Fox would have to pay should it decide to go ahead and take a shareholding.

RS Group PLC (LSE:RS1) was in focus as JP Morgan downgraded is rating to underweight from neutral following the group’s results last week.

It highlighted a deteriorating macro-outlook, uncertainty around the CEO’s absence and a preference for more defensive exposure in the sector.

More signs that the housing market is under pressure with the latest figures from the Halifax showing that UK house prices fell in October at the fastest rate since early last year.

The average house price fell by 0.4% in October, that is the sharpest fall on Halifax’s index since February 2021 and follow a 0.1% drop in September.

07.55am: Sterling dips and recovers, euro gains on the pound

Cable pulled off a nearly 2% dip and recovery at the end of last week as traders digested jumbo rate hikes on both sides of the Atlantic, as well as mixed signals from the US jobs market.

On the one hand, wages grew more than expected – 0.4% compared to 0.3% projections – to weigh on inflation fears, but unemployment rates of 3.7% also outpaced expectations of 3.6%.

Price action appears more muted this morning, with GBP/USD changing hands at US$1.131, having knocked some 15 pips off from yesterday.

The week ahead is fairly quiet on the economic calendar front, but as you may have heard, the US mid-term elections kick off tomorrow.

With inflation pinned as one of, if not the, key issues, could a Republican upset trigger a rally on the US Dollar Index?

GBP/USD: Will a Republican upset cause the pound to dip? – Source: capital.com

We’ll see.

As for EUR/GBP, the pair is changing hands at 87.8p, and looks likely to break above the 87.9p high seen on October 12.

Having rallied hard at the end of last week, EUR/USD has pulled back slightly; parity continues to act is a strong resistance point.

The pair is currently trading at US$0.9928.

Checking in on the Japanese yen, there appears to be some stability, with the US dollar failing to retest the critical 150 yen point for going on three weeks.

At the time of writing, the USD/JPY pair is changing hands at 147.48.

7.52am: UK house prices fall at fastest rate since February 2021

UK house prices fell in October at the fastest rate since early last year, as the market was rocked by the fallout from Kwasi Kwarteng’s disastrous mini-budget.

The average house price fell by 0.4% in October, according to figures from the Halifax building society.

That is the sharpest fall on Halifax’s index since February 2021 and follow a 0.1% drop in September.

Halifax report -0.4% monthly change in U.K. house prices during October - though tends to be a bit more volatile than Nationwide. pic.twitter.com/3n6N9YxxuA— Neal Hudson (@resi_analyst) November 7, 2022

This brings the annual rate of house price inflation down to 8.3% from 9.8%, and means the typical UK property now costs £292,598, down from £293,664 last month.

The market cooled as hopeful house buyers saw mortgage rates surge, with lenders removing thousands of offers as the cost of borrowing rocketed.

The average two-year fixed-rate home loan jumped over 6.5% in October, from below 5% before the mini-budget.

Average prices remain near record highs, but the recent period of rapid house price inflation may now be at an end, warns Kim Kinnaird, director at Halifax Mortgages.

Kinnaird explains that the surge in UK costs following former chancellor Kwasi Kwarteng’s package of unfunded (and now abandoned) tax cuts was a ‘significant shock’:

While a post-pandemic slowdown was expected, there’s no doubt the housing market received a significant shock as a result of the mini-budget which saw a sudden acceleration in mortgage rate increases.

While it is likely that those rates have peaked for now – following the reversal of previously announced fiscal measures – it appears that recent events have encouraged those with existing mortgages to look at their options, and some would-be homebuyers to take a pause.

7.45am: Flutter claims victory over Fox

Flutter Entertainment has claimed victory in a long running dispute over Fox Corporation’s plans to take a stake in US gaming company FanDuel, in which Flutter has a majority shareholding.

The betting company, which owns Paddy Power and Betfair, said the a US ruling had valued FanDuel at $20bn as at December 2020 using fair market value, a price which is subject to a 5% increase up until Fox exercises any option to buy a holding in FanDuel.

As of today, this equates to a valuation for FanDuel of $22bn and a cost of $4.1bn for FOX to acquire an 18.6% stake, Flutter said in a statement.

Peter Jackson, Flutter chief executive, commented: "Today's ruling vindicates the confidence we had in our position on this matter and provides certainty on what it would cost FOX to buy into this business, should they wish to do so.”

“FanDuel is winning in the US market and the clear #1 operator, a position driven by its exceptional market leading product and efficiency in acquiring customers at scale.”

“The team remain focused on maintaining our leadership position and we look forward to updating the market on our progress at our US capital markets day on 16th November."

But Rupert Murdoch’s Fox also claimed victory in the dispute.

Fox said it was “pleased with the fair and favourable outcome of the Flutter arbitration. Flutter cannot pursue an IPO [stock market float] for FanDuel without Fox’s consent or approval from the arbitrator.”

Flutter hit back in a statement: "We can also confirm on-the-record that Fox does not have a block on any potential IPO of FanDuel, should one occur."

A separate legal claim on float veto is due to conclude early next year.

7.00am: FTSE expected to open lower

FTSE 100 set open lower on Monday as investors mulled the latest comments coming out of China regarding their strict Covid rules.

Spread betting companies are calling the lead index down by around 25 points.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank noted: "Despite optimism last week that the Covid measures could be wined down slowly to let people and the economy breath, the Chinese officials reiterated that they will ‘unswervingly’ stick to the Covid zero approach. Therefore, expect last week’s gains in Chinese stocks to be given back."

Michael Hewson chief market analyst at CMC Markets UK said: “Certainly, the progress seen with respect to China agreeing to a deal that allowed BioNTech to supply vaccines to Chinese expats is progress of sorts, as is the tweaking of restrictions around flight suspensions which penalised airlines that brought Covid cases into the country, but it’s an extremely long way from an economic re-opening.”

But he added “Even in the best-case scenario, any reopening is unlikely to happen much before Q2 next year given the onset of winter, and the likely increased spread of infections that comes with the winter months.”

In London the latest Halifax UK house price index reading is due whilst a trading statement is expected from building materials company Kingspan.