Proactive Investors -

- FTSE 100 up 48 points

- Harbour Energy higher

- AO boosted by update

2.40pm: US markets helped by retail results

US stocks started the day on a positive note as retail earnings and a less hawkish stance from the Fed have overshadowed concerns over rising COVID-19 cases in China which saw the major indexes turn red yesterday.

Just after the market opened, the Dow Jones Industrial Average had added 205 points or 0.6% at 33,905 points, the S&P 500 was up 18 points or 0.5% at 3,968 points, and the Nasdaq Composite was up 24 points or 0.2% at 11,046 points.

Forex.com market analyst Fiona Cincotta said that retailers Best Buy Co and Urban Outfitters Inc (NASDAQ:URBN) had beat earnings forecasts bringing cautious optimism to the sector ahead of Black Friday.

Just after the market opened, Best Buy stock had jumped 8.4% and Urban Outfitters had added 5.1%.

“Broadly speaking, US retailers have performed better than expected, suggesting that the US consumer is resilient heading into the crucial holiday quarter,” Cincotta said.

She added that investors would be paying attention to a number of Fed speakers who are due to speak later, including Cleveland Fed President Loretta Mester and known hawk James Bullard.

“The majority of speakers have hinted towards slower rate hikes from December, although hikes could continue higher for longer. Any less hawkish comments could lift stocks higher,” Cincotta said.

“According to CME Fed watch tool, the market is pricing in a 75% probability of a 50 basis point hike and a 25% likelihood of a 75 basis point hike.”

The positive start on Wall Street has helped support the FTSE 100, which is up 48.86 points or 0.66% at 7425.71.

2.16pm: FTSE review runners and riders

It's almost time for the latest changes to the FTSE indices, and there are some indications as to the way things might go.

According to Hargreaves Lansdown (LON:HRGV), Abrdn PLC (LSE:ABDN) is set to rejoin the FTSE 100, as is Weir Group PLC (LON:WEIR) while Harbour Energy PLC and Dechra Pharmaceuticals PLC (LON:DPH) are likely to be relegated to the mid-cap index.

Susannah Streeter, senior investment and markets analyst at Hargreaves, said: ‘’Volatile markets and concerns about the prospects for global growth are the headwinds driving changes in the FTSE 100. Investor risk appetite appears to be returning despite the uncertainty ahead, which is helping the fortunes of Arbdn, which was relegated to the FTSE 250 at the last reshuffle but could return soon return to the top flight. However, the lower oil price and worries about the impact of the larger windfall tax in the UK has weighed heavily on Harbour Energy, pushing it into the relegation zone.’’

Dechra, which specialises in animal healthcare, has been hit by worries about rising costs and the prospect of a fall in consumer spending amid the cost of living crisis.

Meanwhile engineer Weir focused on mining during the pandemic, moving away from the oil industry, and is benefiting from hopes this strategy will pay off.

This latest quarterly review is based on closing share prices on Tuesday 29 November, with changes taking effect after the close of business on Friday 16 December.

12.56pm: Vodafone heads Footsie fallers

Vodafone Group PLC (LON:VOD) is leading the FTSE 100 fallers after a downgrade and an executive departure.

Its shares are 2.45% lower at 95.71p as analysts at Credit Suisse (SIX:CSGN) moved from outperform to underperform and cut their price target from 140p to 90p.

At the same time, the company said it chief commerical officer, Alex Froment-Curtil , was leaving to return to France with his family for "an external opportunity in another industry" with effect from the end of December.

He had been with Vodafone since 2004 and chief executive Nick Read said he had had a "significant impact" in all of his roles at the company.

12.25pm: Results help FTSE 250 but airlines drag

Mid-cap shares are also higher but only marginally.

The FTSE 250 is up 0.18% at 19,447.89.

It has been helped by a positive response to results from Babcock International PLC (LSE:BAB), up 6.83%, and Telecom Plus PLC (LON:TEP), 3.21% higher.

Tullow Oil PLC (LON:TLW) is benefitting from the recovery in the crude price and has added 3.21%.

But airlines are weaker, with Wizz Air Holdings PLC (LON:WIZZ) down 8.05% and easyJet PLC (LON:EZJ) off 3.97%.

Meanwhile the FTSE 100 continues to do better, up 44.26 points or 0.6% at 7421.11.

12.00pm: US markets cautious as investors await Fed minutes

US stocks are expected to open modestly higher, with investors continuing to worry about China’s stance on COVID-19 infections, the ensuing lockdowns, and the effect on global economic growth.

Futures for the Dow Jones Industrial Average were up 0.1% in pre-market trading, while those for the S&P 500 were 0.2% higher, and contracts for the Nasdaq-100 rose 0.1%.

“Market sentiment is fragile on uncertainty regarding whether China would make a U-turn on its COVID reopening plans,” noted Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

A rise in the number of COVID-19 infections in China and the threat of lockdowns in the world’s most populous country are leading to market fears of an economic slowdown. Outbreaks in the capital Beijing and in the southern hub of Guangzhou and the resulting lockdowns are expected to crimp economic activity.

“The widening spread between the US 2- and 10-year yields, which hit the widest inversion since the middle of 80s, and between the US 3-month and 10-year yields warn that recession will be inevitable,” said Ozkardeskaya. “In the past decades, when we had such sustainable inversions - and they are sustainable, a recession followed the next year.”

San Francisco Federal Reserve President Mary Daly’s warning on Monday that too many interest rate hikes could be “unnecessarily painful” for the economy did not help stocks higher but tied in with the overall worries about a recession.

US rate-setters have delivered four consecutive interest rate increases of 75 basis points this year as they try to rein in runaway inflation. The minutes of their most recent rate-setting deliberations are due on Wednesday and will be closely watched.

With the Thanksgiving holiday on Thursday and the so-called Black Friday shopping period close at hand, investors and retailers will be watching how sales pan out especially after a set of mixed earnings from retailers, including gloomy guidance from the likes of Target (NYSE:TGT) last week.

Meanwhile the FTSE 100 has come off its best levels but is still up 38.82 points or 0.53% at 7415.67.

11.55am: Fixed rate mortgage rate falls below 6%

Better news on the UK housing front.

The average 5-year fixed mortgage rate has fallen below 6% for the first time in seven weeks, following the market chaos caused by September's mini-budget.

The typical five-year fixed deal now costs 5.95% a year, according to Moneyfacts, down from 6.5% a month ago. But before Kwasi Kwarteng's disastrous statement rates were much lower at around 4.75%.

Natalie Hines of broker Premier One Mortgages said: “We’re already starting to see 5- and 2-year fixed rates come down and I'm sure we will see other lenders follow suit over the coming weeks. I think we can expect to see further rises in the base rate but it will eventually settle somewhere between 3% and 4%. With swap rates now stabilising, the average fixed rate in 18 months' time is likely to be not dissimilar to where we are now.”

Hannah Bashford, director of Model Financial Solutions, added: “Fixed rates have been slowly coming down for the past few weeks with some lenders making weekly adjustments. I believe that we will see fixed rates around the 4%-5% mark over the next 12 months and for the base rate to increase in the first half of next year but eventually settling around 3%-4% I’d like to see rates settle to a more stable level of 3%-4% long term as this is manageable for most people and more realistic. I still wouldn’t like to put someone on a 5-year fixed rate over 5% as I think we will see rates come down.”

11.03am: Oil firms and miners heading higher

Commodity companies continue to provide support to the market.

Oil shares are higher as crude recovers, with BP PLC (LON:BP.) 5.46% better and Harbour Energy PLC (LON:HBR) 5.01% higher.

Shell PLC is up 3.01% even as the company said it was reviewing its North Sea investments after the windfall tax increase in the autumn statement.

Victoria Scholar, head of investment at interactive investor said, “Shell is reportedly reconsidering £25 billion worth of investments in UK energy following last week’s windfall tax hike from the Treasury. Shell’s UK country chair David Bunch told the CBI ‘We’re going to have to evaluate each project on a case-by-case basis"..

" Although Shell can afford the increased windfall tax now, oil prices may come down significantly between now and 2028 when the end of the tax has been extended until. Recall back in 2020, oil demand collapsed, and prices plunged, putting stress on energy businesses. If another demand shock occurs, Shell’s profits could fall with it, which may be the reason the company may not want to be tied to billions of pounds of long-term investment projects, particularly at a time when the world is attempting to shift away from its dependence on fossil fuels."

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown (LON:HRGV), said: "Shell’s warning that it is now reviewing its projects in the North Sea and across its renewable energy schemes due to the extended windfall tax will make uneasy reading for the Chancellor Jeremy Hunt, the UK finance minister, particularly given concerns that the Autumn Statement did not do enough to spark growth through investment.

"Warnings from BP earlier in the year about the possibility it could drop some spending commitments did not materialise, although that was when the windfall tax was only due to stay in place until 2025. Now the levy has been extended and increased, it is little surprise that fresh reviews are underway. However, the outgoing CEO of Shell Ben van Beurden did indicate the burden to help the poorest in society should fall on the sector and given that Shell’s new CEO Wael Sawan comes from the renewables division, any cutbacks especially in cleaner greener projects are still likely to be minimal."

Meanwhile miners are also moving ahead, with Glencore PLC (LON:GLEN) up 3.03%, Rio Tinto PLC (LON:RIO) rising 1.31% and Antofagasta PLC (LON:ANTO) adding 1.3%.

Fresnillo PLC (LON:FRES) is 1.25% better as it said the electrification of its Juanicipio project was showing progress. The main substation providing power to the project has now been approved for use.

Russ Mould, investment director at AJ Bell, said: “Metal producers bounced back after yesterday’s slump caused by a new COVID-19 outbreak in China, which caused investors to worry that would translate into reduced commodities demand. That concern is still valid and markets will be closely watching how China deals with this latest flare-up."

Overall the FTSE 100 remains buoyant, up 53.04 points or 0.72% at 7429.68.

10.16am: UK economic growth set to slow next year - OECD

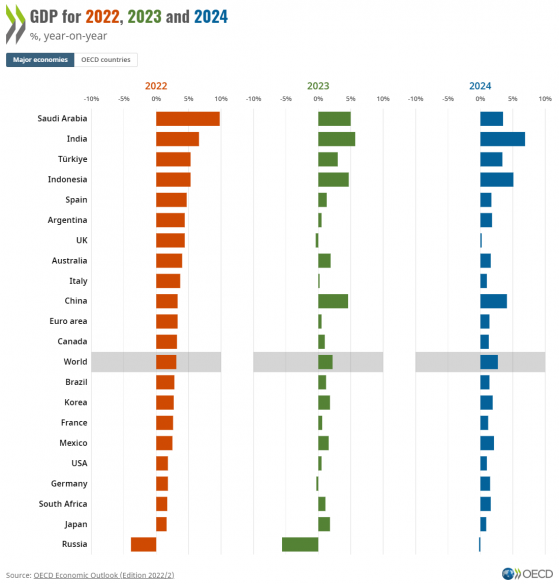

The UK will be the worst performing major global economy next year apart from Russia, according to the OECD.

The Paris-based institution forecast that UK GDP would grow by 4.4% this year but fall by 0.4% in 2023.

Russia is expected to drop more sharply, by 5.6%, the only member of the G20 group of nations set for a worse performance than the UK.

The following year - 2024 - the UK is expected to see GDP rise by 0.2%, but along with Russia this will be the worst in the G20.

Overall, the OECD expects growth in the G20 to be 2.2% in 2023, down from 3% this year as the energy crisis continues to bite.

It said: "The global economy is facing mounting challenges. Growth has lost momentum, high inflation is proving persistent, confidence has weakened, and uncertainty is high. Russia’s war of aggression against Ukraine has pushed up prices substantially, especially for energy, adding to inflationary pressures at a time when the cost of living was already rising rapidly around the world.

"Global financial conditions have tightened significantly, amidst the unusually vigorous and widespread steps to raise policy interest rates by central banks in recent months, weighing on interest-sensitive spending and adding to the pressures faced by many emerging-market economies...

"The uncertainty about the outlook is high, and the risks have become more skewed to the downside and more acute."

9.50am: UK housing transactions down 3% in October

UK housing transactions dipped last month, but although the market is quiet, mortgages brokers are seeing signs of stability following the chaos caused by September's mini-budget.

The provisional non-seasonally adjusted estimate of UK residential transactions in October 2022 is 110,850, said HMRC. This is 29% higher than October 2021 but 3% lower than September 2022

Andrew Montlake, managing director of mortgage broker Coreco said: “These figures don't factor in the chaos of the past month or two. The mini-Budget temporarily blew demand apart as mortgage rates shot up and people played it safe, but transactions and a degree of normality are starting to return.

"First-time buyers are still active and this key demographic is waiting in the wings ready to pounce as prices fall. The fact the mortgage market has now stabilised and that rates are not set to peak as high as we thought has brought some confidence back into the market, despite the predicted long recession that lies ahead. After two years of surreal house price growth, some froth had to come off the market and that will drive transaction levels rather than destroy them.”

Riz Malik, director of R3 Mortgages: "The sliver of activity we are seeing is coming from first-time buyers. With the World Cup, miserable weather and a month before everyone shuts down for Christmas, activity levels are likely to be pretty low. Over the Christmas break, many people will be reassessing their housing requirements so activity may pick up in January. A lot will depend on the strength of the jobs market in 2023 and how long it takes for inflation to come back down to more palatable levels.”

9.38am: No cash for Christmas?

There could be cash shortages at shops and pubs for Christmas after workers at G4S (CSE:G4S) voted to strike over pay.

The GMB union said 1,200 of its members at the security firm - which delivers cash and coins to the likes of Barclays (LON:BARC), HSBC (LON:HSBA), Tesco (LON:TSCO), Wetherspoon and Aldi - would walk out on 4 December.

G4S Cash, part of Allied International, originally offered a part pay freeze, although it has now tabled an offer of 4% and a lump sum bonus based on contracted hours. As a reminder, inflation is currently 11.1%.

Eamon O’Hearn, GMB National Officer, said: “[These] are low paid workers doing a dangerous job, transferring the cash so many of us still rely on every day...

“G4S Cash staff provide an absolutely vital service. If they walk out, we can [expect to see] genuine cash shortages over the festive period.”

Victoria Scholar, head of investment, interactive investor said, “Although recent years have seen a notable shift towards cashless payments, certain demographics such as pensioners and lower-income households rely far more on cash on a day-to-day basis so this strike could disproportionately impact the more vulnerable pockets of society at a time when they are already dealing with pressures on the cost-of-living."

The GMB said that the last time G4S Cash workers voted to strike; the Bank of England is thought to have pressured G4S into improving their offer because the Bank’s insurer demands minimum staffing levels.

9.25am: UK Treasury pays £800mln to Bank for QE costs

The latest borrowing figures show the cost of the Bank of England's quantitative easing programme, with the Treasure for the first time having to pay the Bank to cover a rise in interest rates - in this case £800mln.

The Office for National Statistics report said: "This month the Bank of England Asset Purchase Facility Fund (APF) received its first payment from HM Treasury under the indemnity agreement (previous payments were made by the APF to HM Treasury).

"This £0.8 billion of central government expenditure has been recorded as a capital transfer to the Bank of England."

I did warn you all that QE was not a free lunch. On October the UK Treasury had to pay £800 million to the Bank of England to cover losses as interest-rates rose.— Shaun Richards (@notayesmansecon) November 22, 2022

Laith Khalaf, head of investment analysis at AJ Bell, said: “The former Chancellor George Osborne always insisted that the Treasury should fix the roof when the sun was shining, using economic gains to help keep the Exchequer books in balance. Unfortunately it’s been a long, dark, overcast day for most of the last five years in the UK economy. Weak growth and pandemic spending have left the public finances in tatters and, to add insult to injury, the Exchequer is now starting to pay the Bank of England for the QE scheme.

“That’s because the Treasury pays base rate on the government debt held by the Bank of England, and for the first time since the scheme was launched in 2009, that is now higher than the interest coupons on that debt. On top of that the Bank of England will also require payment for the losses it sustains as it winds down its QE scheme, selling gilts below the price it bought them at.

"This resulted in a net payment from the Treasury to the Bank of England of £0.8 billion in October, according to the ONS.

"This is the very thin end of the wedge, because the OBR estimates there will be cash transfers of £133 billion from the Treasury to the Bank of England to cover the QE scheme over the next 5 years, adding 2.1% of GDP to government debt by 2028. This is a meaningful reversal from the £120 billion of cash that has flowed in the opposite direction since 2009, and one of the contributing factors to the round of belt-tightening the new Chancellor is now implementing."

9.03am: China attempts to support struggling property market

Leading shares continue to head higher, with sentiment helped by more positive news from China despite the concerns about further lockdowns there.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said: ‘’The spectre of COVID-19 is still hovering over the Chinese economy, threatening to cause fresh snarl ups for supply chains and demand for goods. But troubleshooting efforts by authorities to help stabilise the beleaguered property sector have helped pare losses in Asia. spreading optimism as trading got underway in London

"Regulators have asked Chinese banks to extend loans to real estate companies in a reasonable manner, as part of efforts to try and stabilise the shaky-looking sector. These efforts aimed at patching up a malfunctioning part of the economy are offering some hope that China will not have to cope with two crises at once in the months to come."

The FTSE 100 is currently up 56.85 points or 0.77% at 74.33.7.

8.47am: More tax rises in the spring are possible - chartered accountants

Back with the UK public finances, and more tax rises could be on the way in the spring according to the chartered accountants' body.

Alison Ring, director at the ICAEW, said: “The cost of the energy price guarantee and higher interest costs were the biggest drivers behind the increase in the deficit, which at £13.5bn saw interest payments from the Bank of England to HM Treasury for quantitative easing go into reverse for the first time. Public sector net debt reached £2,460bn, on track to reach the OBR’s latest forecast of £2,571bn by the end of this financial year.

“The Autumn Statement last week highlighted how constrained the Chancellor is by the accumulation of debt, which saw him compound the economic misery facing the country by cutting back on public investment over the next five years. The Government is short of money and the potential for further tax rises in the Spring Budget should not be discounted.”

8.35am: Harbour Energy tops the risers

Energy companies are leading the way after the recovery in oil prices.

Harbour Energy PLC is 4.81% higher, BP PLC is 4.46% better and Shell PLC is up 2.77%.

SSE PLC (LON:SSE) has added 1.86% to 1727p after analysts at RBC lifted their rating from sector perform to outperform and raised their price target from 1825p to 2050p.

But Vodafone Group PLC (LON:VOD) is down 2.07% to 96.08p as Credit Suisse (SIX:CSGN) moved from outperform to underperform and cut its target from 140p to 90p.

And Severn Trent PLC (LON:SVT) has fallen 2.2% after its latest update.

8.17am: Strong start for Footsie

Leading shares have made a positive start in the wake of the better than forecast UK borrowing figures and a slight recovery in the oil price.

The FTSE 100 is up 44.47 points or 0.5% in early trading to 7421.32.

Meanwhile Brent crude is up 0.3% at US$87.7 a barrel while West Texas Intermediate has edged up 0.1% to US$80.1.

Monday saw a drop in the oil price on talk Opec+ was considering a production increase at its next meeting. But a denial from Saudi Arabia helped it recover some lost ground.

The prospect of further pandemic related lockdowns in China had also hit sentiment.

Among companies reporting results, Ao World (LON:AO) has surged 13%, as the online electrical retailer forecast top-end full-year earnings despite reporting increased half year losses of £12mln compared to £4mln.

It has also changed strategy to focus more on its domestic UK market.

Richard Hunter, head of markets at interactive investor, said: “AO World’s decision to change tack will not result in overnight success, but the early indications are that the company has made the right choices.

"In particular, the decision to exit the German business and focus on its home market in the UK is likely to result in no cost to the business, versus original estimates of up to £15mln. At the same time, non-core and less profitable lines have been shelved, including some third party tie-ups where the relationship was not progressing as expected."

7.41am: UK borrows more in October, but less than forecast

UK public borrowing has come in much lower than expected last month, but it was still the fourth highest October figure since 1993.

Despite the disruption in the wake of September's chaotic mini-budget, borrowing fell month on month from £20bn to £13.5bn, much lower than the forecasts of around £22bn.

But it was £4.4bn higher than a year ago and £1.8bn more than in the pre-pandemic October 2019.

Public sector net borrowing, excluding public sector banks, was £13.5 billion in October 2022.This was £4.4 billion more than in October 2021 and the fourth highest October borrowing since monthly records began in 1993.

➡️ https://t.co/e92w9opnec pic.twitter.com/aAP3fwT1xk

— Office for National Statistics (ONS) (@ONS) November 22, 2022

Public sector net debt, excluding public sector banks, was £2,459.9 billion at the end of October 2022, or around 97.5% of GDP.An increase of £148.3 billion but a decrease of 0.5 percentage points of GDP compared with October 2021. pic.twitter.com/MgdPGEj3XS

— Office for National Statistics (ONS) (@ONS) November 22, 2022

The UK spent £6.1bn on interest payments on the national debt, with £3.3bn of that due to the rise in gilt yields.

Government spending was also lifted by the first payments under the domestic energy support schemes, which amounted to £1.9bn by the cost of helping households with energy bills.

In total, spending reached £91.2bn.

7.00am: FTSE 100 seen higher, oil price rebounds

FTSE 100 expected to open higher on Tuesday supported by a rebound in oil prices after Saudi Arabia denied a report that oil producers were discussing a production increase for their next meeting, saying a cut approved last month would stay in place until the end of 2023.

The report yesterday in the Wall Street Journal had sent oil prices and oil stocks tumbling. But the denial saw Brent spike to around $87.60/barrel from $83.07 at the London close on Monday.

In London, spread betting companies are calling the lead index up by around 20 points.

In the US markets closed the wrong side of the line but off worst levels for the day after the San Francisco Federal Reserve President Mary Daly commented that officials need to be careful to avoid a "painful downturn."

At the close the Dow Jones Industrial Average was down 45 points, or 0.13%, at 33,700.28, the S&P 500 slipped 15 points, or 0.39%, to 3,950 and the Nasdaq Composite fell 122 points, or 1.1%, to 11,025.

In London, results are due from Severn Trent PLC, Homeserve PLC (LON:HSV) and Helical Bar PLC amongst others.

Read more on Proactive Investors UK