Proactive Investors -

- FTSE 100 pushes higher, up 29 points

- Vodafone CEO, Nick Read, to step down

- UK services PMI contracts in November

10.50am: Sainsbury to invest further £50mln in price

J Sainsbury PLC is to accelerate its value plan, investing a further £50mln by March 2023 to help customers manage the rising cost of living.

In a statement the grocer said £15mln had been set aside to support customers in the festive period including what is described as “an inflation-busting Christmas roast dinner at less than £4 a head.”

The move follows a £65mln value investment announced in September and the FTSE 100 listed group said it will have invested over £550mln in value over a two-year period, 10% more than the original £500mln target it set out in May earlier this year.

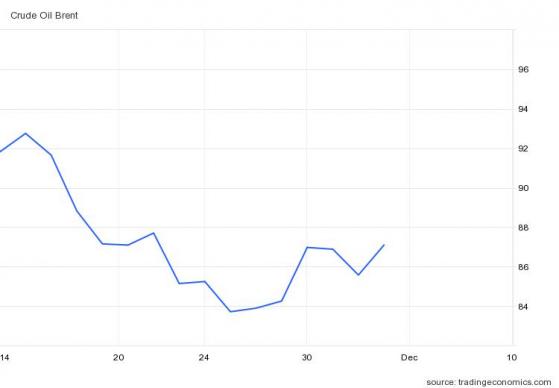

10.30am: Oil prices advances

Oil prices advanced as investors digested a number of developments in the sector over the weekend.

OPEC + decided to stick to its current output targets as the cartel waits to make a judgement on the strength of Chinese oil demand before making any changes to its production strategy, while the G7 $60 price cap on Russian seaborne oil came into effect today as the West tries to limit Russia’s ability to finance the war in Ukraine.

There was also good news as China moved to relax some of its strict Covid rules boosting hopes of rising demand from the economic superpower.

In reaction Brent crude was up 1.95% to $87.21 while WTI crude prices rose 2% to $81.62.

10.00am: UK services sector contracts in November

The UK service sector registered another modest contraction of activity during November as levels of incoming new work continued to fall amid ongoing economic uncertainty and cost of living challenges weighing on discretionary spending according to the S&P Global/CIPS UK Services PMI Business Activity Index.

???????? The UK service sector saw another modest contraction in activity in November (index at 48.8), as new work levels continued to fall amid brewing economic uncertainty and weak discretionary spending. Read more: https://t.co/tAgdAc37FD pic.twitter.com/P4gW0UljDH— S&P Global PMI™ (@SPGlobalPMI) December 5, 2022

Cost pressures showed little signs of abating, with operating expenses again rising sharply, although pricing power was limited to some degree by rising competition and falling sales.

Firms continue to hire additional staff as they sought to address skills shortages at their units, but confidence in the outlook remains historically subdued, despite improving noticeably since October.

The headline seasonally adjusted figure of 48.8 in November was unchanged since October, when the index fell to its lowest level since January 2021 and signalled a second consecutive monthly fall in activity.

Chris Williamson, chief business economist at S&P Global Market Intelligence, which compiles the survey commented: "A further economic contraction signalled by the PMI surveys hints at a growing recession risk for the UK.”

“A change of government and its new economic policies may have helped arrested some of the financial market volatility after September’s ‘mini-budget but the economic picture remains stubbornly unchanged.”

9.21am: New car sales grow for fourth month in a row

Britain’s new car market grew for the fourth month running, up by 23.5% in November, at 142,889 units according to the Society of Motor Manufacturers and Traders (SMMT).

The growth delivered the best total for November since 2019,1 with manufacturers continuing efforts to fulfil orders amid erratic global components supply.

However, registrations in the month were still -8.8% below 2019 levels and, while further recovery is anticipated in 2023, global and domestic economic challenges mean that the market will remain below pre-pandemic levels.

Plug-ins account for more than one in four (27.7%) new registrations as battery electric vehicles (BEVs) take their largest monthly share of the new car market in 2022.

The SMMT also called for urgent government action to deliver charging infrastructure and support EV uptake to deliver UK’s ambitious net zero targets.

The Nissan Qashqai was the best seller in November followed by the Tesla Model Y and Mini.

8.57am: Jefferies upgrades Bellway (LON:BWY), downgrades Persimmon (LON:PSN)

UK housebuilders are once more in focus as Jefferies issued a note on the sector, upgrading Bellway PLC (LSE:BWY) but downgrading Persimmon PLC (LSE:PSN) and Watkin Jones PLC (AIM:WJG).

The broker said while share prices have bounced 10% since their last report in October it continues to see opportunity with the sector still trading at a 15% discount of price to net tangible asset value.

Their analysis suggested share prices are reflecting 20% volume declines, 9-18% price declines, and high-single-digit build-cost inflation.

But with increasing confidence that forecasts reflect the trough downside, Jefferies believed investors will focus on the speed and extent of recovery.

Setting price targets to reflect, on average, 1x book value, suggests an average of 18% upside, the broker said, while a return to previous multiples increases this to >50%.

The broker raised Bellway (up 2.3%) to buy from hold and increased its price target to 2,458p from 1,928p but downgraded Persimmon (down 1%) to hold and trimmed its target to 1,436p from 1,485p. The target price for Taylor Wimpey PLC (LON:TW.) (up 0.5%) was also increased to 124p from 105p with a buy rating reiterated.

8.12am: FTSE 100 little changed

FTSE 100 opened little changed on Monday with the lead index down 2 points at 7,554 and the FTSE 250 down 21 points to 19,343.

Vodafone Group PLC (LON:VOD) rose 1.9% following the surprise departure of its CEO, Nick Read, who is stepping down at the end of the year.

The telco last month lowered its outlook for the full year as profits fell in the first half, driven by a weak performance in its largest market Germany.

The oil price was slightly higher after OPEC + agreed to leave its current output targets unchanged while the G7 $60 price cap on Russian seaborne oil came into effect today as the West tries to limit Russia’s ability to finance the war in Ukraine.

Victoria Scholar, head of investment at interactive investor said: “There are a lot of moving parts in the oil market at the moment with uncertainty around the outlook for Chinese demand as well as global demand as the extent of the economic slowdown is yet to be seen.”

“Meanwhile the cartel is waiting to see whether the new Russian cap goes anyway to impacting market prices.”

Glencore PLC (LON:GLEN) was 0.8% higher after it said it will pay $180mln to the Democratic Republic of Congo to cover claims linked to alleged acts of corruption for over a decade.

The Anglo-Swiss commodity trading and mining company said these corruption allegations included activities in group businesses that had been the subject of various investigations by, among others, the US Department of Justice and the DRC's National Financial Intelligence Unit and Ministry of Justice.

Early last month, Glencore said it would pay £281.0mln after it admitted to bribing offences in Africa.

7.47am: Investors contemplate dollar peak as greenback continues to fall against pound and euro

The US Federal Reserve has a jobs problem. Specifically, according to data released at the end of last week, Americans are getting paid too well, having netted another 0.6% monthly increase in hourly earnings– the biggest gain in 10 months.

Certainly good news for employees, but given the implications for inflation, it also throws a spanner in the works for any plans to ease up on monetary policy.

Investors didn’t appear to take note though, since the US dollar continued to cuts back against the major currencies. This could be taken as the latest signal of a dollar peak.

GBP/USD reached six-month highs of 1.234 this morning, before seeing a minor correction back to 1.230 as the Asia trading window progressed.

GBP/USD hits half-year highs. Is dollar peak in? – Source: capital.com

EUR/USD opened the session at 1.054 and is now changing hands at 1.056, the highest the pair has been since late June.

The US Dollar Index is looking fairly flat at 104.05, in part because of a minor rally against the Japanese yen, with 45 pips added to USD/JPY this morning, thus bringing the pair up to 134.88.

Eurozone retail sales are due later today, with a -0.6% year-on-year slide to be expected, while UK services PMIs are expected to remain unchanged from November.

7.45am: CBI cuts 2023 GDP forecast

The Confederation of British Industry (CBI) has warned the UK’s economy has fallen into a recession that could last until the end of next year.

In its latest economic forecast, the CBI warned that the Prime Minister and Chancellor must do more to boost long-term growth, having stabilized financial markets.

With inflation mounting, the CBI has slashed its forecast for growth in 2023, and predicts that UK GDP will shrink by 0.4% next year, down from 1% growth expected before.

The economy is likely to have fallen into a recession in quarter three 2022, when GDP shrank by 0.2%, the CBI said, adding they expect the recession to last until the end of 2023.

High inflation is at the heart of weaker economic activity and the CBI forecast that pricing pressures will “remain significantly above the Bank of England’s 2% target next year, likely to end 2023 at 3.9%.”

Tony Danker, CBI director-general, warned that the UK is suffering ‘stagflation’": “Britain is in stagflation – with rocketing inflation, negative growth, falling productivity and business investment. Firms see potential growth opportunities but a lack of “reasons to believe” in the face of headwinds are causing them to pause investing in 2023.”

“Government can change this. Their action or inaction to support growth and investment will be a key determinant of whether recession is shallow or deep.”

7.25am: Vodafone CEO to step down

Vodafone Group PLC’s chief executive, Nick Read, is to step down at the end of the year.

In an unexpected move the FTSE 100 telco said Read would remain as an adviser to the board until the end of March 2023 with Margherita Della Valle appointed interim group chief executive.

In a statement the group said “ She will accelerate the execution of the company's strategy to improve operational performance and deliver shareholder value.”

Della Valle will also continue as group chief financial officer.

Nick Read, Group Chief Executive said: "I agreed with the board that now is the right moment to hand over to a new leader who can build on Vodafone's strengths and capture the significant opportunities ahead".

Vodafone last month lowered its outlook for the full year as profits fell in the first half, driven by a weak performance in its largest market Germany.

The company is also in talks with CK Hutchison, owner of rival telecoms group Three, to combine their UK businesses which would create the biggest mobile operator in the country.

7.00am: FTSE 100 seen flat

FTSE 100 expected to make a subdued start to the week ahead of a number of composite PMI reports.

Spread betting companies are calling the lead index up by around 3 points.

Some support should be provided by news over the weekend that more cities in China are relaxing covid rules despite rising infections. “Shanghai joined the likes of Beijing and Shenzhen in easing restrictions, announcing the scrapping of PCR testing requirements to enter outdoor public spaceslike parks, as well as riding on public transport” noted Michael Hewson, chief market analyst at CMC Markets UK.

Elsewhere, on Sunday, the Organization of the Petroleum Exporting Countries, led by Saudi Arabia and Russia, agreed to maintain their current output levels.

"OPEC+ also agreed to maintain its existing policy on oil production over the weekend, despite concerns they might have looked at another cut due to recent weakness in the oil price, with the slow relaxing of Covid rules in China perhaps playing a part in that decision," said Hewson.

In London, results are expected from Fusion Antibodies Ltd and Induction Healthcare Group PLC while on the economic data front composite PMI figures are also due.