Proactive Investors -

- FTSE 100 higher, continuing strong start to the year

- House prices rise in January according to Rightmove

- Marks and Spencer (LON:MKS) plans 20 new stores

12.37pm: Deutsche prefers HSBC to Standrad Chartered ahead of Fed pivot

Deutsche Bank (ETR:DBKGn) has a preference for HSBC Holdings (LON:HSBA) PLC over the other Asian-focused UK listed bank, Standard Chartered (LON:STAN) PLC, as it looks ahead to the Fed pivot.

Analyst Robert Noble forecast rising global rates should lead to a bumper earnings year for both banks but cautioned the Fed pivot presents a challenge for 2024 earnings, guidance and consensus expectations.

In a research note the bank said both banks should reach returns not seen in the last decade regardless of how the pivot is navigated.

“However, we see structurally higher returns at HSBC; greater capital generation; better capital return; more potential to upgrade conservative guidance; and now more attractive relative valuation after 17% underperformance versus Standard Chartered in 2022.”

As a result Deutsche has switched its preference for how to profit off the Fed pivot from Standard Chartered which it downgraded to ‘hold’ from ‘buy’ to HSBC which it moved the other way, upgrading to ‘buy’ from ‘hold’.

The price target for HSBC was increased to 760p from 650p and for Standard Chartered to 900p from 800p.

Shares in HSBC were trading 0.9% higher in early afternoon trading with Standard Chartered 0.9% lower.

12.24pm: Matalan agrees sale to lenders

Matalan has agreed to a sale to a consortium of lenders as part of a recapitalisation process which will end founder John Hargreaves’ control of the retailer.

The lenders, led by Invesco, Man GLG, Napier Park and Tresidor, have sealed the deal after Matalan launched a sales process in September, according to a statement on the company website.

Under the deal, which is scheduled for completion on 26 January, the group’s gross debt will fall from £593mln to £336mln while £100mln of new capital will provide funding for operations and delivering its growth strategy.

The agreement will provide a financing runway for the next four years with the earliest maturity in the new debt package now pushed out to January 2027.

The retailer said sales rose 7.3% growth in the third quarter of its fiscal year and by 14.6% in the December peak trading period but recent profitability has been adversely affected by a combination of market conditions and the approach taken to the buy plan for the Autumn / Winter season.

11.39am: Global recession ahead - World Economic Forum

The Footsie is holding firm as we approach midday, up 10 points, but a survey of leading economists suggests a global recession lies ahead.

The poll of senior economists by the World Economic Forum (WEF) came ahead of the launch of the gathering of politicians and business leaders in at Davos, Switzerland later today.

Almost two-thirds of respondents say a global recession is likely in 2023. Learn more from the January 2023 @wef Chief Economists Outlook. #wef23https://t.co/0e2w4HVhSR pic.twitter.com/iNhpfRwcDb— World Economic Forum (@wef) January 16, 2023

The majority of 22 chief economists surveyed by the WEF believe a global recession is likely in 2023 and all those surveyed expect weak or very weak growth in 2023 in Europe, while 20 said they expected weak or very weak growth in the US.

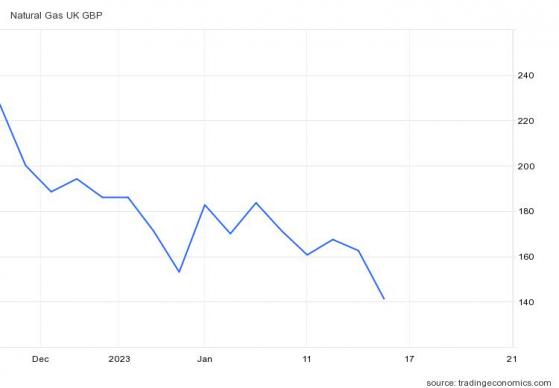

10.55am: Gas prices tumble

Gas bills may be set to remain high (see below) but they are sharply lower today with some big moves in today as they hit 16-month lows as full stockpiles in China forced buyers to send supplies to the continent.

Mid-morning and Dutch TTF natural gas futures have fallen below €60/MWh, the lowest since September 2021, down nearly 12% to €57.08 while UK gas prices slipped 13.1% to 141.26p/therm.

Mild weather in Europe combined with news that Chinese importers are trying to divert February and March shipments to Europe amid weak prices at home and high inventories contributed to the move.

It eased concerns that the reopening of the country's economy will boost demand and pull cargoes away from the West.

10.35am: Gas and electricity bills set to remain high

Gas and electricity bills are unlikely to return to pre-pandemic levels, according to the boss of a Norwegian energy giant.

Anders Opedal, chief executive of Equinor, told the BBC that the transition away from fossil fuels to more sustainable sources of energy will mean costs remain high.

Opedal also said that windfall taxes on gas and energy companies were affecting investment in the UK.

Meanwhile, the former boss of BP (LON:BP) has said energy costs will stay high for the next decade because of massive underinvestment in oil and gas in the wake of new climate change targets.

Speaking about the switch to renewables, Opedal commented: "This will require a lot of investment and these investments need to be paid for, so I would assume that the energy bills may be slightly higher than in the past but not as volatile and high we have today."

Opedal said there is "a kind of re-wiring of the whole energy system in Europe particularly after the gas from Russia was taken away". He said huge investment in renewables was needed, including using more hydrogen for example.

10.00am: Has M&S got its mojo back?

A bit more on the store opening plans by Marks and Spencer PLC – the retailer will invest £480mln in the new stores, creating 3,400 new jobs across the UK.

The new store pipeline for 2023-2024 includes eight full-line destination stores in key city centre locations, including Leeds, Liverpool, Birmingham, Manchester and Lakeside Thurrock.

These stores will be relocated to former Debenhams sites – part of M&S’ investment to regenerate currently vacant sites.

AJ Bell investment director Russ Mould said it “feels significantt given the retail environment is not “exactly buoyant right now.”

“It demonstrates physical retail continues to have a role and that Marks & Spencer sees its multi-format stores, with a mix of clothing, homewares and food, as a competitive advantage” he said.

“The push to revamp the store estate also shows it recognises the importance of having sites which are appealing for shoppers to visit and are in the right places to attract healthy footfall.”

"Coming off the back of the group’s better-than-expected Christmas trading, it seems Marks & Spencer has rediscovered its mojo” he felt.

9.25am: JP Morgan expects New Year rally to fade

Steady progress in London so far today with the FTSE slightly higher but JP Morgan (JPM) believes that the current market rally will start fading heading through quarter one.

It suggested that the positive catalysts that it has previously highlighted – the peak in bond yields, in inflation and in the US dollar, China reopening and more benign European gas prices – are now in the open.

But “while January still offers favourable seasonals, and the current investor positioning is far from heavy, both of which support stocks for the time being, we believe that one should be using potential gains over the next weeks in order to reduce exposure.”

JPM said the market is behaving as if we were in an early cycle recovery phase, but the Fed has not even concluded hiking yet.

Typically, this phase is seen only after a period of Fed cuts, it pointed out.

JPM stuck to its call that bond yields have likely peaked which typically helps defensives.

But the bank predicted lead indicators point to more softness while earnings are likely to be challenged next.

It forecast a downside to earnings for cyclicals on weaker pricing.

JPM does think “cyclicals are likely to rally more sustainably, discounting a fundamental inflection point in PMIs and a bottoming out in earnings, along with a potentially clearer pivot by the Fed, but this is not yet, in our view.”

9.00am: Jefferies upgrades Man/downgrades Abrdn

FTSE is holding in positive territory but as Neil Wilson at markets.com noted "with the US closed it will be a thin day."

Richard Hunter, head of markets at interactive investor, noted it was a continuation of their "sprightly start to the year"

He added: "There has also been some suggestion that certain US investors are currently looking towards Europe for more immediate investment opportunities, with the FTSE100 having been one of last year’s relative success stories and already having added 5.5% in 2023."

At 9.00am the lead index was up 10 points at 7,854 continuing its march towards its record all-time highs

Jefferies has adjusted its rating for some European asset managers in a sector review today upgrading Man Group PLC but downgrading Abrdn PLC.

The broker has upgraded Man Group to buy with a 285p price target believing the shares offer cheap downside protection should the current more constructive market backdrop start to unravel.

Jefferies said its AHL franchise reasserted its credentials in 2022 likely generating over US$700mln of performance fees for the group.

Whilst net flows will have deteriorated in the second half, gross inflows have remained strong, the bank noted while “extraordinary capital returns should remain an attractive recurring feature of the equity story.”

The broker suggested “undertaking a turnaround of its core investments unit in current market conditions will be challenging and recent commentary (press and company) re CFO succession planning adds uncertainty to the mix.”

Shares in Man Group rose 1.9% and Abrdn fell 0.5%.

On the downside, shares in energy storage firm ITM Power PLC slumped 12% after it warned that its full-year results would now be "materially different" to current guidance, with both lower revenues and a larger underlying loss.

ITM stated this reflected losses on customer contracts, legacy commitments for earlier product generations causing onsite support costs, warranty provisions, and inventory write-downs originating from iterations of product designs during manufacturing.

8.15am: FTSE 100 makes bright start to the week

FTSE 100 pushed higher at the open as it continued to look upwards to its record all-time highs of just over 7,800.

But with US markets closed trading may be quieter as investors await some key data in the UK on inflation, average earnings and retail sales.

At 8.15am London’s lead index was up 17 points to 7,861 with the FTSE 250 up 26 points to 19,979.

Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown (LON:HRGV) at: “Investors appear to have fallen back in love with UK assets, after a difficult period when FTSE 100 was the wallflower among global indices.”

“Confidence has rebounded as investors eye up China’s reopening, helping commodity stocks”.

“A stronger than expected appetite from consumers has boosted the retail, travel and hospitality sectors, while banks are still riding the wave of higher interest rates.”

“Things are looking up for the UK, and the footsie is the flavour of the month, but there is a risk this could be a short-lived crush.”

“There are still niggles of worries which could blow up about ebbing consumer and company resilience in the months to come on both sides of the Atlantic.”

Some encouraging news on the housing market with Rightmove PLC reporting prices rose in January by 0.9% after a series of falls. Some housebuilders took encouragement from the news with Bellway PLC (LON:BWY) up 0.5%, Barratt Developments PLC (LON:BDEV) up 0.5% and Persimmon PLC (LON:PSN) up 0.4%.

QinetiQ Group PLC rose 0.8% after securing a £80mln contract with the Ministry of Defence and Marks and Spencer PLC was another early riser after reports that it plans to open 20 new stores.

But Amigo Holdings PLC tumbled 31% as the sub prime lender said it had failed to find a cornerstone investor for a planned capital raise.

Amigo said it had been seeking to raise capital, but had failed to find a cornerstone investor. It said it was now looking for a syndicate of investors to pull together £45mln.

8.07: Yen in the spotlight, USD and GBP volumes dip as financial elite head for the slopes

The Japanese yen is in the spotlight in anticipation of Wednesday’s central bank meeting.

Having made indications of monetary policy tightening at the December meeting after a multi-decade hands-off approach, investors are pondering whether the Bank of Japan (BoJ) will again let its bond market peg go higher.

Citibank strategist Ebrahim Rahbari called another policy change “likely” despite sellers testing the Bank of Japan’s mettle by pushing yields up in December.

The yen surged against the greenback at the end of last week but has since calmed down; though USD/JPY remains near nine-month lows of 128.04.

Volatility has been low across the other majors, mainly due to the closed US markets for Martin Luther King Day. GBP/USD remains ranged between 1.22 and 1.23, while EUR/USD is changing hands at 1.083, having closed fewer than 10 pips lower on Sunday.

US markets close for the day, GBP/USD volumes dip – Source: capital.com

With the World Economic Forum shindig kicking off in Davos today, the world’s financial elite likely have Après-Ski on their minds too.

Price action could pick up in the following two days for Cable, given tomorrow’s UK employment data read and Wednesday’s UK year-on-year inflation rate, which is still expected to remain in the double digits.

EUR/GBP has remained pinned to 88.55p since closing 0.4% lower on Friday.

7.50am: M&S plans 20 new stores

Marks & Spencer PLC is stepping up its store opening programme with the launch of 20 "bigger and better" new shops throughout Britain and the creation of 3,400 jobs, according to a report in The Times.

While other retailers are switching online or are disappearing from the high street, Stuart Machin, the chain's co-chief executive, said he was committed to offering "great shops", in spite of previously announcing plans to close 67 underperforming branches, the paper said

There will be eight ‘full line’ stores and 12 food halls across the UK, which ‘fits into the levelling-up agenda’ according to CEO Stuart Machin.

7.38am: House prices rise in January

Signs of hope in the housing market? The average price for a house in the UK rose a modest 0.9% in January according to a survey by property website, Rightmove PLC (LON:RMV).

The news which followed falls towards the end of 2022 following the botched mini-budget takes the average price for a house in the UK to £362,438, up £3,301 on the previous month.

Rightmove said that a rise in asking prices would normally be expected in January.

Rightmove's Director of Property Science Tim Bannister said: "The numbers certainly suggest that activity has bounced back after Christmas and agents will now be busy trying to match the likely revised expectations of buyers and sellers as we move towards the important spring season.”

“The seasonal increase in new-seller asking prices this January from December is particularly encouraging for movers who are looking for the reassurance of familiar trends and a calmer, more measured market after the rapidly changing and at times chaotic economic climate of the final few months of last year” he said.

7.28am: Qinetiq wins £80mln deal

Qinetiq Group PLC (LON:QQ) has won a 10-year contract with the Ministry of Defence worth £80mln.

In a statement the science and engineering company said the contract will provide expertise, training and support to accelerate and transform mission data production.

“We will work in partnership with the MOD for a 10-year period on the transformation project, providing a specialist mission data and electronic warfare skills solution alongside training and IT support” the group said.

7.00am: FTSE seen flat

FTSE 100 is expected to make a cautious start to the week with trading likely to be quieter with US markets closed for the day.

Spread betting companies are calling London’s blue chip index down by around 5 points consolidating some of last week’s gains.

In the US on Friday, Wall Street ended higher, with the Dow Jones Industrial Average up 0.3%, the S&P 500 up 0.4% and the Nasdaq Composite up 0.7%.

In Asia on Monday, the Japanese Nikkei 225 index was down 1.1%. In China, the Shanghai Composite was up 1.0%, while the Hang Seng index in Hong Kong was down 0.6%. The S&P/ASX 200 in Sydney closed up 0.8%.

A quieter day on the corporate front in London with a trading statement from FTSE 100 miner Rio Tinto (LON:RIO) expected, as well as from investment manager Ashmore.

But investors will be eyeing UK inflation, average earnings and retail sales figures due later this week.