Proactive Investors -

- FTSE 100 extends gains, up 16 points

- US markets seen higher

- Pound steady close to three-month highs

1.40pm: Primark to open four new stores in £140mln investment

Primark has announced a £140mlm investment leading to the opening of four new shops and the creation of at least 850 jobs.

Parent company Associated British Food said it plans to make the investment over the next two years in its UK operations.

As part of that investment the company said "at least" four news shops will be opened.

The locations announced on Friday are Bury St Edmunds in Suffolk, Craigavon in Northern Ireland and Salisbury in Wiltshire.

1.10pm: Jaguar to cut production at UK factories - Guardian

Jaguar Land Rover is cutting production at its UK factories until the spring, according to a report in The Guardian.

Citing industry sources the report said the carmaker, whose chief executive, Thierry Bolloré, last week announced his resignation, has decided to cut production at factories in Solihull and Halewood between January and the end of March as it tries to prioritise its most profitable models.

JLR and other carmakers have been plagued by shortages of semiconductors since early 2021.

Many carmakers cut their orders for the computer chips at the start of the coronavirus pandemic, only to find themselves at the back of the queue when demand roared back.

12.05pm: US markets seen higher

US stocks are expected to open slightly higher on the half-day return after the Thanksgiving holiday with trading likely to be quiet as many investors opt for a long weekend, while Black Friday sales will be a focus.

With US markets closing at 1.00pm ET today, futures for the Dow Jones Industrial Average were up 0.2% in pre-market trading, while those for the S&P 500 were 0.2% higher, and contracts for the Nasdaq-100 were flat.

For now, investors and retailers alike will focus on the Black Friday sales which are key, especially after some recent mixed earnings from retailers, including gloomy guidance from the likes of Target (NYSE:TGT).

Investors still worry that the world’s biggest economy is heading for a prolonged recession and a strong holiday sales season will help allay some of those fears.

Earlier this week, minutes from the last Federal Open Market Committee meeting in early November revealed that the rate-setting body saw little evidence that inflationary pressures were easing. Rate setters are committed to raising interest rates as high as necessary to bring inflation under control, which would mean less spending and lower overall growth for that to happen. The news dampened sentiment.

The Fed has delivered four consecutive 75 basis point interest rate hikes this year in as many outings. While many hope that recent data showing an easing in the headline inflation rate will lead to a scaling back in further interest rate increases, the likelihood of more rate hikes remain.

Elsewhere, China's central bank on Friday signaled lower reserve ratios for banks, and conducted reverse repo operations to boost liquidity in the system, as news of fresh Covid restrictions continue to creep in, noted Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

The news is important amid concerns that slowing growth in China will dampen economic activity across the globe.

“The Chinese news certainly prevents oil bulls from jumping in the market right now, and the American crude consolidates below $80 per barrel this morning, with solid offers seen at the $82/85 range,” added Ozkardeskaya.

12.00pm: Black Friday not such a tonic for small retailers

Three quarters (73%) of small independent retailers said Black Friday is bad for business and loses them sales, as people are drawn to global or UK retail giants promising significant discounts, according to a joint survey by shop local platform, Shopappy, and small business free publicity platform, Newspage.

The survey, of 1000 small retailers based around the UK, also revealed that eight in 10 (81%) respondents say Black Friday is putting pressure on them to lower their prices to remain competitive, at a time when margins and profits are already down due to the cost of living crisis and soaring inflation and energy bills.

Unsurprisingly, nine in 10 (89%) survey respondents said they would like to see the annual shopping event removed from the UK calendar altogether, with one describing it as an ‘annual kick in the teeth for small independent retail businesses”.

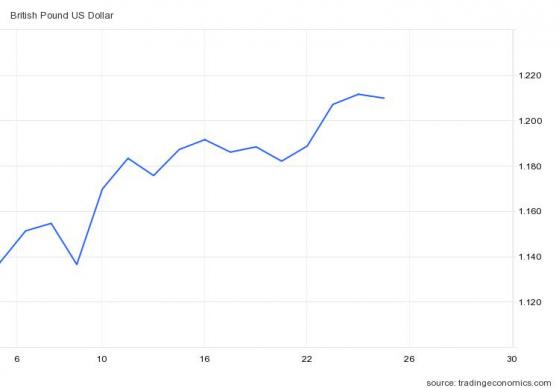

11.20am: Pound steady near three-month highs

Sterling held near a three-month high against a sluggish dollar this morning, while hawkish signals from the bank of England also provided some support.

The pound is on track to end the week nearly 2pc higher – its third straight week of gains.

The UK currency has benefited from a sell-off in the dollar this month amid growing signs US inflation may be peaking. Meanwhile, two BoE officials yesterday said the central bank must continue raising interest rates even as a recession looms.

11.05am: People’s Bank of China lowers Reserve Requirement Ratio

The People’s Bank of China has lowered its Reserve Requirement Ratio rate by a quarter-point, which will allow banks to lend more money to support the economy.

Craig Erlam, senior market analyst, UK & EMEA, OANDA said the move was “a bid to support the economy which is once more going through a difficult period.”

“How effective that will prove to be when cities are seeing restrictions and effective lockdowns reimposed is hard to say.”

“But combined with other measures to boost the property market and ease Covid curbs, the cut could be supportive over the medium term when growth remains highly uncertain.”

Capital Economics said: "The reduction in the required reserve ratio that the PBOC just announced will help banks follow through on a directive to defer loan repayments from firms struggling with widening lockdown restrictions."

"Market interest rates may also edge down as a result, even if that’s not the main goal. But few firms or households are willing to commit to new borrowing in this uncertain environment. A small fall in interest rates wouldn’t make a difference."

10.35am: Black Friday boosting transactions by a sixth - Nationwide

Consumer spending this morning is up around a sixth on a normal Friday, according to date from Nationwide Building Society.

By 9am, Nationwide members had made 1.37mln transactions – 17% higher than a typical Friday.

Live Black Friday spending data - 9am update: 1.37m transactions made so far today - 17% higher than an average Friday. Number of purchases made is 7% higher than on Black Friday last year. #spending #BlackFriday #costofliving https://t.co/ny9pqczo9O— NBS External Affairs (@NationwidePress) November 25, 2022

That’s about 7% more than on Black Friday in 2021, despite cost of living pressures.

Mark Nalder, director of payment strategy at Nationwide Building Society said: “Early indications are that this Black Friday will be the busiest shopping day of the year."

"The lure of a Black Friday bargain ahead of Christmas is clear to see as the number of purchases are currently up 17 per cent on an average Friday.”

Barclaydcard Payments said its data showed the volume of Black Friday payment transactions was broadly in line with 2021.

10.01am: OIl majors support Footsie

FTSE 100 has extended its gains with a firmer oil price supporting shares in index heavyweights BP PLC (LON:BP.) and Shell PLC (LON:RDSa).

Brent crude was trading 1.23% higher at $86.42/barrel while WTI crude was up 1.8% at $79.40/barrel.

Neil Wilson, chief market analyst, at markets.com said “Oil is catching some bid with Iraq and Saudi Arabia promising additional measures if necessary to sooth the oil market.”

“This kind of plays into the idea that with prices down still, the OPEC meeting next week is more likely to look at cuts and not increasing production.”

There were reports, later denied, that the cartel could raise production which sent oil prices tumbling.

Shell topped the FSE 100 risers up 1.6% with BP in second place up 1.3%.

9.28am: German third quarter GDP revised upwards

Some better news from Germany where the economy grew a little faster than first thought in the third quarter, which may ease fears of a deep recession.

German GDP increased by 0.4% in July-September, up from an earlier estimate of 0.3%.

German GDP growth in Q3 was even better than in flash estimate: 0.4% QoQ, from 0.3%. That’s a surprise. Growth was driven by government and private consumption. Net exports and construction sector were drag on growth. https://t.co/sf41uVUAG4— Carsten Brzeski (@carstenbrzeski) November 25, 2022

Separate figures from GfK showed German consumer confidence has improved. GfK forecasts its tracker to tick up to negative 40.2 points in December, from negative 41.9 points in November.

9.05am: Housebuilders weak as Berenberg cuts profit forecasts by around 40%

FTSE 100 up 11 points now but four of the top five fallers are housebuilders not helped by a sector review from Berenberg.

The broker reiterated its cautious stance on the sector and has slashed earnings forecasts and price targets.

In a note published today the broker said “As a result of further declines in affordability, we lower our base-case forecasts for the UK housing market and cut PBT forecasts by c40%, on average.”

“Importantly, we do not expect the sector-wide trough in earnings to occur until 2024.”

“Indeed, we do not yet believe that company valuations are attractive enough for us to turn more positive on the sector and we maintain just two Buy ratings, primarily for stock-specific reasons.”

The broker forecast a 10% decline in volumes and a 5% decline in prices in the housing market, spread over 2023-24.

One bright spot is balance sheet strength with the sector in robust financial health, it said.

“We think that company valuations are fair, but they are not attractive enough for us to turn more positive on the wider sector given the continued macroeconomic headwinds and uncertainty” it said.

The two buy ratings are on Berkeley Group PLC and M J Gleeson PLC (LON:GLEG).

Taylor Wimpey PLC (LON:TW.) fell 2.3%, Persimmon PLC (LON:PSN) slipped 2.6%, Bellway PLC (LON:BWY) dipped 2.5% and Redrow PLC (LON:RDW) declined 3.1%.

8.45am: Banks in focus at RBC - Lloyds upgraded, NatWest (LON:NWG) downgraded

RBC Capital Markets has taken a look at the UK banks and taken a brighter view of Lloyds Banking Group PLC (LON:LLOY).

“We expect the market will start to reward Lloyds for better cost control and asset quality vs peers” the broker said.

As a result it has raised its rating to outperform from underperform and lifted its price target to 57p from 44p, implying 24% upside.

But it has taken a less favourable view of NatWest Group PLC downgrading its rating to sector perform from outperform with a slightly reduced price target of 290p from 300p,

“Whilst valuation remains attractive, we see the potential for more upside elsewhere” it said.

“Earnings momentum from higher rates may have peaked, and we worry about the bank's cost trajectory in full year 2023.”

Meanwhile the FTSE 100 is holding steady, 5 points to the good.

8.10am: Devro soars after agreeing takeover

FTSE 100 opened slightly higher on Friday as a large disposal by SSE PLC (LON:SSE) and news of that Devro PLC (LSE:DVO) had agreed to be taken over sparked some interest.

At 8.10am London’s blue-chip index was up 5 points at 7,471 while the FTSE 250 was down 27 points at 19,513.

Devro PLC soared 59% after food manufacturer Saria announced it had agreed terms to buy the sausage casing maker for £540mln on a fully diluted basis, or 316.1p per share.

The price implied an enterprise value of £667mln equivalent to a multiple of 10.9 times enterprise value to EBITDA for the 52 weeks ended 30 June 2022.

"Saria believes that Devro represents an attractive opportunity to acquire a highly regarded global business of scale which will accelerate the growth of the Bidco group and deliver a number of benefits to the enlarged Saria business, its employees, customers and suppliers," the Selm, Germany-based firm said.

SSE PLC rose 1.3% after announcing the sale of a 25% stake in its Transmission business for £1.465bn to the Ontario Teachers' Pension Plan Board.

The FTSE 100 listed generator said the deal would help unlock significant growth in both the Transmission business and across the wider SSE Group.

Banking stocks are in focus following some rating changes at RBC Capital Markets.

The broker has upgraded Lloyds Banking Group PLC, up 0.4%, to outperform from underperform but downgraded NatWest Group PLC (LON:NWG) to sector perform from market perform.

The price target for Lloyds has been increased to 57p from 44p but trimmed for NatWest to 290p from 300p.

Elsewhere, retailers will be in focus on Black Friday.

7.45am: UK car production returned to growth in October

UK car production returned to growth last month but is still well below pre-pandemic levels, new figures show.

A total of 69,524 cars were built in October, an increase of 7.4% on the same month a year ago, said the Society of Motor Manufacturers & Traders.

UK car production output returns to growth in Octoberhttps://t.co/5BEwFYDP1m pic.twitter.com/y8Gb530LIh— SMMT (@SMMT) November 25, 2022

The rise followed a fall in September, which came after four consecutive months of growth, which the SMMT said illustrated how supply chain turbulence, in particular global chip shortages, continues to affect UK car manufacturers.

Mike Hawes, SMMT, chief executive said: "A return to growth for UK car production in October is welcome – though output is still down significantly on pre-Covid levels amid turbulent component supply. Getting the sector back on track in 2023 is a priority"

7.32am: SSE nets £1.465bn from sale of stake in Transmission arm

News of a biggish deal to kick off Friday as SSE PLC (LSE:SSE) announces the sale of a 25% stake in its electricity transmission network business, SSEN Transmission, for £1.465bn to the Ontario Teachers' Pension Plan Board.

The FTSE 100 listed generator said the deal would will help unlock significant growth in both the Transmission business and across the wider SSE Group.

The disposal is expected to be completed shortly with proceeds to be used to support further growth in the transmission business and further growth opportunities across other core businesses.

The group said last year it was planning selling minority stakes in distribution and tranmission assets following a similar move in renewables. A deal on the distribution side is expected early next year.

7.00am: FTSE 100 seen little changed

FTSE 100 expected to open flat on Friday with US markets closed yesterday for Thanksgiving, and closing early today, and with little economic or corporate news in the diary.

Spread betting companies are calling the lead index up by 1 point.

Asian stocks were mixed on Friday, The Nikkei 225 in Tokyo was 0.4% lower. In China, the Shanghai Composite was 0.4% higher, but the Hang Seng in Hong Kong was down 0.5%. The S&P/ASX 200 in Sydney closed up 0.2%.

Retailers will be in focus as they try to tempt shoppers to spend with a flurry of Black Friday offers

Back in London, there's trading statements from sausage casings maker Devro and construction materials firm Breedon.

Read more on Proactive Investors UK