Proactive Investors -

- FTSE 100 marches higher, up 75 points

- Retailers lifted by Nike results and CBI survey

- Business confidence improves in December - Lloyds (LON:LLOY)

1.01pm: UK government commits up to £4.5bn to support Bulb

The UK government has committed to provide as much as £4.5bn to fund the takeover of collapsed energy company Bulb by rival Octopus, according to a statement from the Department for Business, Energy & Industrial Strategy.

The sale, which will result in Octopus gaining 1.5mln customers, was completed late on Tuesday despite a legal challenge by Octopus’s rivals.

The statement said the objective of the support was to address the hardship that would be caused to Bulb’s customers if Bulb were to be forced into a ‘hard close insolvency’ and to remedy the failure of the loan market in terms of its willingness to provide affordable finance to energy companies in the current economic climate.

The extent of government support could be lower than £4.5bn, depending on energy prices this winter, the statement continued.

12.45pm: The only way is up

Dare I say Santa rally? Certainly a brighter feeling in London as the lead index has powered ahead more than 70 points boosted by gains in retailers, oil stocks and housebuilders.

The mood was lifted by surveys pointing to improved business confidence and a surprising bounce in retail sales while there are expectations for gains in the US this afternoon where results after the bell yesterday from Nike Inc (NYSE:NKE) and FedEx (NYSE:FDX) were viewed favourably.

Housebuilders were given a further boost by positive comments from Liberum which continues to see 40% upside in the sector as it believes shares already discount a landing as hard as in 2008.

“We still expect a moderate 5% softening in prices in 2023 because we do not expect much forced selling, by owners or developers, and unemployment expectations remain modest” the broker said.

They forecast mortgage rates falling to 4.5% which “should mean better activity in spring 2023.”

Liberum’s top picks are Barratt Developments PLC (LON:BDEV), Berkeley Group Holdings plc, Bellway PLC (LON:BWY) and MJ Gleeson.

12.12pm: US stocks expected to open higher

US stocks are expected to open higher on Wednesday, building on gains from yesterday, with after-hours results from FedEx Corp and Nike Inc providing a lift for weary investors still holding out for a pre-Christmas rally.

Futures for the Dow Jones Industrial Average (DJIA) rose 0.7% in pre-market trading, while those for the broader S&P 500 index were 0.5% higher and contracts for the Nasdaq-100 added 0.4%.

“Wall Street advanced yesterday and futures markets suggest Wednesday will see further gains in early trade,” said James Hughes, chief market analyst at scopemarkets.com

Shares in FedEx and Nike were in focus as investors weighed the impact of the latest results from both firms which contained bright spots. Nike shares were up over 12% in pre-market deals, while FedEx shares were up over 4%.

“Economic news remains thin on the ground and there was also that canary-in-the-coalmine warning from FedEx last night after its revenues missed expectations in what many see as an alternative indicator over the pace of economic growth.

"However, it was far from a universally gloomy picture amongst corporates, with FedEx’s EPS (earnings per share) beating forecasts, whilst Nike which also reported last night saw shares add as much as 12% in the wake of well-received earnings news," noted Hughes.

Wall Street’s gains during Tuesday’s regular trading session snapped four straight days of losses and brought some much-needed Christmas cheer.

That said, worries about the path for interest rates in the world’s biggest economy continue to keep many investors on the sidelines.

Last week, the Federal Reserve lifted interest rates by 50 basis points and signaled that its fight to dampen inflation is not over despite its year-long spate of rate increases.

Investors worry that the aggressive tightening of monetary policy will push the US economy into a prolonged recession.

On the economic data front on Wednesday, US home sales data for November, due out at 10.00am ET, will likely get some attention as they will show whether buyer confidence has been dented by the Fed rate hikes.

11.40am: Retail demand picks in December - CBI

Better news from the high street as UK retailers reported an unexpected pick-up in demand in December, although they expect consumer spending to slide again in 2023 as shoppers are pressured by the rising cost of living, according to a survey from the Confederation of British Industry (CBI).

The news was reflected in gains for for Next plc (LON:NXT), Kingfisher (LON:KGF) and Marks & Spencer Group plc, while JD Sports Fashion PLC and Frasers Group PLC have the additional boost provided by Nike's strong results.

The CBI's monthly distributive trades index rose to +11 in December from -19 in November, well above both the -21 forecast by retailers and the -23 median forecast by City analysts.

However, for January retailers see the sales balance falling back to -17.

Sales volumes were seen as typical for the time of year in December and are expected to remain broadly in line with seasonal norms next month according to the survey.

Martin Sartorius, principal economist at the CBI, said: ”“It’s encouraging to see retail sales surprise by growing this month, but any festive cheer is expected to be short-lived.”

“Retailers are bracing themselves for the chill winds that will blow through the sector this winter, with consumer spending set to be hit hard by high inflation in 2023”.

“The decision by the UK government to freeze business rates from April provides some welcome relief to the retail sector.”

“However, retailers also need to see long-term sustainable growth measures from the government to encourage investment and address ongoing labour shortages”.

The survey showed that online sales had fallen further in December to a figure of -22 from -5% in November, with an even steeper decline expected next month (-34%).

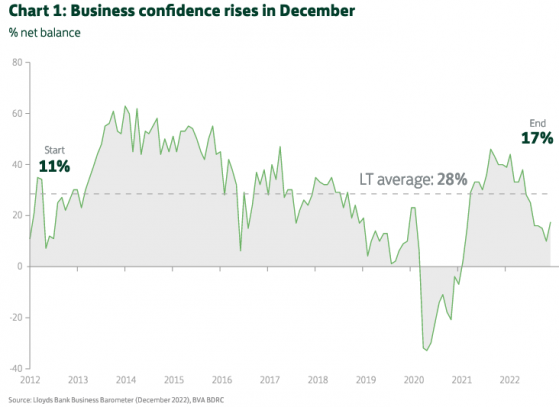

11.00am: Business confidence bounces back in December - Lloyds (LON:LLOY)

Business confidence bounced back in December, driven by the biggest monthly rise in optimism about the wider economy for twenty months according to the latest Lloyds Bank business monitor.

The headline business confidence index gained 7 points to 17%, the highest since July, but it remains below both the level of a year ago (40%) and the long-term average (28%).

Firms’ perceptions of their trading prospects for the year ahead also improved, reversing last month’s fall, the survey found, while businesses reported prospects of a better festive trading period than last year and confidence in a more successful 2023.

Inflation and the risk of an economic downturn remain the biggest concerns.

Hann-Ju Ho at Lloyds Bank Corporate & Institutional Banking said: “Business confidence has received a boost in the run up to Christmas as firms anticipate a better festive trading period than last year.”

“While firms report being hopeful for a more successful 2023, inflation and the risk of an economic downturn remain the biggest concerns for businesses, with rising costs evidenced by the number of firms expecting to raise prices.”

“Wage growth is expected to remain high for now as retaining existing staff and attracting new talent will continue to be priorities for many businesses going into next year.”

10.23am: Drax rises on favourable windfall tax update

Shares in Drax PLC rose 2.6% as analysts highlighted benefits from the latest government update on proposals for a windfall tax on excess profits made by some electricity generator companies.

"The levy will be applied to a measure of extraordinary revenues, defined as revenues from selling periodic output at an average price above 75 pounds ($91.12) per MWh," the Treasury said in a statement yesterday.

Analysts at Barclays (LON:BARC) Capital said it “appears that high cost generation will be allowed extra allowances” adding “based on our first look we see the potential for Drax to receive an extra £25/MWh benefit” which it estimated at “c.30p/share EPS per annum."

The bank kept its overweight rating on the FTSE 100 listed generator.

9.30am: JD and Frasers boosted by Nike

JD Sports Fashion PLC, the UK’s biggest sportswear retailer, and Frasers Group PLC, which owns Sports Direct (LON:FRAS), were prominent risers in the FTSE 100 today boosted by better-than-expected earnings and revenue from US giant, Nike Inc (NYSE:NKE).

JD Sports was top of the FTSE 100 risers, up 7%, while Frasers rose 3.25%, as investors took heart from the news.

Victoria Scholar, head of investment, interactive investor said: “Nike has proven that the sheer force of its brand and the strength of its product line are resilient to the challenging macroeconomic headwinds that have plagued US retail this year.”

Second quarter reported revenues were $13.3bn, up 17% year-on-year with Nike Direct sales up 16% at $5.4bn.

Analysts at Peel Hunt said “the read-across to JD is obvious and there is a "shout out" to them in the conference call as a key partner.”

On JD Sports they added: “We believe that the trend seen in 1H has probably broadly continued in 2H and that the update in mid January will likely be at least solid.”

“The shares however discount bad news, and therein lies a major opportunity.”

Over in Europe, Adidas (ETR:ADSGN), up 7.8% and Puma, up 8.9%, also rose strongly after the figures.

9.07am: Retailers lead the way

London’s blue chips have continued their steady path upwards with the FTSE 100 now up 21 points supported by advances amongst retail stocks.

Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown (LON:HRGV) said the gains were also helped with the FTSE’s “defensive nature coming to the fore again, spreading a small sprinkle of Christmas cheer.”

Higher than expected UK borrowing numbers have been shrugged aside as the government’s energy support package prompted figures to overshoot expectations.

The EY ITEM Club pointed out “The ONS continues to describe the cost of these schemes as “initial indicative estimates”, so large revisions are likely.”

“It will be some time before a true picture of the state of the public finances emerges” they said.

“But the increase in the energy price guarantee and end of universal support will mean that the cost of energy support measures will be much lower from spring next year.”

Retailers were in favour with JD Sports Fashion PLC leading the risers, up 7.5%, supported by the better than expected numbers from Nike Inc (NYSE:NKE)., while Ocado Group PLC (LON:OCDO), up 3.5%, and Kingfisher (LON:KGF), up 2%, completing the top three.

Frasers Group PLC, up 1.9%, and &M European Value Retail SA, up 1.7%, weren’t far behind as investors hoped for a late surge in Christmas sales.

In the FTSE 250 Pets at Home Group PLC (LON:PETSP) added 2% as the pet-focused retailer said it has appointed former Asda CEO Roger Burnley to its board.

AIM-listed Directa Plus was another early riser, up 7%, as it announced an exclusive agreement with Pigmentsolution, a European distributor of speciality chemicals and ingredients, to support the development and distribution of Directa’s new patented Graphene Plus (G+) product, Grafyshield G+, initially in Germany, Austria, Switzerland and Poland, with the potential for further expansion in Europe.

Giulio Cesareo, founder and CEO of Directa Plus, said: "this contract is a significant win for the group.”

8.30am: Lift off for Virgin Orbit

The first space mission on British soil is due for lift off in the coming weeks after the Civil Aviation Authority (CAA) granted launch and range licences to Virgin Orbit to undertake launch activities from the UK.

The decision has the backing of transport secretary Mark Harper and comes after Virgin satisfied a range of tests put in place by the CAA.

In a statement the CAA said entrepreneur Sir Richard Branson's company demonstrated “it has taken all reasonable steps to ensure safety risks arising from launch activities are as low as reasonably practicable.”

Tim Johnson, director for space regulation at the UK Civil Aviation Authority said: "This is another major milestone in enabling the very first orbital space launch from UK shores and these licences will assist Virgin Orbit with their final preparations for launch.”

Virgin is planning a launch from Spaceport Cornwall at Cornwall Airport Newquay in the coming weeks.

8.15am: Cautious early progress

FTSE 100 moved higher at the open boosted by gains in the US and despite higher than expected UK borrowing figures.

At 8.10am the FTSE 100 was up 14 points at 7,385 and the FTSE 250 advanced 52 points to 18,598.

UK public sector borrowing rose to £22bn in November, up £13.9bn on the same month last year making it the highest November figure since monthly records began in 1993 and ahead of City forecasts of £13bn.

Samuel Tombs, chief UK economist, at Pantheon Macroeconomics said “public borrowing was boosted in November by the government’s energy and cost of living interventions, the decision to reverse April’s National Insurance hike, and high inflation.”

He also expected public borrowing to overshoot the OBR’s forecast in future years.

“We think public borrowing eventually will settle at about 4% of GDP in the mid-2020s, above the 3% ceiling specified by the new fiscal rules” he said.

Corporate news was thin on the ground as we head to the holiday period but Bunzl PLC (LSE:LON:BNZL) was in focus after forecasting a 17% jump in 2022 revenues and operating margins ahead of previous guidance. Shares rose 1% in early trading.

JD Sports Fashion PLC (LSE:JD.) rose 3.5% after strong results from sportswear retail giant, Nike Inc (NYSE:NKE). after the US market close which sent its shares sharply higher.

JD is the UK’s sportswear retailer and has a partnership with Nike which gives its customers access to more of the US brand's footwear and clothing.

Peel Hunt noted “the read-across to JD is obvious and there is a "shout out" to them in the conference call as a key partner.”

7.44am: Borrowing hits £22bn in November, above City forecasts

Public sector net borrowing (PSNB) hit £22.0bn in November, the highest November total since monthly records began in 1993 and a big jump from £13.9bn last year according to figures from the Office for National Statistics (ONS).

The number was also ahead of City forecasts of £13.0bn.

Public sector net borrowing excluding public sector banks was £22.0 billion in November 2022.This was £13.9 billion more than in November 2021 and the highest November borrowing since monthly records began in 1993.

➡️ https://t.co/9zbLoWZLZn pic.twitter.com/iiboMrXmFY

— Office for National Statistics (ONS) (@ONS) December 21, 2022

PSNB was £105.4bn in the financial year to November 2022, £7.6bn less than in the same period last year, but £50.8bn more than in the financial year to November 2019 (pre-coronavirus).

This is the fourth highest financial year to November borrowing since monthly records began in 1993, the ONS said.

Debt interest payable was £7.3bn in November, which was £2.4 billion more than in November 2021 and again the highest November figure since monthly records began in April 1997 with the volatility largely because of the effect of RPI changes on index-linked gilts.

Public sector total expenditure was £98.9bn while public sector total receipts were £76.9bn.

7.32am: Bunzl forecasts 17% jump in 2022 revenues

Bunzl PLC said that operating margins in 2022 would be slightly ahead of previous guidance and in line with 2021 while revenues are expected to rise 17% at actual exchange rates.

“The group is expected to deliver very strong growth over the year, continuing to reflect the resilience and strength of the Bunzl business model” it said.

Updating investors on trading the FTSE 100-listed company also said “negotiations with our largest customer by revenue are ongoing.”

Looking ahead, Bunzl forecast revenue in 2023 would be slightly higher than in 2022, driven by both organic growth and acquisitions, and partially offset by a small impact from a previously announced disposal.

The company said it expects adjusted operating profit in 2023 to be resilient, with operating margin slightly higher than historical levels although adjusted EPS is expected to be moderately lower year-on-year due to higher interest rates and an increased effective tax rate.

CEO Frank van Zanten, said: “We have committed more than £280mln of spend to acquisitions over the year, with our pipeline remaining active and supported by our strong balance sheet."

7.00am: The only way is up

FTSE 100 is expected to open higher on Wednesday as US markets broke their four day losing streak.

Spread betting companies are calling the lead index up by 23 points.

Michael Hewson chief market analyst at CMC Markets UK said: “After 4 days of losses US markets just about managed to break their losing streak, with the focus this week very much on Friday’s PCE report and US consumer spending reports for November, which has thus far held up reasonably well this year, despite declining consumer confidence.”

At the close the S&P 500 was up 0.1% at 3,822, the Dow reached 32,850 for a 0.3% gain, and the Nasdaq was flat at 10,547.

In a positive sign for consumer confidence, Nike reported strong revenue growth in its second quarter, sending its shares up 13% in after-hours trade in New York.

Back in London and the early focus will be on UK public finances numbers for November while results are due from Bunzl and Carnival (NYSE:CCL).

Read more on Proactive Investors UK