Benzinga - by Vandana Singh, Benzinga Editor.

Coya Therapeutics Inc (NASDAQ:COYA) is a clinical-stage biotechnology company developing treatments focused on regulatory T cells (Tregs) to target systemic inflammation and neuroinflammation.

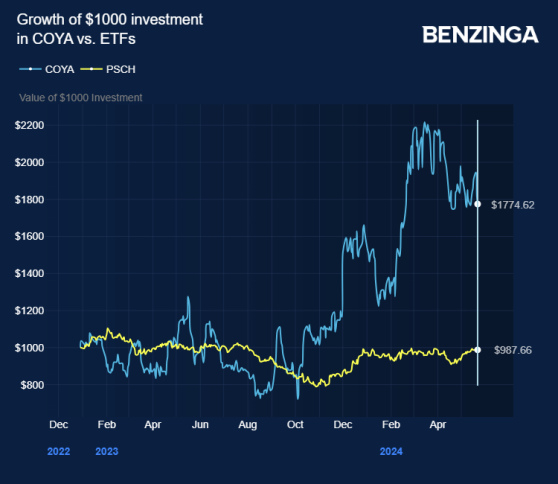

Since its IPO in December 2022, Coya shares have surged around 70%, significantly outperforming the Invesco S&P SmallCap Health Care ETF (NASDAQ:PSCH).

Howard Berman, Chairman and CEO of Coya Therapeutics, sat down with Benzinga this week to share updates on his company’s projects and insights into the industry. Berman had also appeared on Benzinga’s All Access in February.

In the Q&A session, Berman pointed out that many biotech companies concentrate on a single neurodegenerative disease, target, mechanism, or drug, suggesting that a more comprehensive approach might be more effective.

“We believe the traditional ‘one disease – one target – one drug’ approach might not be the most appropriate framework for neurodegenerative disorders and may be partly responsible for the lack of available and truly effective treatments,” Berman said.

He noted that the company is moving into the combination approaches and biologics regime, just like the general biotech market has done in cancer, HIV, and viral disease treatment.

Here’s a summary of the Q&A:

Benzinga: Coya Therapeutics is working on therapies for neurodegenerative and inflammatory diseases. What are the particular problems the company aims at, and how do you think it is committed to transformation?

Berman: “We are developing an innovative therapeutic platform which has the potential to transform the treatment of neurodegenerative and autoimmune diseases…Further, numerous investigations have determined the key role of Tregs in autoimmune conditions.”

“Our mission is to restore the immune balance by enhancing Treg function, resulting in suppression of systemic and neuro-inflammation and modifying the course of these devastating conditions.”

Benzinga: Can you discuss Treg’s ‘beyond cancer?’

Berman: “New cancer immunotherapies paved the road to developing multi-targeted treatment strategies to fight disease. In neurodegenerative diseases, the suppressive function and number of circulating Tregs are decreased. This Treg dysfunction results in increased inflammation and, consequently, disease progression.”

Benzinga: Can you shed more light on your lead program, COYA 302?

Berman: “COYA 302 is an investigational biologic treatment designed to be administered as a simple subcutaneous injection like many people administer daily insulin or heparin.

COYA 302 – the company’s lead biologic investigational product is now being developed for amyotrophic lateral sclerosis (ALS) Frontotemporal Dementia (FTD), Parkinson’s Disease, and Alzheimer’s Disease.

Coya plans IND submission for FTD and Parkinson’s disease animal data in the second half of 2024.

COYA 302 combines two active components – low-dose interleukin-2 and CTLA4-Ig – to deliver a unique dual mechanism of action in vivo. While low-dose interleukin-2 restores Treg function, CTLA4-Ig suppresses the surrounding pro-inflammatory cells.”

The company expects to file an FDA IND in 2Q24, followed by initiating a Phase 2 trial with COYA 302 in ALS.

Benzinga: What is the take on COYA 302 for amyotrophic lateral sclerosis after Amylyx recently withdrew its drug after the failed trial?

Berman: Following the failure of Amylyx’s drug, it is even more important to develop new safe and effective treatment options for ALS. At Coya, we are committed to delivering innovative treatments to fight ALS and other serious conditions characterized by Treg dysfunction.

Benzinga: Who are Coya’s competitors? Biogen already has a drug for ALS associated with a mutation in the SOD1 gene.

Berman: First, we welcome all products that may help ALS patients…Specifically, to your question, Biogen Inc’s (NASDAQ:BBIB) product is indicated for a small subset of ALS patients and requires in-hospital administration. Our approach is quite different, as COYA 302 is intended to treat all patients with ALS, including familiar and sporadic.

Benzinga: What is the expected total addressable market Coya is looking at?

Berman: The first indication we are pursuing is ALS. In the U.S. and EU combined, there are ~70,000 patients living with ALS. We plan to include mild-to-moderate ALS patients regardless of genotype, and this covers >50% of ALS patients. In addition, we are pursuing clinical studies in FTD, a disease with very limited options and >100,000 patients in the US/EU.

Benzinga: How do you see the growth of Treg therapies panning out in the short and long term?

Berman: We see COYA 302 as a ‘pipeline in a product,’ as its mechanism of action and ease of use have the potential to offer a safe and effective treatment in multiple neurodegenerative conditions driven by immune imbalance and Treg dysfunction. We have a clear path forward to continue exploring the potential of COYA 302…Moreover, we also believe it holds additional potential in Alzheimer’s disease, Parkinson’s disease, and FTD, and we anticipate additional clinical trials in those indications in the coming months and years as well.

Benzinga: What is your message for your investors?

Berman: I want to thank our investors for their continuous support. Coya is the result of hard work supported by trust and strong ethical principles. Our investors are an essential part of the Coya family, and we all share the same mission: deliver new treatments to patients affected by neurodegenerative diseases.

Recently, Alzheimer’s Drug Discovery Foundation purchased 603,136 Coya Therapeutics shares at $8.29 per share for an aggregate investment of $5 million. The company intends for this equity investment to help fund the development of COYA 302 in a planned Phase 2 trial in FTD.

Price Action: COYA shares closed 2.9% lower at $7.91 on Friday.

Watch Berman’s February interview on Benzinga’s All-Access below:

Now Read: Benzinga’s ‘Stock Whisper’ Index: 5 Stocks Investors Secretly Monitor But Don’t Talk About Yet

Image generated using artificial intelligence via Midjourney.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga