By Peter Nurse

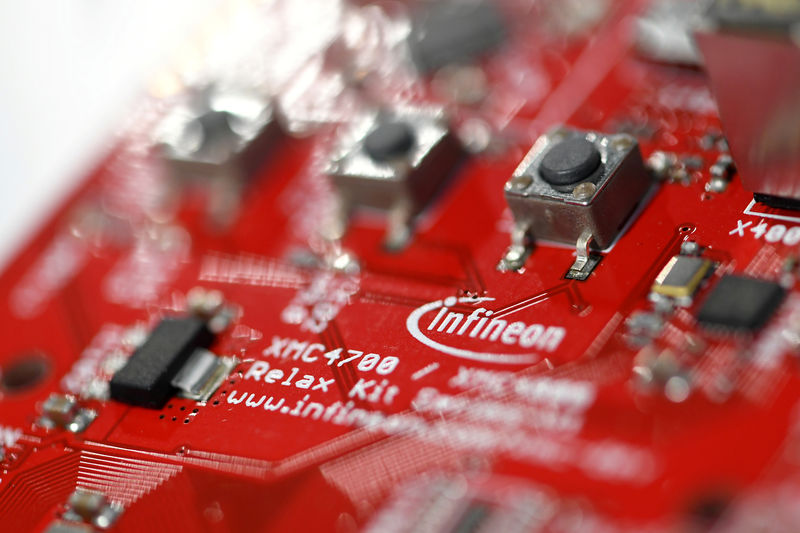

Investing.com - European stock markets edged higher Tuesday, helped by strength in the heavyweight energy sector, while Infineon (OTC:IFNNY) impressed with positive 2022 guidance.

At 3:35 AM ET (0735 GMT), the DAX in Germany traded 0.1% higher, the CAC 40 in France rose 0.3% and the U.K.’s FTSE 100 climbed 0.5%.

The important energy sector received a boost in Europe Tuesday from crude oil prices rising to multi-year highs. This followed the Organization of the Petroleum Exporting Countries and allies led by Russia, a group known as OPEC+, decided to continue increasing output only gradually despite demand recovering as the Delta-variant Covid-19 wave ebbs.

Global cases hit their lowest in nearly two months on Monday, according to Johns Hopkins data.

U.S. crude futures traded 0.3% higher at $77.89 a barrel, while the Brent contract rose 0.5% to $81.69. Both contracts gained well over 2% on Monday, with WTI hitting a seven-year high and Brent reaching a three-year peak.

These gains helped the oil majors power ahead Tuesday, with BP (NYSE:BP) stock climbing 1.2% to a 52-week high, Royal Dutch Shell (LON:RDSa) stock up 0.6%, Eni stock up 0.7% and TotalEnergies stock 0.8% higher.

In other corporate news, Infineon (DE:IFXGn) stock rose 0.8% after the German semiconductor manufacturer confirmed its full-year guidance and predicted strong revenue gains the following year.

Swiss Re (OTC:SSREY) stock rose 0.3% after the reinsurer put its preliminary claims burden from Hurricane Ida at $750 million, while updating its loss estimate for the July floods in Europe to approximately $520 million. Greggs stock climbed 3.7% after the U.K. bakery chain raised its profit forecast for the full year despite warning of rising cost pressures.

In economic news, British new car registrations fell last month by 35% year on year, according to preliminary industry data Tuesday, marking the weakest September for at least 23 years.

On the flip side, French industrial production rose 1.0% on the month in August, a significant improvement from the revised 0.5% gain the previous month, while the final PMI data for the European region are still due.

The positive open for Europe comes despite concerns over losses on Wall Street on Monday, with the tech-heavy Nasdaq Composite, in particular, falling more than 2% on the back of rising Treasury yields as the standoff over the U.S. debt ceiling continues.

Tech weakness translated to selling in Asia, with Japan’s Nikkei 225 falling more than 2%, while markets in mainland China remain closed.

Elsewhere, gold futures fell 0.4% to $1,760.90/oz, while EUR/USD traded 0.2% lower at 1.1600.