FRANKFURT (Reuters) - Global sales of industrial robots rose by 16 percent in 2016, driven by the electronics industry, and are expected to rise faster in 2017, the International Federation of Robotics (IFR) said on Wednesday.

The world market was worth $13.1 billion (9.77 billion pounds), an increase of 18 percent, or an estimated $40 billion including software, peripherals and systems engineering.

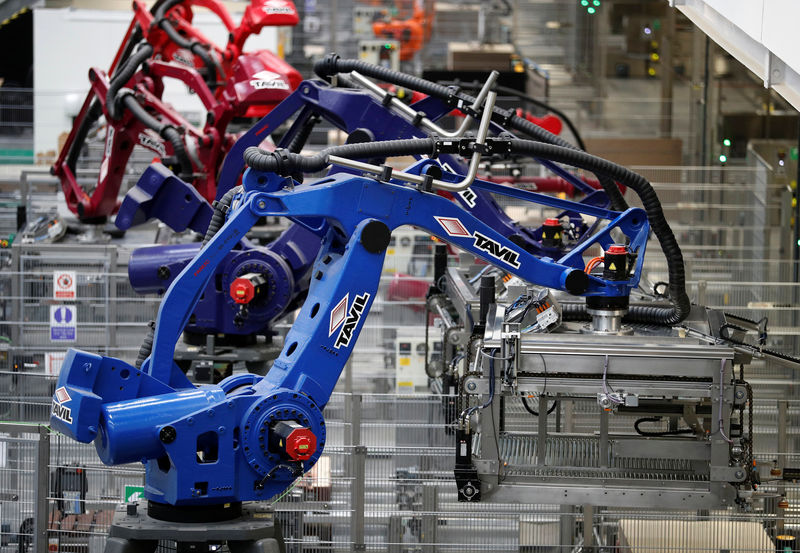

Electronics accounted for almost as many shipments as the automotive industry, which has driven industrial robot sales since the 1970s, as robots become smaller, cheaper and more precise while demand soars for batteries, chips and displays.

Sales to the electrical and electronics industry jumped 41 percent to 91,300 units, while sales to the automotive industry rose 6 percent to 103,300 units, or 35 percent of total sales of 294,312 units.

The IFR said it expected global robot installations to increase by at least 18 percent this year, and at least 15 percent annually between 2018 and 2020.

Future drivers of demand would be the industrial internet that links real-life factories with virtual reality, collaborative robots that can work alongside humans, and machine learning and artificial intelligence, it said.

Tom Riley, manager of Robotech strategies at AXA Investment Managers, with more than 2 billion euros ($2.35 billion) under management, said the increasing intelligence of systems that control robotics provides fruitful ground for investment.

"The expanding range of applications of robotics and automation technology continues to support a robust growth rate," he told Reuters.

China, the world's biggest robot market with about 30 percent of the global sales, saw shipments rise 27 percent.

"China and Korea are already dominated by consumer electronics in terms of units," Gudrun Litzenberger, general secretary of the Frankfurt-based IFR, told a news conference.

South Korea, the second-biggest market, saw a rise of 8 percent. With 2,145 robots for every 10,000 employees in manufacturing industries, so-called robot density has almost doubled from 2009 and is the highest in the world.

"Huge projects aimed at manufacturing batteries for hybrid and electro cars might be the reason for this high increase in robot density," the IFR said.

Samsung (LON:0593xq) SDI (KS:006400), LG Chem (KS:051910) and SK Innovation (KS:096770) are among those racing to mass-produce long-distance car batteries as countries around the world led by China push a shift to electric mobility.

Japanese robot sales rebounded last year to rise 10 percent.

Japan continues to dominate among industrial robot makers, with only Swiss ABB (S:ABBN) and Germany's Kuka (DE:KU2G) in the league of Fanuc (T:6954), Yaskawa (T:6506), Kawasaki (T:3045) or Nachi (T:6474).

In the United States, robot installations rose 14 percent.

The IFR said U.S. growth continued to be driven by a desire to keep manufacturing at home or bring it back from overseas through increased automation and competitiveness.

In Germany, home to major carmakers Volkswagen (DE:VOWG_p), BMW (DE:BMW) and Daimler (DE:DAIGn), robot shipments more or less stagnated.