(Bloomberg) -- With the euro-area economy in the best shape in almost 20 years, now is the time to prepare for future slumps, according to European Central Bank policy maker Benoit Coeure.

The region’s expansion is proving increasingly balanced and robust, much like its upturn in 1999, the ECB Executive Board member said on Thursday. But while current monetary stimulus will continue as long as necessary, the success must also be nurtured by structural reforms that will better equip the region for the next shock, he said.

“This recovery is carried in no small part by monetary policy and the exchange rate and equally by low commodity prices,” Coeure said in Lyon, France. “These are factors that won’t last forever. And if we accept this, the states of the euro zone will find themselves unarmed when the next crisis arrives.”

The ECB has spent years pumping cash into the economy to revive inflation and growth, and last month pledged to keep doing so until at least September 2018, albeit at a slower pace. Yet the debate over when the central bank should step back is gaining intensity.

The commitment to keep interest rates low until after asset purchases end doesn’t leave policy makers room to raise borrowing costs next year, Governing Council member Ewald Nowotny said in a radio interview on Friday. At the same time, the ECB should bring QE to an end after September, “if the economy develops in a way that we currently expect,” he said.

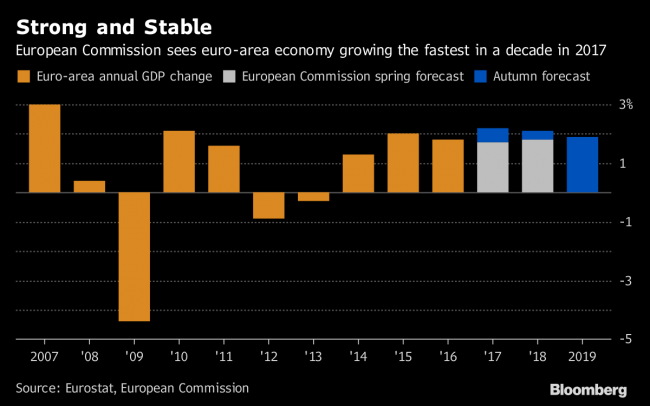

While Coeure was referring to the broad character of the economy, a European Commission report on Thursday highlighted how output growth is proving stronger than anticipated. The commission raised its forecasts to show gross domestic product expanding 2.2 percent this year, up from its May prediction of 1.7 percent. That would be the highest pace in a decade.

“Euro-area growth will be sustained in the next two years thanks to strong investment and thanks to increased convergence among countries,” Governing Council member Francois Villeroy de Galhau, the French governor, said on Thursday in Brussels. “This forecast, including a positive but still subdued inflation, confirms the adequacy of the gradual normalization of our monetary policy we are engaged in.”

Inflationary Signs

Irish governor Philip Lane backed that position, saying it is too early for a “radical shift” in policy, though he raised the prospect that the situation could change relatively quickly.

“There are some signs that inflation is snapping back. I also do not exclude that there could be surprises and that inflation might be higher in the future than we currently expect,” he said in an interview with Boersen-Zeitung. “Our monetary policy does not always have to follow such a gradual and incremental approach as it is currently the case.”

ECB policy makers decided last month to keep buying debt until consumer-price growth is back on track toward their goal of just under 2 percent, and to maintain interest rates at record lows even longer.

An expansionary monetary policy was needed as a response to the crisis, Bundesbank President Jens Weidmann told an audience in Leipzig, Germany. But the euro area is now “far away from deflation” and the current era of low rates “will have to be over at some point,” he added.

Coeure, as head of market operations one of the heavyweights in the ECB’s policy debate, was said to have advocated tying the overall stimulus -- rather than just the bond-buying program -- to the inflation outlook. On Thursday he said that “nothing” justifies ending the ECB’s support just yet.

New Firepower

Still, his concerns about complacency among other actors echo worries expressed by the institution’s chief economist Peter Praet, who warned a day after the last meeting that it’s difficult to imagine that the central bank would have the space to be able to combat a new shock.

“The ECB has done what it can do and will continue to do what it can do but within the constraints of a mandate that is tightly defined,” Coeure said. “We need to build up new firepower and for that we need reforms.”

His point was echoed by Weidmann, who said central bankers “can’t do more than warn” that the upswing provides an opportunity for reform that shouldn’t be wasted.

Coeure also said the ECB is monitoring the risks to financial stability, including those resulting from low interest rates, and noted concerns in some countries and asset classes such as an increase in French corporate debt.

But he said there are no signs of financial bubbles at the euro-area level, and added that when the next crisis comes, it might not be foreseeable.

“The crisis will necessarily arrive because that is how the economic cycle works. We don’t know where it will come from,” he said. “It might come from China, it might come from the U.S, or from within the euro zone.”

(Updates with Nowotny comments in fifth paragraph.)