Benzinga - by Piero Cingari, Benzinga Staff Writer.

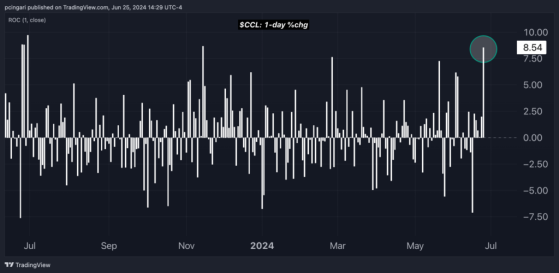

Carnival Corp. (NASDAQ:CCL) rallied over 8% by 2:30 p.m. ET Tuesday, eyeing its best trading session of 2024 after delivering second-quarter earnings that significantly beat expectations.

Goldman Sachs analyst Lizzie Dove highlighted that the cruise line’s Q2 beat and the Q3 guidance "hit the key marks that investors were looking for," driving the positive market reaction.

The investment bank maintained a ‘Buy’ rating on Carnival, setting a 12-month price target of $22 per share, implying a robust 34% surge from current levels.

Other cruise-line stocks rallied in sympathy with Carnival on Tuesday. Royal Caribbean Cruise Ltd. (NYSE:RCL) and Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH) soared by 4.2% and 5.6%, respectively.

Chart: Carnival Eyes Strongest Session Since November 2023

Carnival Q2 Earnings: Key Highlights Carnival reported an adjusted EBITDA of $1.2 billion, far surpassing the consensus estimate of $1.06 billion and its guidance of $1.05 billion. Revenue came in at $5.78 billion, above the expected $5.7 billion.

Adjusted earnings per share (EPS) came in at $0.11, well above the consensus estimate of a $0.02 loss.

Dove noted several key metrics that contributed to the strong quarterly performance.

- Ticket revenue per Passenger Cruise Days (PCD) was $154.49 beating Goldman Sachs’ estimates and increasing 7.2% year-over-year.

- Onboard revenue per PCD grew by 2.9%, an improvement from the previous quarter's decline, indicating strong consumer spending.

- Occupancy rates reached 104%, surpassing the estimate of 103.3%; net yields of $186.55 exceeded expectations, marking a 12.2% year-over-year increase.

- Carnival also improved its efficiency from a cost perspective, as net cruise costs ex fuel fell 0.3% year-over-year compared to a 3% rise according to previous guidance.

The company now expects adjusted EBITDA of $5.83 billion, up from $5.63 billion, and adjusted EPS of $1.18, up from $0.98.

For the third quarter, Carnival forecasts an EBITDA of $2.66 billion and net yield growth of 8% year-on-year.

Now Read: Chipmakers, Cruise Lines, Crypto Rally, Nvidia Reclaims $3 Trillion; Blue Chips, Small Caps Dip: What’s Driving Markets Tuesday?

Image: Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga