(Bloomberg) -- Follow @Brexit on Twitter, join our Facebook (NASDAQ:FB) group and sign up to our Brexit Bulletin.

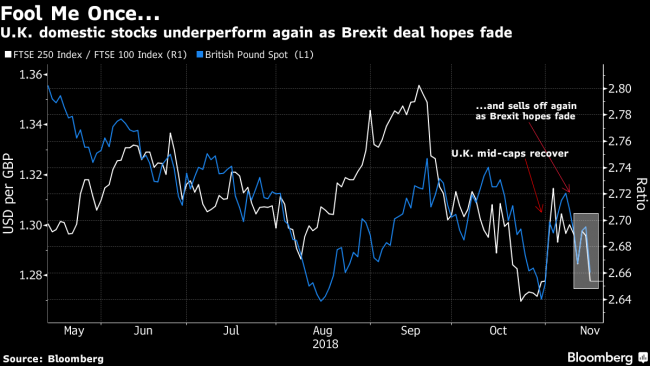

Once again, traders were reminded never to get too hopeful about a Brexit deal.

Not even a day after the accord was reached, Brexit Secretary Dominic Raab resigned, imperiling yet again an agreement that would pave the way for the U.K.’s orderly departure from the European Union.

The reaction in markets was swift -- and, in many ways, predictable. The pound plunged, boosting the international-packed FTSE 100. British mid-caps, which tend to be more domestic-facing, fell. Even the Stoxx Europe 600, which reacts less to the day-to-day Brexit headlines, reversed its gains to drop 0.3 percent.

“We are barely past 9 a.m. and already the situation is slipping out of control,” Chris Beauchamp, chief market analyst at IG Group Holdings (LON:IGG) Plc, said in an email. “Brexit has just blown up again and, thrown together with Italy, trade wars and U.S. earnings, risk appetite is unlikely to recover for long.”

The slide in local stocks was brutal:

- Among banks: Barclays (LON:BARC) Plc fell 3.6 percent, Royal Bank of Scotland Group (LON:RBS) Plc dropped 4.8 percent and Lloyds Banking Group Plc (LON:LLOY) slid 2.8 percent

- Among homebuilders: Barratt Developments (LON:BDEV) Plc declined 4.5 percent, Persimmon (LON:PSN) Plc tumbled 5.2 percent, Berkeley Group Plc lost 3.9 percent and Redrow (LON:RDW) Plc fell 4.4 percent

- Among retailers: Next Plc dropped 3.9 percent, Marks & Spencer Group (LON:MKS) Plc was down 4.4 percent and Kingfisher (LON:KGF) Plc weakened 3 percent

- Real-estate company British Land Plc shed 2.9 percent, only hours after a Credit Suisse (SIX:CSGN) note said catalysts for the stock include “reduced uncertainty surrounding Brexit”