MELBOURNE (Reuters) - BHP Group Ltd (AX:BHP) (L:BHPB) posted on Tuesday a 7.2% rise in first-quarter iron ore production, slightly above expectations, supported by stable demand from China, the world's top consumer of the steelmaking ingredient.

As the world grapples with the fallout of the COVID-19 pandemic, major miners are hoping Beijing's commodity-intensive stimulus measures will deliver an economic rebound for China.

The world's largest listed miner produced 74 million tonnes (Mt) of Western Australia Iron Ore in the three months ended Sept. 30, up from 69 Mt a year earlier and slightly above a UBS estimate of 73.5 Mt.

BHP said, however, that December quarter iron ore production will be affected by work linking its Mining Area C and South Flank projects in Western Australia. Its full-year forecast of 276 milllion – 286 million tonnes was kept unchanged.

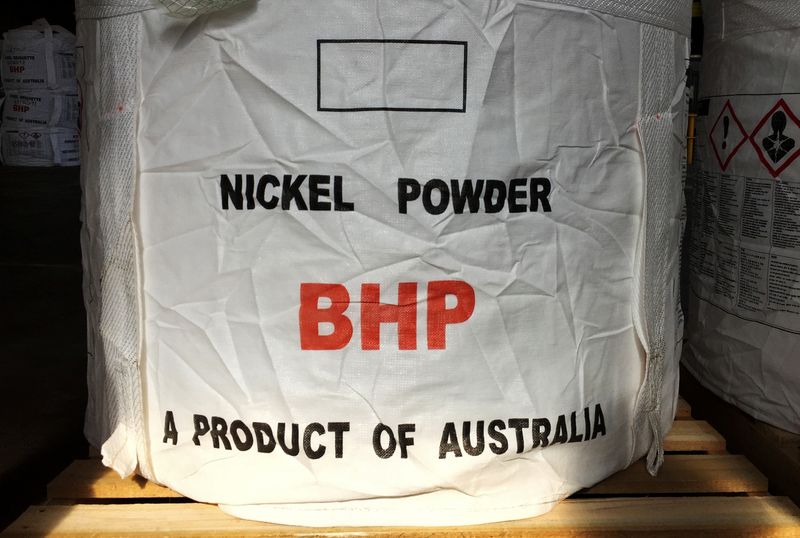

"BHP's projects are on track, and the company is securing growth options in copper and nickel. No major surprises in this report. Reiterate Buy," broker Jefferies said in a note.

For copper, BHP's $2.46 billion (1.9 billion pounds) Spence expansion in Chile is on track for first production in the January quarter but a $2.5 billion expansion project at South Australia's Olympic Dam has been canned after extended drilling showed it would not be economic.

The company's metallurgical coal production rose 5% to 10 Mt, while energy coal output slid 17%. The miner said it is "monitoring for any potential impacts from restrictions on coal imports into China."

Costs at its Jansen potash project in Canada, for which a final investment decision is due mid 2021, have climbed by $272 million due to challenges in mine shaft lining and also its COVID-19 response, bringing total costs to $3.0 billion.

Last week, Rio Tinto (AX:RIO) warned a resurgence in coronavirus cases was putting global economic growth at risk, and that steel production outside China has sharply dropped.