By Joyce Lee and Se Young Lee

YONGIN, SOUTH KOREA (Reuters) - Samsung (LON:0593xq) Electronics (KS:005930) plans to triple the market share of its contract chip manufacturing business within the next five years by aggressively adding clients, a senior company executive said, as it targets new growth drivers for the chips business.

The estimated 5.3 trillion won (3.65 billion pounds) business at Samsung was split off as a separate arm within its semiconductor division in May, in a clear statement that the technology giant was preparing to focus on the business and narrow the big market share gap with leader TSMC (TW:2330).

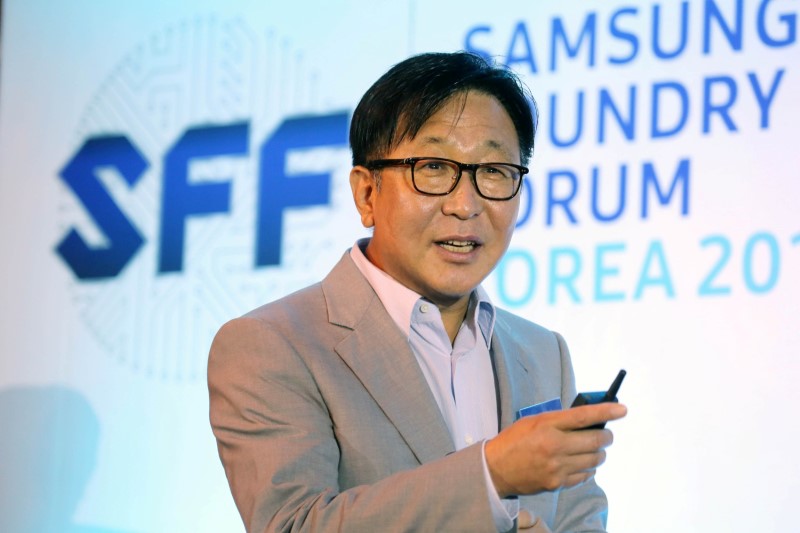

E.S. Jung, executive vice president and head of the new Samsung foundry division, told Reuters on Monday at the South Korean company's Giheung chip campus the firm wants a 25 percent market share within five years and will seek to attract smaller customers in addition to big-name clients to fuel the growth.

"We want to become a strong No. 2 player in the market," Jung said.

Samsung is on track for record profits and is widely expected to pass Intel Corp (O:INTC) as the world's top chipmaker by sales in 2017 on the back of a memory market boom.

But the firm lags well behind Taiwan's TSMC in contract manufacturing: TSMC held a market share of 50.6 percent last year compared with Samsung's 7.9 percent, according to research firm IHS. It also trailed U.S.-based Global Foundry, which had a 9.6 percent share, and Taiwan-based UMC's (TW:2303) 8.1 percent.

The memory industry is notoriously cyclical and unlikely to repeat the massive revenue gains seen this year. And as new applications such as cloud computing, autonomous driving and virtual reality emerge, analysts say Samsung needs to strengthen the rest of its chip portfolio to secure future growth.

Jung declined to comment on revenue or investment targets, but said foundry and memory businesses will share the 6 trillion won next-generation chip production line that will be built in Hwaseong, South Korea.

Samsung doesn't reveal its chip contract manufacturing revenue, but analysts estimated it at 5.3 trillion won last year, with Daishin Securities forecasting it will see an increase of 10 percent or more this year.

While TSMC splurges around $10 billion of capital expenditure annually, Jung said Samsung will be able to keep production capacity flexible depending on market demand by relying on memory chip lines.

Though Samsung already counts major firms such as Qualcomm Inc (O:QCOM), Nvidia Corp (O:NVDA) and NXP Semiconductors (O:NXPI) as clients, it has a long way to go to catch up to TSMC.

Analysts estimate Samsung lost Apple (NASDAQ:AAPL) to TSMC in 2015 and the Taiwan firm has had 100 percent of Apple's mobile processor business in 2016 and 2017.

"You need a technology that can wow your clients. Without such advanced technology, it'll be difficult to win back customers from your rivals," Jung said, without specifying any clients' names.

He said Samsung was confident of producing chips using the latest manufacturing technology called EUV (extreme ultraviolet) lithography ahead of rivals.

EUV is a next-generation technology that potentially lowers the cost and complexity of chip manufacturing. Samsung and TSMC are neck-and-neck in introducing EUV.

Samsung says it will start manufacturing chips with circuitry widths of 7 nano metres by using EUV tech in the second half of 2018. TSMC also said earlier this month that its chip manufacturing process using EUV technology will be the "most advanced technology in foundry industry" in 2018 in terms of density, performance and power.