By Saikat Chatterjee and Sujata Rao

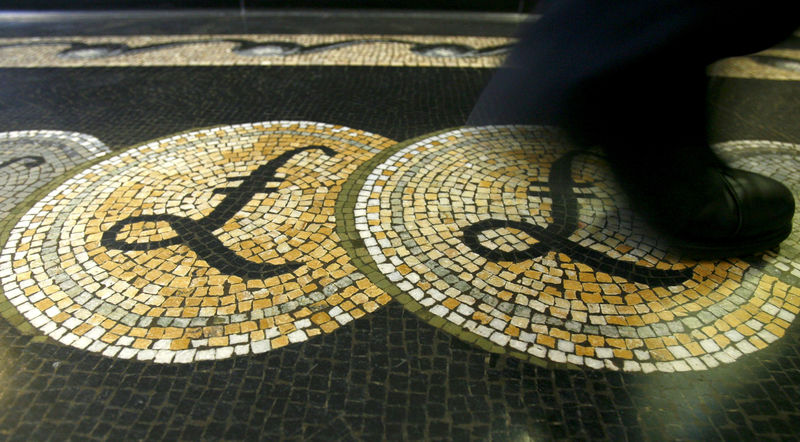

LONDON (Reuters) - Sterling fell below $1.24 on Wednesday, levels not plumbed for more than two years, as investors continued to price the growing risk of Britain's crashing out of the European Union without a transition agreement in place.

With economic data also showing the UK economy struggling, putting more pressure on the Bank of England to ease monetary policy, investors are taking to currency derivatives and futures markets to bet on more weakness.

After falling to as low as $1.2382, the pound later rebounded slightly on Wednesday to trade at $1.2426

"Clearly the issues facing the UK currently have not been faced in the last decade or so, even during the global financial crisis, and the potential for the pound to hit the 2016 lows is there," said Neil Mellor, a senior currency strategist at BNY Mellon in London.

In October 2016, the British currency dropped briefly below $1.15, its lowest in more than three decades, during a flash crash in the currency markets in early Asian trading hours.

It has since recovered, strengthening to nearly $1.34 earlier this year. But fears the next British Prime Minister will drag Britain out of the EU without a deal have prompted traders to dump the pound in recent days.

Arch-Brexiteer Boris Johnson is the favourite to become Conservative Party leader next week and hence the next prime minister. Johnson and his opponent for the leadership, Jeremy Hunt, have been vying with each other to show party members their willingness to force a "hard" Brexit.

(For a graphic on 'One direction for sterling', click https://tmsnrt.rs/2NZstIC)

The pound has lost 1% against the euro this month and more than 2% against the dollar, putting it on track for its biggest monthly drop since June 2018.

It is this year's worst-performing G10 currency against the dollar. HSBC strategists said a "no-deal" outcome would push the pound all the way to $1.10.

(For a graphic on 'Sterling worst performing G10 currency in 2019', click https://tmsnrt.rs/32t7xgc)

Against the euro, sterling weakened to as low as 90.51 pence (EURGBP=D3) on Wednesday, a new six-month low, before recovering to 90.285 by 1445 GMT.

"UNDERPRICED"

Traders' fears seem justified, with Britain's Brexit minister, Stephen Barclay, telling lawmakers on Wednesday no-deal risk was "underpriced".

The hard Brexit risk was boosted this week when both Johnson and Hunt said they would not accept the so-called Northern Irish backstop in Theresa May's proposed Brexit agreement.

The backstop is intended to prevent the return of a hard border between EU member Ireland and British province Northern Ireland. If implemented, the UK would follow many EU rules until arrangements are made to avert a hard border.

That has sent investors scurrying to price greater pound volatility, with implied volatility gauges jumping in recent days -- the six-month contract, encompassing the Oct. 31 Brexit deadline, has risen above 9 vols for the first time since early-April, up from 8.3 vols two weeks ago

"These are all risks we've known about for months, so it's not new, but there is the need for sterling vol to actually price these risks, which it simply was not doing much of before this week," Nomura strategists told clients.

Markets were shrugging off economic data, with "hedging flows more of a focus", they said.

Net short sterling positions are at $5.69 billion, having grown for four weeks straight, according to the Commodity Futures Trading Commission.

(For a graphic on 'GBP volatility curve', click https://tmsnrt.rs/32sNMW4)