By Kirstin Ridley

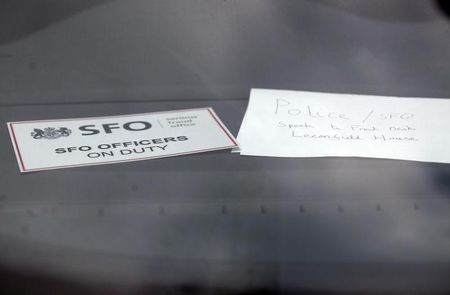

LONDON (Reuters) - Britain's Serious Fraud Office (SFO) has asked the government for an extra 26.5 million pounds ($42.4 million) to help fund complex inquiries such as financial benchmark manipulation and top corruption cases.

The request announced on Thursday tops the extra 24 million pounds sought last financial year and is one of the biggest cash injections asked for by the agency, which investigates and prosecutes high-profile cases with a meagre annual budget set this year at 35.2 million pounds.

Its biggest and costliest cases remain the investigation into the manipulation of Libor (London interbank offered rate) interest rates, an inquiry into circumstances surrounding Barclays' 8 billion pound recapitalisation in 2008 and bribery allegations linked to Rolls Royce divisions.

The funding request for the financial year to March 2015 also includes a 4.5 million pound payment to the property baron brothers Robert and Vincent Tchenguiz to settle a 300 million pound damages claim over a botched investigation, a SFO spokesman confirmed. Extra legal costs have yet to be announced.

The SFO, which can request "blockbuster funding" if the cost of cases exceeds a percentage of its budget, had been expected to seek extra cash this year to meet the demands of what its head, David Green, calls its most demanding case load ever.

Green, who has often pointed to the size of London's vibrant white collar crime legal sector as a sign of how much work the agency faces, highlighted the recent successes of the SFO, which has had a chequered history in nailing top fraudsters.

These include its first conviction for fraud-related offences linked to Libor, a benchmark against which about $450 trillion of financial contracts are pegged.

"This is an important, if not a pivotal time for the SFO," he told a London conference on Thursday.

News of the guilty plea coincided with speculation that the government was reviving plans to roll the SFO into the country's broader crime-busting force, the National Crime Agency.

Green said he was not surprised the government was again reviewing coordination and the effectiveness of law enforcement agencies in tackling bribery and corruption.

But he stressed such a move would thwart the agency's ability to tackle high-level fraud as a demonstrably independent agency -- particularly when dealing with iconic British companies -- undermine staff morale and encourage less cooperative suspects "just as the SFO is making real headway".

Emily Thornberry, the opposition Labour party's spokeswoman on judicial affairs, urged the government to examine the SFO's funding or risk curbing its capacity to take on new cases.

"This government will not convince people that it is serious about clamping down on City (of London) crime for as long as the Serious Fraud Office is in a state of perpetual bankruptcy," she said in an emailed statement.

(1 US dollar = 0.6246 British pound)

(Editing by David Clarke)