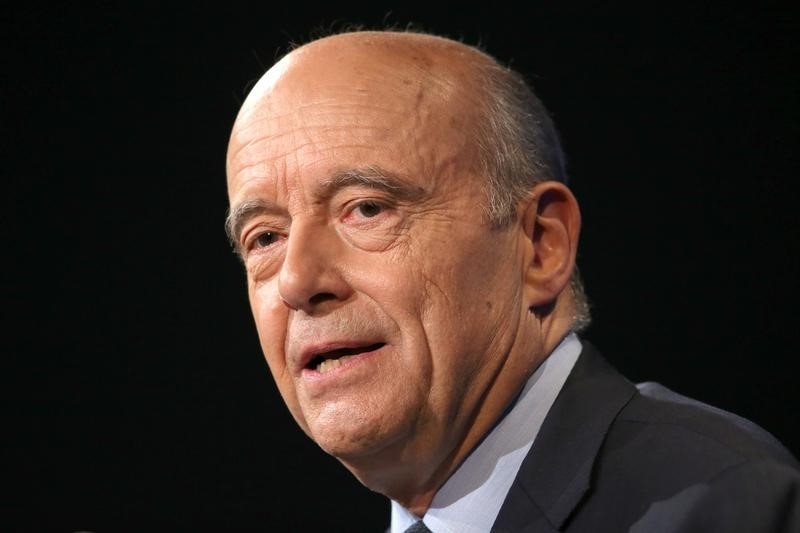

LONDON (Reuters) - France will have to react to Britain's plan to cut corporation tax to below 15 percent and enact reforms needed to reduce its budget deficit, Alain Juppe, a leading candidate in the French presidential race said on Monday.

Juppe, who was in London to meet French expatriates in the wake of Britain's referendum decision to leave the European Union, also said France needed to prove it was competitive and he pressed the need for fiscal harmonisation within the EU.

"It's a new challenge, of course. We have to react," Juppe told journalists without providing detail about the policy changes he would implement if he were to win next May's presidential election.

France's Socialist government wants to capitalise on the Brexit vote and lure banks and other big business to Paris, but Juppe said investors were wary of what he described as the constantly shifting fiscal and judicial landscape.

France's standard corporation tax rate is 33 percent and firms with revenues over 250 million euros pay an additional 10.7 percent of the total corporate tax paid under a "temporary" surcharge due to expire at the end of this year.

That compares with Britain's current corporation tax rate of 20 percent and an average rate among the world's most developed countries of 25 percent.

Juppe, who will run up against former President Nicolas Sarkozy for the conservative Les Republicains' party ticket in the election, said there was a wide gulf between the French corporate tax rate and the EU average.

"We have to cut this gap between taxes in France and the average level in Europe," Juppe said, speaking in English.

"We have to show that France is a competitive country."

In the mid-1990s Juppe served as a deeply unpopular prime minister, triggering France's worst unrest in decades over pension reforms.

Now aged 70 he has shrugged off a decades-old image of a grey technocrat and promises to roll back France's 35-hour working week and scrap a wealth tax if elected.