SINGAPORE (Reuters) - Regulators may need to look at new rules to control the fixed pay of bankers as well as their bonuses so that it can be clawed back in the event of wrongdoing, the governor of the Bank of England said on Monday.

Developed economies have brought in a series of reforms to financial sector bonuses in recent years, bringing in laws to defer when they are paid and the ability to take them back in the event of banker misconduct or excessive risk taking.

In response, many banks are reported to have raised the fixed level of pay awarded to their staff.

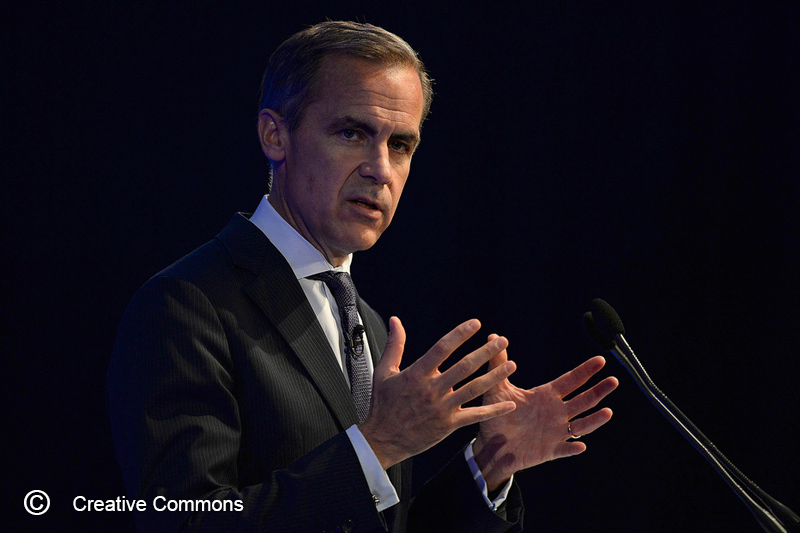

"Standards may need to be developed to put non-bonus or fixed pay at risk," Mark Carney said in a speech in Singapore.

"This will help re-build trust in financial institutions," he added.

His comments came less than a week after five banks in different countries were fined a total of $4.3 billion for failing to prevent traders from trying to rig the foreign exchange market, the latest in a series of scandals since the 2007-2009 financial crisis.

Carney, who is also chairman of regulatory watchdog The Financial Stability Board, said a proposal by New York Federal Reserve Bank President William Dudley to bring in "performance bonds" for senior bankers was "worthy of consideration".

Dudley said last month that deferred pay for senior bankers should be in the form of debt, rather than shares, and that these "performance bonds" would be forfeited to pay some of the fines imposed on a lender for wrongdoing, easing the burden on shareholders.

"We think that leaders and senior managers must be personally responsible for setting the cultural norms of their institutions," Carney said.

His view on potential reforms to fixed pay was driven in part by a new European Union rule, which will apply to awards handed out from early 2015, stating that a banker's bonus can be no higher than fixed pay, or twice that level with shareholder approval.

He said this rule has an undesirable side effect of limiting the size of bonus "claw-backs".

"European rules create a situation that makes the case for additional reforms to ensure that the burden of excessive risk taking and misconduct by staff can still be borne by those staff," he said.

(Reporting by Rachel Armstrong and Masayuki Kitano; Editing by Richard Borsuk & Kim Coghill)