By Kylie MacLellan and Helen Reid

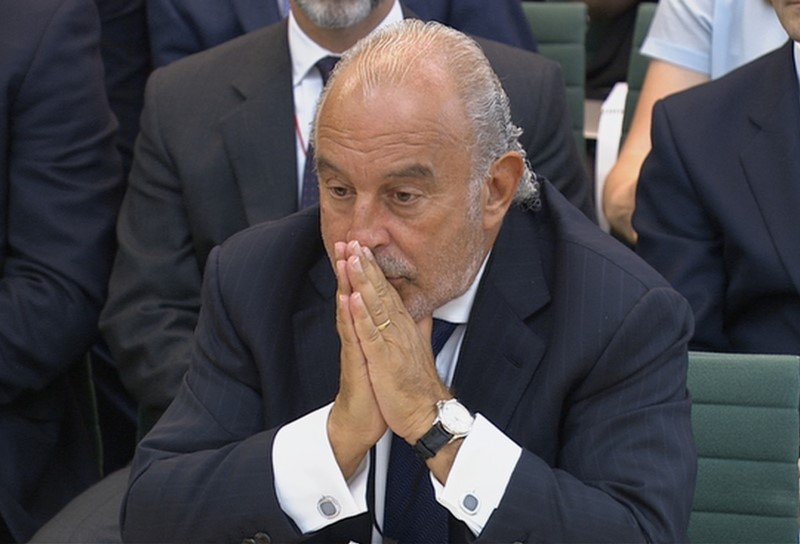

LONDON (Reuters) - British lawmakers backed stripping billionaire Philip Green of his knighthood over the collapse of BHS department store, in a symbolic move on Thursday that will raise pressure on the tycoon over his promises to resolve the company's pension problems.

Green owned BHS for 15 years before he sold the loss-making 180-outlet chain to Dominic Chappell, a serial bankrupt with no retail experience, for just one pound ($1.22) last year. It went into administration in April and the last of its stores closed in August, with the loss of some 11,000 jobs.

BHS had a 571-million-pound hole in its pension fund, which if not filled will leave 20,000 pensioners facing significant cuts to their income.

A report by members of parliament in July said Green was greedy and disregarded corporate governance, leading to the demise of BHS It called him "the unacceptable face of capitalism".

Following a debate in parliament lasting more than two hours, MPs backed a call for Green to be stripped of his knighthood, awarded in 2006 for services to retail. The motion was unopposed by those in the debating chamber.

A spokesman for Green declined to comment.

Opposition Labour lawmaker Iain Wright, chair of parliament's business committee, said of Green in the debate: "he took the rings from BHS's fingers, he beat it black and blue, he starved it of food and water, he put it on life support and then he wanted credit for keeping it alive."

The vote was symbolic, as decisions to remove honours are made by the Honours Forfeiture Committee.

That committee, which includes senior civil servants and members independent of government, can recommend removing honours from people who have done something to "bring the honours system into disrepute". The final decision is made by the Queen.

RARE MOVE

Removal of knighthoods, among the highest honours bestowed by Britain for outstanding achievement or service, is rare.

Past cases include Anthony Blunt, a notorious British double agent who spied for the Soviets, and Benito Mussolini, who was stripped of an honour awarded by King George V in 1923 after declaring war on Britain in 1940.

Former RBS (LON:RBS) boss Fred Goodwin, criticised for his role in the bank's near collapse, was stripped of his knighthood in 2012, although the government described it as "an exceptional case".

Green has said he sold BHS to Chappell in good faith but has accepted he was the wrong buyer. He has apologised to the company's former workers and its pensioners, but MPs said he had run the company in a way that enriched himself at the expense of the long-term growth of the company.

Green told MPs in June he would resolve the pensions issue and in an interview with ITV (LON:ITV) News on Tuesday he said there was some "light in the tunnel to a solution". But Britain's Pensions Regulator said it has not received a comprehensive and credible written offer or proposal from Green.

"Honour may seem to some people to be an unusual word to use when it comes to business, but for effective business ultimately honour is all that you have," said Conservative lawmaker Richard Fuller, who headed the call to strip Green's knighthood.

"You can amass a great fortune but in such turbulent market times you can lose it in a day. All you are left with is your honour ... were the actions of Sir Philip Green honourable?."