By William Schomberg and David Milliken

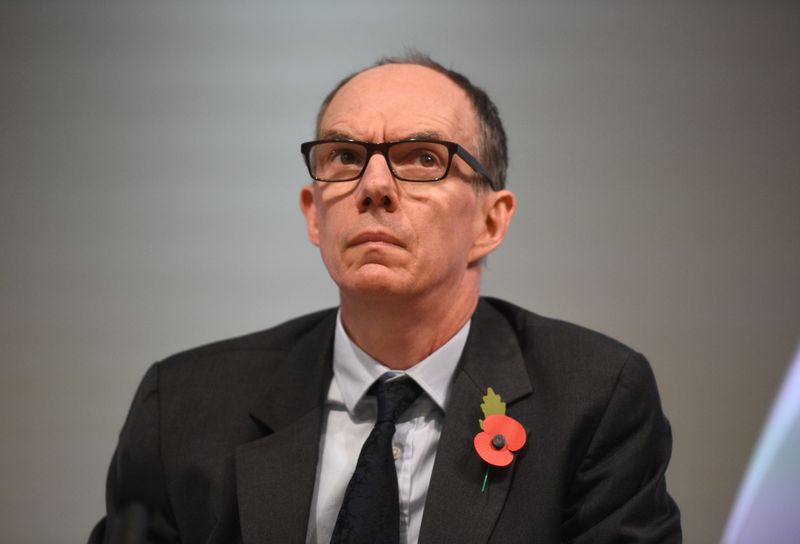

LONDON (Reuters) - Bank of England Deputy Governor Dave Ramsden said the central bank's nearly 900 billion-pound bond-buying programme remained its most immediate stimulus option, and discussion of negative interest rates represented contingency planning.

"My overall take on QE (quantitative easing) is still that it is a tried and tested tool," Ramsden said in a speech on Wednesday to the University of Birmingham.

The BoE doubled the size of its bond-buying programme to 895 billion pounds ($1.24 trillion) over the past year as it sought to protect Britain's economy from the impact of the coronavirus crisis.

The precise effectiveness of bond purchases in terms of lifting consumer prices or lowering unemployment was hard to measure, and almost certainly changed over time, but Ramsden said it remained the best way for the BoE to fine-tune demand.

"For me it is the marginal monetary policy tool at present."

The BoE is buying 4.4 billion pounds of gilts a week, but wants the current tranche of purchases - 150 billion pounds' worth announced in November - to last until the end of 2021.

"For that reason, and assuming no material worsening in market functioning, I would envisage some further slowing in pace at some point in the remainder of the year," Ramsden said.

When the pandemic hit a year ago, the BoE also cut interest rates to a record low of 0.1% and this month it gave banks six months to get ready for any decision to take rates below zero.

Ramsden said that, alongside work on new guidance on how the BoE might go in the opposite direction and tighten monetary policy, represented "transparent contingency planning for possible future uses of our monetary policy tools".

Investors took the BoE's message this month to be a signal that negative rates were unlikely to be used any time soon in Britain.

He said there were links between QE and the huge issuance of bonds by the government to fund its emergency spending to help the economy cope with the pandemic.

"But these are very different from the charge of 'monetary financing'," he said, referring to concerns that the BoE and other central banks have resorted to bailing out governments.

Financial markets' inflation expectations have remained in check, which would not be the case if markets doubted the BoE's commitment to its 2% inflation target, Ramsden said.

He said the rapid progress of coronavirus vaccinations in Britain had boosted financial markets' risk appetite and pushed up short-term interest rate expectations, though these remained very low.

Ramsden also said the BoE was grappling with how to ensure its purchases of corporate bonds - which account for 2% of its total QE programme - aligned with the government's push to make Britain's economy less carbon intensive.

($1 = 0.7220 pounds)