By Anjuli Davies and Andrew MacAskill

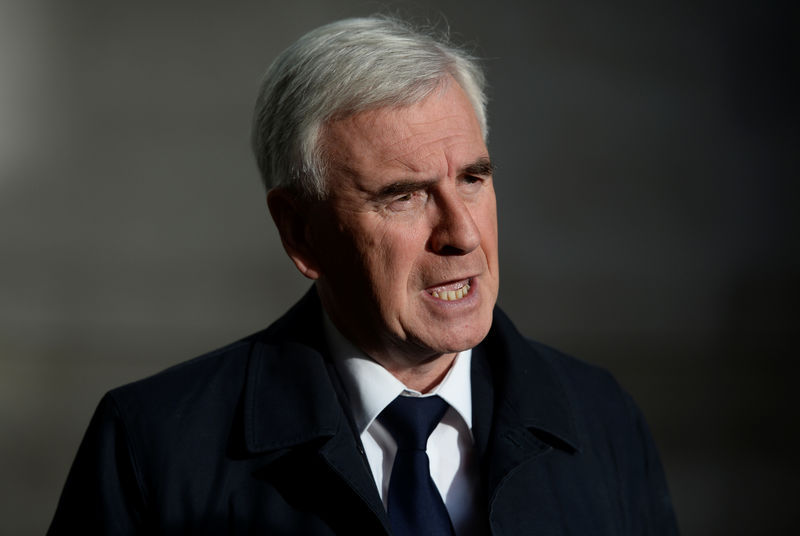

LONDON (Reuters) - The British Labour Party's would-be finance minister, John McDonnell, has accepted an invitation for talks at the Wall Street bank Goldman Sachs (NYSE:GS) as it seeks better relations with a political party whose leaders have pilloried bankers.

Banks in London had hardly bothered to court Labour since 2015, when it elected the leftist Jeremy Corbyn as its leader - but are taking it more seriously after a strong election in which it deprived the Conservatives of their absolute majority and left Prime Minister Theresa May severely weakened.

McDonnell's spokesman said he had accepted Goldman's invitation.

"I said of course I would (meet)," McDonnell said in an interview with Bloomberg, which first reported news of the plan to meet a top executive. "We'll even make him a cup of tea and throw in some Rich Teas (biscuits) as well."

There is clearly work to be done. The U.S. investment bank Morgan Stanley (NYSE:MS) has told investors political uncertainty is a bigger threat to Britain than Brexit, given the risk of Corbyn winning power and dismantling its free-market economy.

Under Corbyn and McDonnell, Labour has shifted from the centrist pro-business platform of former prime minister Tony Blair to being more interventionist and left-wing - and Corbyn's response was forthright.

"Bankers like Morgan Stanley should not run our country but they think they do," he said in a video posted on Twitter on Dec 1. "So when they say we're a threat, they're right: We're a threat to a damaging and failed system that is rigged for the few."

SHIFT IN TONE

But there are also signs of a shift in tone from both sides.

After Labour's unexpectedly strong gains with an anti-austerity message in June's election, Barclays (LON:BARC) Bank Chairman John McFarlane praised Corbyn's campaign as "bang on".

"What people soon realise is how serious we are about tackling some of the long-term economic problems the UK faces," Jonathan Reynolds, the Labour party's envoy for financial services, told Reuters on Tuesday, "and that we really do welcome their input into our policy development."

Nevertheless, Labour sees scope to extract more revenue from the City of London, home to more banks than any other financial centre. London vies with New York for the title of the world’s financial capital and dominates the $5.1-trillion-a-day global foreign exchange market; financial services contributed 11.5 percent of total UK government tax receipts in 2016.

McDonnell has already met executives from Standard Chartered (LON:STAN), the London Stock Exchange, the City of London Corporation, lawyers, lobbyists and accountants about Labour’s proposals to expand an existing tax on shares to include trading on other assets such as bonds and derivatives.

FLEEING TAXES?

Industry figures say such a tax could exacerbate the impact of Brexit by prompting more businesses to flee London.

McDonnell also said on Monday that he had held discussions with Royal Bank of Scotland (LON:RBS) Chief Executive Ross McEwan after Labour said it wanted to break up the state-owned lender into smaller banks with a mandate to serve local areas.

As a backbencher a decade ago, McDonnell attacked Goldman Sachs financiers for giving themselves multi-million pound bonuses at the height of the financial crisis.

"The people and institutions who have brought us to the brink of recession are rewarding themselves by becoming even more filthy rich," he said.

In the past, McDonnell has said he wants to overthrow capitalism and nationalise banks, and praised Karl Marx and Friedrich Engels's "Communist Manifesto".

"If we have Corbyn, we have Cuba without the sun," Bobby Vedral, a London-based partner at Goldman Sachs, said recently.

But others take a more pragmatic view.

Mark Dowding, head of investment grade at BlueBay Asset Management, a specialist fixed income investor with $51.7 billion of assets under management, recently met McDonnell.

"The thing I would observe is the portrayal of individuals such as McDonnell that are verging on the hysterical," he said.

"In meeting with individuals such as himself, we are struck by the fact that there is a degree of thoughtfulness and passion about them that is encouraging."