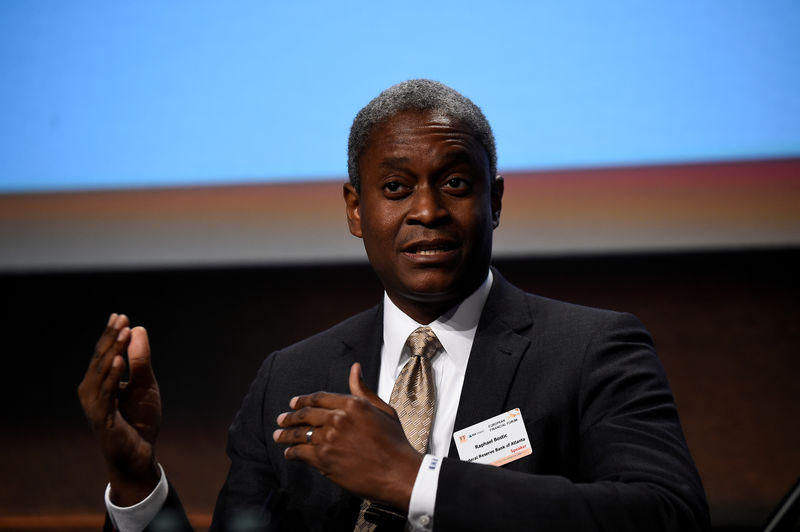

SAN FRANCISCO (Reuters) - The Federal Reserve's patient approach to monetary policy does not mean the U.S. central bank will not increase interest rates, or cut them, should the need arise, the president of the Atlanta Federal Reserve Bank, Raphael Bostic, said on Friday.

"We may move up; we may move down," Bostic said in remarks prepared for delivery to a monetary policy conference at the San Francisco Fed.

The comments were Bostic's first since the Fed made an unexpectedly dovish shift on Wednesday. Eleven of its 17 policymakers forecast no rate hikes this year, and Fed Chairman Jerome Powell cited low inflation, a slowing global economy and risks like U.S. trade tensions with China for the need to remain patient "for some time."

After the Wednesday announcement, financial markets, which had already priced out any chance of a rate hike this year, began pricing in the likelihood of a rate cut next year.

But to see the Fed's recent pronouncements as a "definitive signal" that the central bank will hold rates steady for the balance of the year is not accurate, Bostic said on Friday, adding that patience does not constrain the Fed's options.

"I am open to all possibilities as we aim to support sustained economic expansion, strong labour market conditions, and inflation near the Committee’s symmetric 2 percent objective," Bostic said, referring to the policy-setting Federal Open Market Committee. "Markets should understand that, so I hope I have made my position clear."

In February, Bostic said he expected the Fed would need to raise interest rates once this year, after raising rates four times in 2018. He did not say how many rate hikes he now thinks are appropriate.

The Fed has become increasingly worried about meeting its 2 percent inflation target and sceptical that the Trump administration's tax cuts and deregulation will unleash faster economic growth.

So have financial markets.

Data published earlier on Friday showed U.S. manufacturing activity unexpectedly cooled in March, a troubling sign for the U.S. economic outlook that helped push long-term borrowing costs below short-term ones, an indication of near-term risk and seen by many as a potential harbinger of recession.

The spread between yields on three-month Treasury bills and 10-year notes fell below zero for the first time since 2007 after U.S. manufacturing data missed estimates.

Earlier on Friday, data out of Germany showed the factory sector there was continuing to contract, another worrying sign for the global economy.