By Jesús Aguado and Angus Berwick

MADRID (Reuters) - The chairman of Banco Popular (MC:POP) has told his executives that the struggling Spanish lender was solvent and urged them to remain calm and confident, while a source said he would hold a routine meeting with the European Central Bank next week.

Popular's shares fell almost 40 percent in the past three days on concern it would not find a buyer or raise new capital to fix its balance sheet, which is weighed down with 37 billion euros (31.80 billion pounds) of non-performing real estate assets.

One of Europe's top bank watchdogs warned European Union officials that Popular might need to be wound down if it failed to find a buyer, an EU official told Reuters this week.

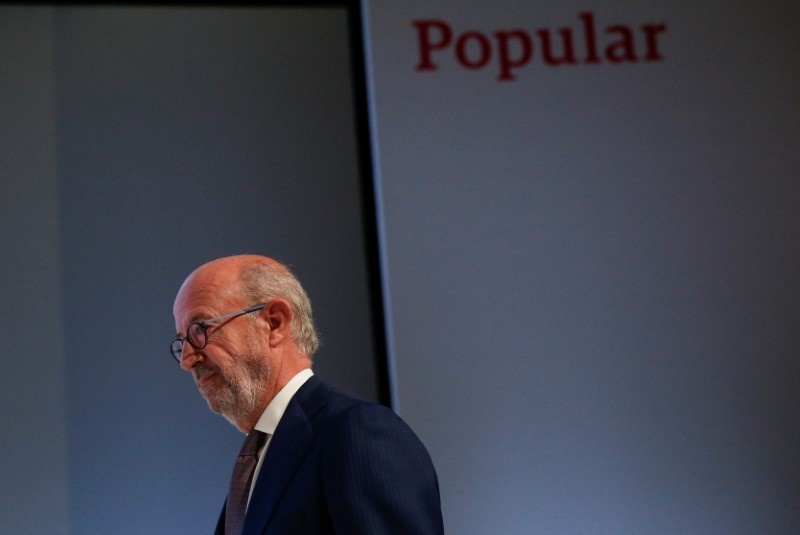

"Banco Popular remains solvent and has positive equity," Chairman Emilio Saracho wrote to his executives in a letter sent on Friday, seeking to reassure them despite what he called the "difficult situation."

The letter, first published by Expansion newspaper, was confirmed by a bank spokeswoman who read the content to Reuters.

Saracho would meet ECB officials on Tuesday, a source familiar with the meeting told Reuters, adding that the appointment was part of the ECB's routine supervisory responsibilities and was scheduled "some time ago".

Popular and the ECB declined to comment on the meeting.

Saracho, hired in February in a leadership reshuffle, said in his letter that Popular would continue to seek new capital or a sale to fix its non-performing real estate assets that are the highest among Spanish banks.

"Our clients and shareholders are the most important for us. For that reason we must relay them a message of calm and confidence that we are trying as hard as possible to overcome this situation," Saracho, a former JP Morgan executive, wrote.

Elke Koenig, who chairs the EU's Single Resolution Board (SRB), a body that resolves struggling banks, had issued an "early warning", according to the EU official. The SRB said at the time it could not confirm the story.

Spain's government said on Friday it was not worried about Popular and would await the outcome of the sale process, which the bank says it could extend past a June 10 offer deadline.

The economy minister, Luis de Guindos, has said he does not expect a state bailout given Popular's capital levels were still above regulatory requirements set out by the ECB.

Spain's biggest bank Santander (MC:SAN) and state-owned lender Bankia (MC:BKIA) are seen as the most likely buyers for any acquisition. A capital increase, which analysts say would need to raise at least 3 billion euros, faces resistance from shareholders who fear greater dilution.

Popular shares have fallen 75 percent over the past year, making them the worst performers on the European STOXX banking index (SX7P). This week's slip made Popular the smallest company by valuation on Spain's blue-chip Ibex index (IBEX).