PoundSterlingLIVE - Capital Economics has reviewed its mortgage forecasts and can reveal the hit to borrowers posed by a higher Bank of England base rate is likely to be "more severe" than initially anticipated with some facing a 50% jump in mortgage rates over the coming months.

"The recent upward revision to our mortgage rate forecast and the fact that the majority of those that need to refinance this year are on two-year fixes means that we are now more worried about the risk posed by refinancing," says Andrew Wishart, Senior Economist at Capital Economics.

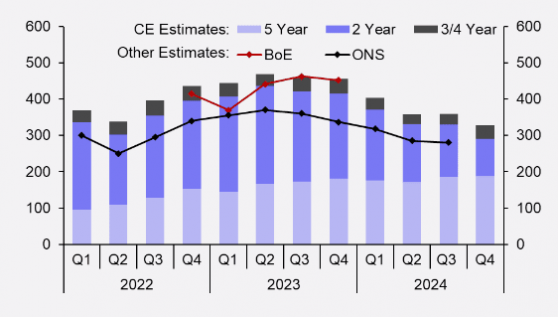

Capital Economics has pored over data from the major mortgage providers which have produced estimates of the number of fixed-rate mortgage deals that will expire this year, as well as data from the Office for National Statistics (ONS) and Bank of England (BoE) estimates.

The research concludes the Bank of England's data to be the most accurate available, revealing a higher average of 430,000 households needing to refinance each quarter this year.

"The upward revision we recently made to our mortgage rates forecast means these borrowers will be subject to a larger interest rate shock than we previously envisaged," says Wishart.

The data comes alongside news that HSBC (LON:HSBA) suddenly pulled its mortgage products without warning overnight as it became the latest lender required to raise its rates.

The lender said the move was because it was experiencing "significant demand" as borrowers rushed to take advantage of the lower rates on offer. The new deals would be made available Monday.

Nationwide Building Society (LON:NBS), the country’s second-largest lender, said Thursday it would increase fixed-rate mortgage deals by up to 0.25 percentage points today.

Capital Economics' new mortgage forecasts reveal mortgage rates will now increase to 5.6%, as opposed to previous estimates for stabilisation of around 4.6% over the next year.

"Those coming to the end of a 2-year fix will see a particularly large increase in the cost of their mortgage. While those refinancing a 5-year fix this month may see their mortgage rate jump from 2.1% to 4.9%, those on a 2-year fix will see an increase from 1.4% to 5.2%," says Wishart.

Capital Economics meanwhile reckons the largest jump in mortgage costs will come in early 2024: someone who took out a 75% LTV mortgage of £180,000 on the average priced house of £240,000 in June 2021 will see their mortgage payment increase from around £700 to £1080, up 50%.

The research says the majority (55%) of borrowers refinancing this year, or around 250,000 a quarter, are coming to the end of a 2-year fix so will be subject to this particularly severe interest rate shock.

"As a result, we are now more concerned about arrears than we were," says Wishart.

"In the past there has been a lag of around a year and a half between the increase in mortgage costs and higher mortgage arrears and repossessions. There is a growing risk that the pressure on household budgets from inflation and the large increase in payments for those coming to the end of a 2-year fix cause financial distress to occur earlier than in the past," he adds.

An original version of this article can be viewed at Pound Sterling Live