By Tommy Wilkes and Muvija M

LONDON (Reuters) - Japanese Prime Minister Fumio Kishida took his appeal for foreign investment to the bankers and investors of the City of London on Thursday, saying his shift to an upgraded version of capitalism would spur economic growth.

In a speech at the medieval Guildhall at the heart of Britain's financial district, Kishida set out his plan to grow the world's third-largest economy by attracting private-sector investment and redistributing wealth.

Japan, like countries around the world, has been hit by rising energy, food and living costs however, and its economy is expected to have slowed to a crawl in the first quarter while the yen trades at two-decade lows to the dollar.

In a world of geopolitical instability, Kishida said Japan could stand out.

It has vowed to double the amount of foreign direct investment to 80 trillion yen ($617 billion), or 12% of GDP in 2030, from the current 43.5 trillion yen, and encourage firms to increase wages and spend more on research and development.

"Of course, Japan does face many challenges," he said. "But I am prepared to lead reform efforts to tackle these challenges head-on.

"Sustained growth; stable markets; and safe, reliable companies, products and services. This is why Japan is a 'buy'".

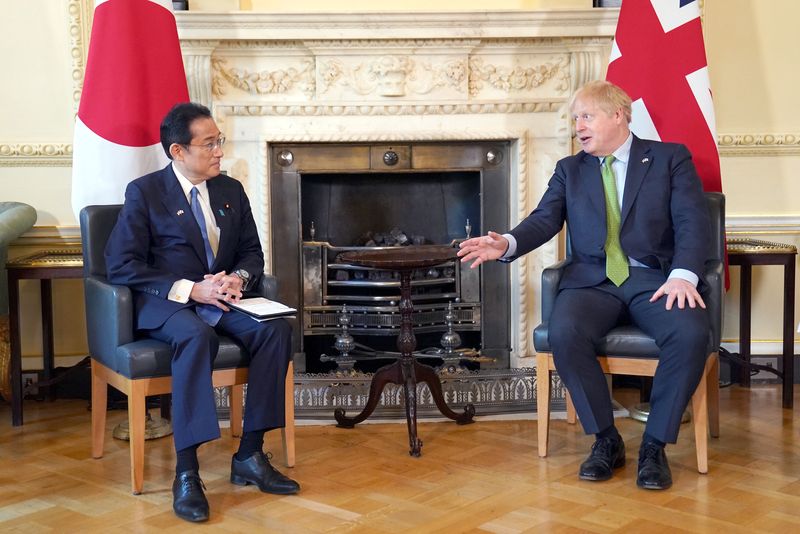

Kishida, who became prime minister and won an election last autumn, had been on an extended visit to Southeast Asia before he arrived in London to address the City of London and meet British Prime Minister Boris Johnson.

Delivering his speech on the economy, he acknowledged the country faced challenges including labour shortages and said companies there needed to become more diverse.

He said the government would introduce tax incentives to encourage the private sector to boost wages, and that further R&D investment was needed to hit international levels.

The yen's weakness would normally be a boon for inbound travellers, but Japan, fearing COVID-19, has kept its borders closed to tourists.

Once a boost to Japan's trade-reliant economy, yen weakness is also benefiting exporters to a lesser extent as many Japanese firms have shifted production overseas.

The government recently upgraded its assessment of the economy for the first time in four months, citing an expected recovery in spending, but warned the outlook was clouded.

($1 = 129.7100 yen)