(Bloomberg) -- China’s exports grew faster than expected, while imports surged, showing both domestic and international demand continue to rise despite the uncertainty of trade relations with the U.S.

Exports rose 12.2 percent in July in dollar terms from a year earlier, the customs administration said Wednesday, faster than the forecast 10 percent. Imports climbed 27.3 percent, leaving a trade surplus of $28 billion.

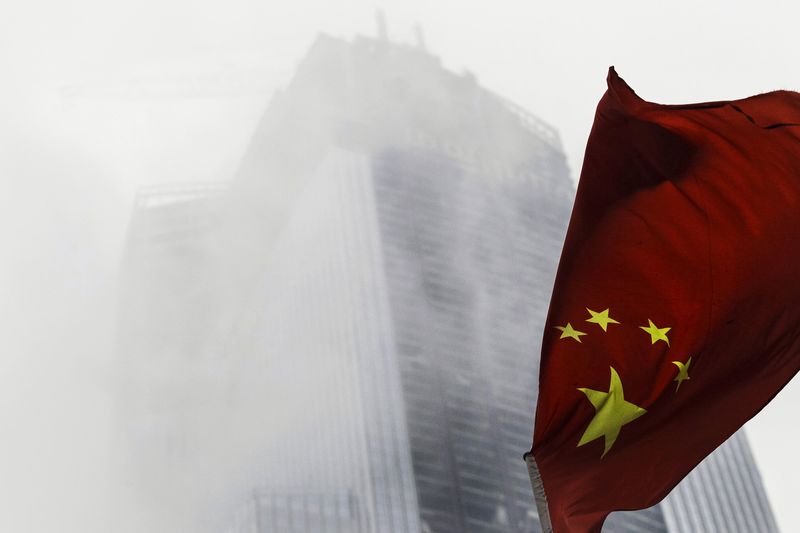

As the world’s largest exporter, China is still benefiting from robust global demand, but increasing tensions and rising trade barriers with the U.S. are weighing on the outlook. Although most the threatened tariffs still haven’t gone into effect, the two are locked in an escalating tit for tat exchange.

“The higher than expected imports were pushed up by energy prices, which narrowed the trade balance,” said Iris Pang, greater China economist at ING Wholesale Banking in Hong Kong. “The impact of tariffs on exports is yet to be reflected. We will see a full-month tariff effect in August.”

The Chinese government last week announced its list of $60 billion worth of U.S. goods it will hit with higher import taxes should the U.S. follow through on a plan to impose duties on an additional $200 billion of Chinese goods. That follows a previous round, where each side imposes tariffs on $34 billion of imports, with promises of $16 billion more.

In the meantime, China’s economy is showing signs of weakness -- the yuan has been on a losing streak for more than a month, the equity market has suffered declines, and other early indicators are pointing to a slowdown. The central bank has made it more expensive to bet against the currency in a bid to ease pressure on the currency.

(Updates with economist’s quote and chart from fourth paragraph.)