Benzinga - Good Morning Everyone!

Hope you're ready for another short squeeze. Bed Bath & Beyond stock is up 20% pre-market after the company said it was heading for bankruptcy last week.

Cambiar a la suscripción paga

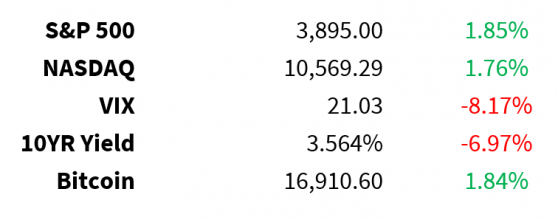

Prices as of 4 pm EST. 1/6/23; % YTD

MARKET UPDATE Today:

- Positive headlines out of China

- Offset by

- 2023 earnings estimates at risk as Q4 results begin this week

This week:

- Thursday CPI

- Friday U.S. bank earnings

Q4 earnings kick off on Friday

- JP Morgan (NYSE: JPM), Citi (NYSE: C), Bank of America (NYSE: NYSE:BAC), Wells Fargo (NYSE: NYSE:WFC)

Today: RBC Canadian Bank CEO Conference

Today: Management group seeking to take Canaccord Genuity private

Today: Goldman Sachs (NYSE: NYSE:GS) to eliminate 3,200 jobs (largest cut ever)

Issues going into the bank Q4 quarter:

- Higher credit provisions

- Higher expenses/comp inflation

- Higher deposit funding

- Mild recession (see chart below)

- Focus: management forward guidance during Q4 results

2-10 curve is extremely inverted

- Getting to 1980 levels

- Most investors calling for a mild recession later this year

What’s the U.S. dollar doing?

Crude 76 +3%

-

Oil up on news:

- China re-opened air, land and sea borders on Sunday

- China increased crude oil import quotas for China’s refiners

Apple (NASDAQ: NASDAQ:AAPL)

- Expects to be exporting more than $2.5 billion iPhones from India from April to December

- Nearly twice the previous year

- Trend: accelerating shift from China with geopolitical tensions on the rise

Earnings None

CRYPTO UPDATE

Digital asset fund flows- Outflows continue, $9.7 million

- 3rd consecutive week

-

Bitcoin (CRYPTO: BTC): -$6.5 million

-

Volumes remain low, ~$5 billion per day

- 2022 average = $9 billion

-

Volumes remain low, ~$5 billion per day

- Short-Bitcoin: +$1.2 million

- Ethereum (CRYPTO: ETH) : -$3.1 million

-

XRP: +$3 million

- Suggests legal case with SEC could be heading towards positive outcome

SBF thinks he should retain the $450 million of (NASDAQ: HOOD (NASDAQ:HOOD)) he purchased with customer funds

- Says his ability to pay for lawyers is more important than debtors’ ability to recover losses

MEME OF THE DAY

Eggs are the new bitcoin. pic.twitter.com/rXyTgPxaDD© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.— Genevieve Roch-Decter, CFA (@GRDecter) January 8, 2023

Read the original article on Benzinga