Terra (CRYPTO: LUNA) touched a fresh all-time high of $83.74 on Monday night.

What’s Moving? The token of the project that uses fiat-pegged stablecoins to power global payments traded 2.8% higher over 24 hours at $82.45. LUNA 24-hour volumes rose 43.99% to $3.9 billion. Over a seven-day trailing basis, LUNA has soared nearly 48%.

Over a 24-hour period, LUNA moved 0.35% lower against the apex cryptocurrency, Bitcoin (CRYPTO: BTC). It inched up 0.19% against Ethereum (CRYPTO: ETH).

Since the year began, LUNA has skyrocketed 12648%. The coin’s 90-day gains have amounted to 216%, while over the last 30 days it has shot up 88%.

Why Is It Moving? LUNA moved higher in tandem with other major coins at press time as the global cryptocurrency market capitalization increased 2.42% to $2.25 trillion over 24 hours.

LUNA was among the most mentioned coins at press time on Twitter. It attracted 1614 tweets, as per Cointrendz data.

The top three most mentioned coins on Twitter (NYSE:TWTR) were BTC, ETH, and Shiba Inu (SHIB), which attracted 9,711, 4,290, and 3,202 tweets, respectively.

On Monday, cross-chain router protocol Multichain, previously known as Anyswap, said Terra/Fantom (FTM) bridge was live.

Shortly after $UST, @terra_money’s $LUNA is also live on #Multichain currently supporting #Terra#Fantom swapHappy Bridge https://t.co/YYjVqiTNDS pic.twitter.com/MWwNRkFTHY

— Multichain (Previously Anyswap) (@AnyswapNetwork) December 21, 2021

Recently, the launches of liquidity hub Astroport and market protcol Mars Protocol have buoyed LUNA and given it a boost even as prices of major coins remain under pressure.

The recent price increase of LUNA was attributed to investors buying spot tokens to lock up in Astroport then hedging positions via perpetual futures to remain delta neutral by Delphi Digital.

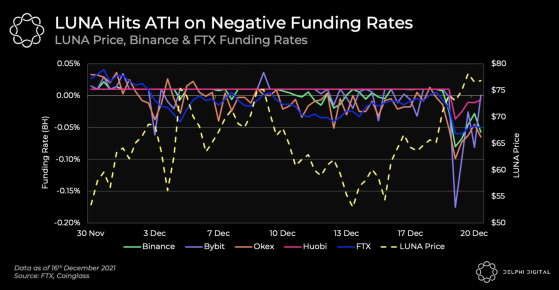

Luna Price, Binance & FTX Funding Rates — Courtesy Delphi Digital

“Negative funding rates across major exchanges further suggest delta-neutral traders played a part. The current 8-hour funding rate on Binance is -0.05%, which translates to shorts paying longs ~65% APR to keep their position open,” the independent research firm wrote in an emailed note.

Notably, over $1 billion worth of capital was locked into Astroport since the lockdrop launch on Dec. 14, as per the note.

Automated market-maker Terraswap liquidity providers have ported their assets to Astroport, which will soon be a part of Astroport’s total value locked once liquidity is migrated, making it Terra’s largest DEX, as per Delphi Digital.

Terraswap TVL Share Locked In Astroport — Courtesy Delphi Digital

The consistent burning of LUNA since the beginning of December has also acted as a price booster for the token.

Recently, TerraUSD (UST) overtook the fellow stablecoin DAI in terms of market capitalization. At press time, DAI had regained its lost position.

It should be noted that in order to increase the supply of UST, LUNA tokens need to be burned.

UST growth has been fueled by new capital entering the Terra ecosystem following Columbus-5 among other factors, noted Delphi Digital.

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga