FRANKFURT (Reuters) - Germany's biggest digital classifieds group Scout24 said its initial public offering (IPO) would be worth up to 1.06 billion euros ($1.20 billion).

The group, which is owned by private equity firms Hellman & Friedman and Blackstone (NYSE:BX) as well as Deutsche Telekom (XETRA:DTEGn), announced plans for a flotation earlier this month.

As part of the listing, Scout24 said it expected to issue up to 8.5 million new shares worth 225 million euros. Its shareholders would put another 21 million shares on the market for between 26.50 euros and 33 euros.

At the lower end of the price range, and if the over-allotment option of 15 percent is fully exercised, Hellman & Friedman and Blackstone would keep 49 percent of Scout24 and Deutsche Telekom would still have about 14 percent.

But the shareholders have the option to increase their offer by another 15 million shares, Scout24 said.

Hellman & Friedman and Blackstone own 70 percent of Scout24, which they bought in 2014 for about 1.5 billion euros from Deutsche Telekom, which still holds 30 percent.

The group includes ImmobilienScout24 - Germany's biggest property portal, attracting more than 12 million unique monthly visitors - and AutoScout24, an online marketplace for cars and motorbikes with about 8 million monthly users.

It has undergone a cost-cutting programme since the private equity takeover. It has also sold off some smaller assets and refinanced its debt on more attractive terms while paying a dividend to its owners.

It aims to use the proceeds of the IPO to reduce its debt, which stood at about 950 million euros at the end of June.

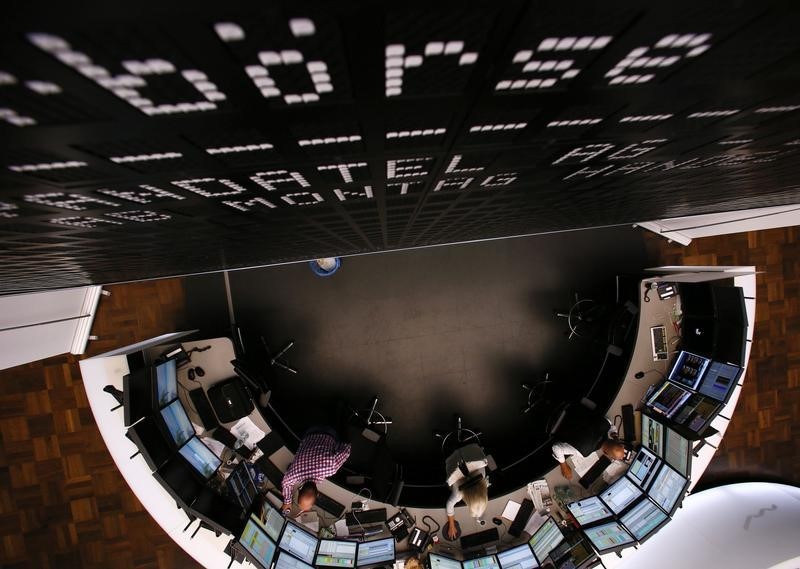

The offer period for the IPO begins on Sept. 21 and is expected to end on Sept. 30. The first day of trading on the Frankfurt Stock Exchange is to be Oct. 1.

Credit Suisse (SIX:CSGN) and Goldman Sachs (NYSE:GS) are acting as Joint Global Coordinators and Joint Bookrunners, Scout24 said. Barclays (LONDON:BARC), Jefferies and Morgan Stanley (NYSE:MS) are acting as Joint Bookrunners.