By Leika Kihara and Stanley White

MATSUMOTO/TOKYO, Japan (Reuters) - Bank of Japan policymakers signalled on Wednesday they had raised the threshold for further easing after last month's policy revamp - keeping their pledge to expand stimulus if needed, but only to protect the economy from external shocks.

Yutaka Harada, who has been among the most vocal advocates of aggressive money printing on the BOJ's nine-member board, said he saw no need to ease policy at the central bank's next rate review.

"Job markets continue to improve as a trend so for now, additional easing may not be necessary," even though inflation was undershooting prior forecasts, Harada told reporters on Wednesday.

In an earlier speech to business leaders in Matsumoto, central Japan, Harada said it would take a "sudden change in the global economy" that threatened the achievement of the BOJ's price target for the central bank to consider easing.

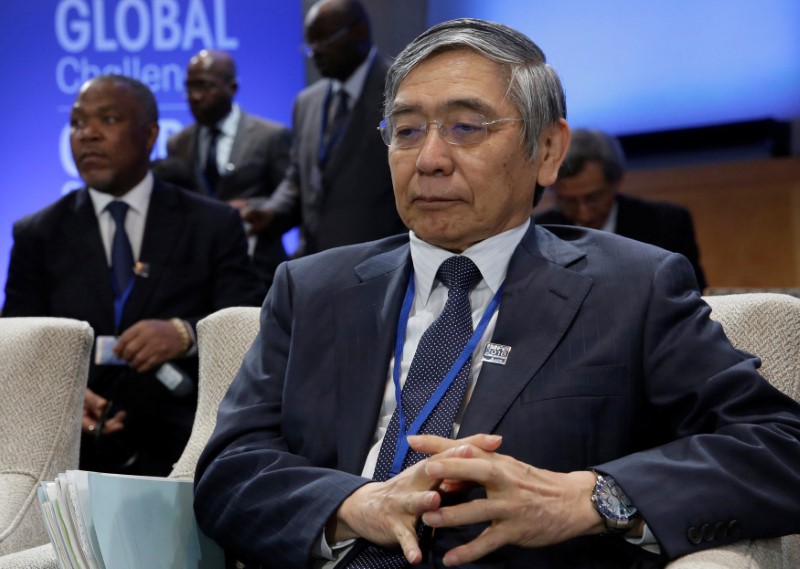

Neither did BOJ Governor Haruhiko Kuroda refer directly to a need to achieve his inflation target quickly when he reiterated his readiness to expand stimulus.

"We are prepared to ease policy again, including lowering short-term rates, if we judge that the merits outweigh the costs," Kuroda told parliament on Wednesday.

Before last month's change in policy framework, BOJ officials have said they would not hesitate to ease if it would hasten achievement of their elusive price growth target.

"It is clear from the change in the policy framework that the BOJ has essentially given up on a quick victory in achieving 2 percent inflation," said Hiroshi Shiraishi, senior economist at BNP Paribas (PA:BNPP) Securities.

"The BOJ will not be proactively easing policy to achieve 2 percent inflation quickly. It is moving toward a more flexible inflation target," he said.

BOND BUYING PACE UNCHANGED?

Wednesday's comments by Kuroda and Harada foreshadow the BOJ's next policy meeting on Oct. 31-Nov. 1, when it may again push back the timing for achieving its price target in a quarterly review of its forecasts.

Only a handful of analysts polled by Reuters predicted the BOJ would ease at the next review, while about 70 percent said it would act next year.

The BOJ last month switched its policy to targetting interest rates and away from expanding the monetary base - or the pace of money printing - after years of massive asset purchases failed to jolt the economy out of decades-long stagnation.

Analysts say the move aimed to change the BOJ's framework into one suited for a long-term battle to accelerate inflation.

The BOJ maintained a loose pledge to keep the size of its balance sheet roughly unchanged even after shifting to a rate target, reflecting the views of board members such as Harada who insisted aggressive money printing was key to ending deflation.

Harada, who voted for last month's policy make-over, said the BOJ should hold off on reducing bond purchases and allow the 10-year bond yield to fall below its target, if such a yield drop was caused by a negative shock to the economy.

"By keeping up the 80 trillion yen (633.17 billion pounds) per year bond buying and allowing interest rates to fall (below the BOJ's target), the BOJ can avoid tightening monetary conditions," he said.

Harada's view contradicts that of Kuroda, who has said the pace of the BOJ's bond purchases could slow if the bank can hit its yield control target with less buying.