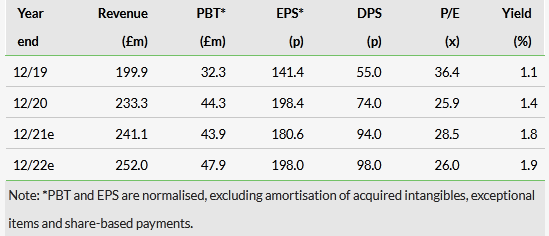

XP Power (LON:XPP) has reported another strong set of results, with H121 revenue up 14% y-o-y and normalised EPS up 33% y-o-y. The semiconductor equipment sector continues to be a strong driver of revenue and orders, and industrial technology has returned to growth. As expected, healthcare declined from the exceptional levels seen last year with demand reverting back to non-COVID applications. Overall, exceptional revenue growth and order intake drive upgrades to our forecasts, with EPS up 5.4% in FY21 and 6.9% in FY22.

Robust performance in H121

In H121, XP reported revenue growth of 14% y-o-y (23% constant currency (cc)), driven by 47% growth from the semiconductor manufacturing equipment sector. The company also saw improving demand from the industrial technology sector (+5% cc) while, as expected, healthcare demand reverted back to pre-COVID levels, although revenue was still 6% higher y-o-y. Strong revenue growth combined with y-o-y gross margin improvement resulted in normalised diluted EPS growth of 33% y-o-y.

Share Price Performance

Outlook: Trading ahead of consensus

Order intake was 8% higher y-o-y (17% cc), with Q2 order intake accelerating to 15% growth y-o-y from 1% in Q1. As trading has been so strong in H1, management expects to be modestly ahead of consensus for FY21, while also noting that several potential risks remain (COVID, component shortages). We have revised our forecasts to reflect higher revenues in FY21 and FY22, although in FY21 underlying revenue growth is masked by the strength of sterling versus the dollar this year. This results in EPS upgrades of 5.4% in FY21 and 6.9% in FY22.

Valuation: Semiconductor sector drives volatility

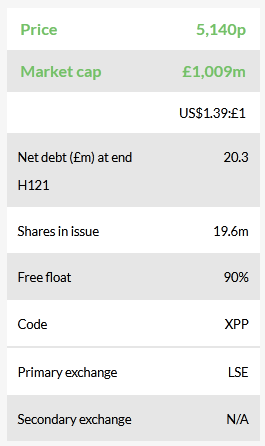

The stock is up 7% year to date, although it is down 10% from the recent peak of 5,690p reached in early July, despite continued positive news from the semiconductor sector regarding fab investment plans. On an FY21e P/E basis, XP is trading at a 17% premium to global power-converter companies but at a 2% discount to UK electronics companies, with a dividend yield at the upper end of the range. The company generates EBITDA and EBIT margins at the top end of both peer groups. Strong cash management during the crisis leaves the company well-funded to pursue both organic and acquisitive growth.

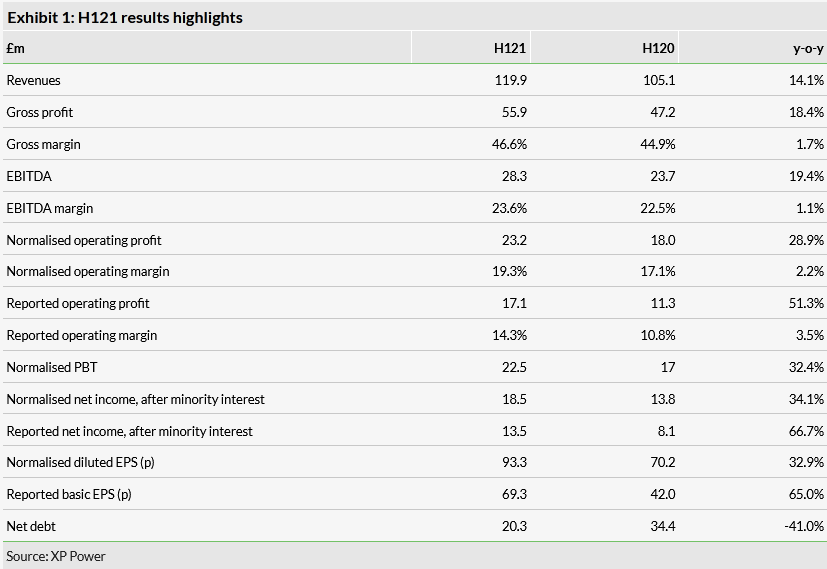

Review of H121 results

XP Power reported strong revenue growth for H121, up 14% y-o-y (or 23% on a constant currency (cc) basis). With an improvement in the gross margin of 1.7pp, gross profit increased 18% y-o-y. The gross margin benefited from favourable product mix and the transfer of US manufacturing to Asia, partially offset by higher freight costs. Normalised operating profit increased 29% y-o-y and the operating margin expanded by 2.2pp. The company reported an exceptional charge of £4.7m consisting of £3.7m for an ongoing legal case, £0.9m for the ongoing ERP roll-out and £0.1m fair value adjustment on currency hedge. The effective tax rate on adjusted PBT was 17.3%; guidance is for a rate of 16–18%. Normalised diluted EPS grew 33% y-o-y. The company declared a Q2 dividend of 19p, in line with our expectations, with the total dividend for H121 at 37p.

The company closed H121 with net debt of £20.3m, down from £34.4m a year ago and up from £17.9m at the end of FY20. Net debt/EBITDA at the end of H121 was 0.33x, well within its covenant maximum of 3x. Adjusted cash from operations of £26.4m was 3% higher y-o-y, after working capital consumption of £3.6m (H120: £0.8m inflow) to support customer demand, and equated to cash conversion of 113%. Capex totalled £10m in H1, with £2.2m for maintenance and to increase capacity, £3.6m for the ERP system roll-out in Asia and £4.2m capitalisation of product development costs.

Segmental performance

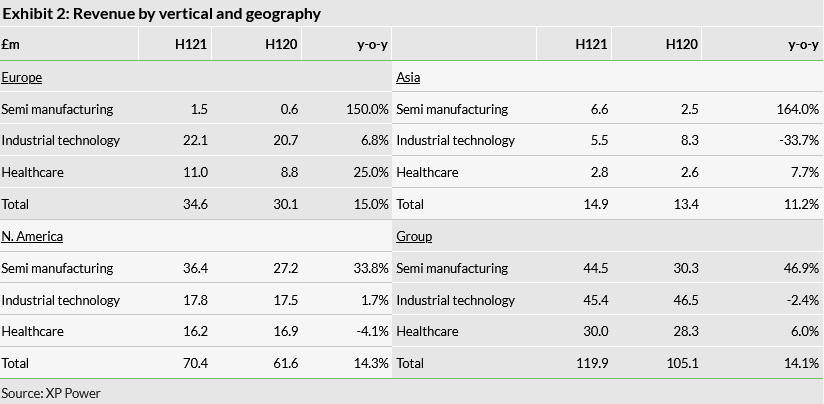

Exhibit 2 shows revenue by end-market and geography.

■ Semiconductor manufacturing equipment: this sector remains strong, with revenue up 47% y-o-y (62% cc). We note that growth from this sector in H120 was 65%, so this period’s growth was despite a tough comparative. Order intake was also strong during H1, up 40% cc y-o-y. The sector remains buoyant for several reasons: chipmakers are investing in short-term capacity increases to deal with ongoing chip shortages, governments are increasingly supporting local chip manufacturing (US and Europe planning to fund new fabs) and technology trends such as big data, AI, IoT and 5G support long-term growth of the chip sector.

■ Industrial technology: revenue from this sector declined 2% y-o-y, although was 5% higher on a constant currency basis. Within this total, XP saw 12% growth in revenue from the distribution channel, where it believes it has grown its market share. The company is seeing increasing demand from this sector as lockdowns are progressively lifted around the world, with orders 50% higher y-o-y in constant currency.

■ Healthcare: revenue from this sector increased 6% y-o-y (14% cc). XP received a high volume of orders in H120 for use in critical care equipment to support COVID-19 patients – much of this was shipped in H220 and orders in H1 declined 37% cc y-o-y. However, XP is now starting to see increased demand for non-COVID-related healthcare equipment such as robotic surgical tools, medical imaging and endoscopy.

Manufacturing update

The company noted that the transfer of production of low-power, high-voltage DC-DC modules from the Minden facility in Nevada, US to Vietnam is now complete. The Vietnam facility is qualified to produce 2,688 different low-voltage products, up from 2,616 at the end of FY20. Vietnam has recently seen a surge in COVID-19 cases, after a long period of successfully suppressing the virus, and the government has imposed a lockdown. XP’s facility is classified as a ‘3-in-1’ site, where staff work, eat and sleep, so has been allowed to continue operating essentially as a sealed site.

Outlook and changes to forecasts

XP received orders worth £157.6m in H121 (£73.7m in Q1 (+1% y-o-y), £83.9m in Q2 (+15% y-o-y), 8% higher y-o-y on a reported basis and 17% higher cc. XP saw continued high demand from semiconductor manufacturing equipment customers, while industrial technology started to recover, and healthcare declined after a strong period of ordering for equipment related to treating COVID patients. Book-to-bill was 1.31x for H121 (Q1 1.29x, Q2 1.34x). At the end of H121, the order book stood at £150.3m, up 9% y-o-y and 21% h-o-h.

The board expects FY21 trading to be modestly ahead of analysts’ consensus expectations (adjusted PBT of £44.6m for FY21), injecting a note of caution considering the various headwinds (eg COVID, component shortages, currency).

We have revised our forecasts to reflect H121 results and order intake. We have revised up our revenue forecasts for FY21 (+5.9%) and FY22 (+6.0%) and factored in a small increase in gross margins. We note that reported revenue growth for FY21 is reduced by the strengthening of sterling versus the US dollar (we use 1.39 for FY21 versus 1.28 in FY20); our dollar-based revenue forecast assumes 12% revenue growth in FY21. Overall, we lift our normalised diluted EPS forecast by 5.4% for FY21 and 6.9% for FY22.

Click on the PDF below to read the full report