- Nitesh Shah, Head of Commodities & Macroeconomic Research, Europe

With the Federal Reserve maintaining a hawkish tone, bond yields have risen, and the US Dollar remains strong. As a result, we have edged down our gold forecasts, but the risk of central banks overdoing it could send gold soaring, especially if inflation remains high while economic growth is hurt. In a base case of inflation moderating without a recession, silver should largely keep up with gold. However, an industrial downturn could hurt silver disproportionately.

Revising gold forecasts

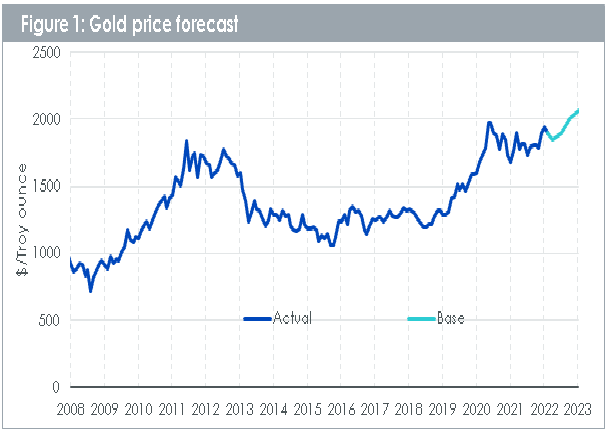

In Gold outlook to Q1 2023: Is gold returning from the alternate universe? we presented a projection for gold, based on consensus economic forecasts from March 2022. Since we published that paper, consensus economic views have shifted, acknowledging the bond sell-off and a stronger US Dollar. Consensus has also revised inflation forecasts upwards, acknowledging the stubbornness of prices despite the hawkish actions of central banks. Higher bond yields and a stronger US Dollar are gold price negative while higher levels of inflation are gold price positive. Our model indicates that by Q1 2023, gold prices will still rise (see Figure 1), but not as much as previously expected (circa US$2300/oz[1]) when the bond and US Dollar headwinds were lower. We assume, in our revised forecast, that 10-year bond yields rise to 3.2% (currently 2.80%[2]) and the US Dollar basket appreciates to 105 (currently 102[3]) by Q1 2023 and inflation only moderates to 4.3% (from 8.3% in April 2022[4]). The bear and bull cases are unaffected by these changes.

Source: WisdomTree Model Forecasts, Bloomberg Historical Data, data available as of close 29 April 2022. Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

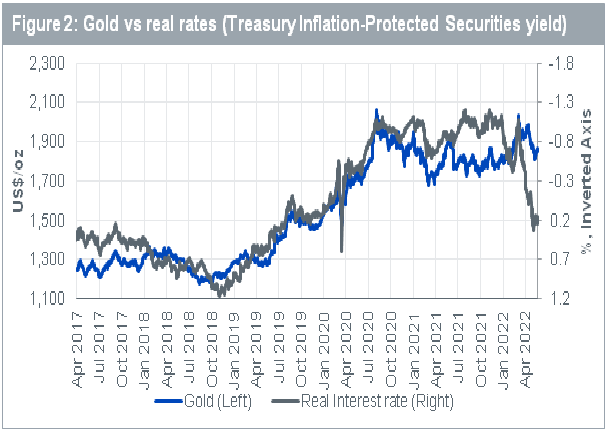

Gold keeps on defying bond headwinds

We have observed that gold is holding up well relative to bond markets, breaking down the traditionally strong relationship between gold and Treasury Inflation-Protected Securities (Figure 2). Gold is an asset that generally performs well in adverse economic and financial conditions. With fears of a recession rising, investors are increasingly turning to gold as a hedge. We have seen 7.3 million ounces of inflows into global gold exchange-traded commodities (ETCs) in the year so far to 24 May 2022 (compared to a net outflow of 9.2 million ounces in full year 2021)[5].

Source: Bloomberg, WisdomTree. 5 April 2017 to 24 May 2022. Historical performance is not an indication of future performance and any investments may go down in value.

Stagflation could be good for gold

Traditionally, recessions tend to moderate price pressures. However, when price increases are generated by external shocks, we may not see that come to effect. Market pundits are increasingly talking about ‘stagflation’ – a recession combined with high inflation. Today, we are facing energy price shocks and food shortages – consequences of the COVID pandemic and the war in Ukraine. The impact of these events does not appear to be fading as much as many had hoped.

Episodes of stagflation are extremely rare and, therefore, making quantitative conclusions from them is fraught with difficulty. Between Q3 1973 and Q1 1975, US GDP[6] had been declining in real terms and, over that period, inflation rose from 7.4% to 10.3%[7]. Gold prices had risen 73% in that time frame[8]. In the late 1970s, we also saw economic deceleration[9] combined with accelerating inflation, with gold prices more than doubling in calendar year 1979.

Silver riding on gold’s coat-tail, for now

Using our revised base case gold forecast, our silver model indicates that silver prices are likely to rise to US$25.89/oz (from US$21.93/oz[10]) by Q1 2023. Mining capital expenditure has been rising in recent years and that could drive silver out of a supply deficit in the coming year. We assume that manufacturing activity (proxied by manufacturing Purchasing Manager Indices) will continue to moderate but won’t fall below 50 (that is, won’t contract in outright terms).

Our silver forecast indicates that the gold-to-silver ratio (Figure 3), which is currently elevated[11], could moderate a little.

Source: WisdomTree (forecasts: 30/06/2022 – 31/03/2023), Bloomberg (historic data: 01/06/1990 – 24/05/2022). Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

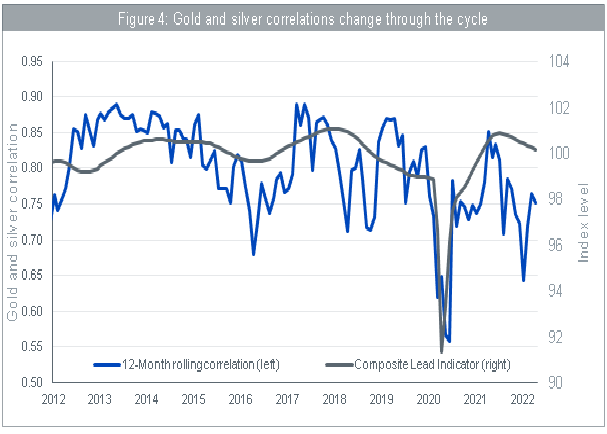

A recession could treat silver differently to gold

Our silver model assumes that the metal’s sensitivity to gold prices is broadly stable through the economic cycle. However, in reality, the correlation between the two metals fluctuates (Figure 4). We believe that if recession becomes the main driver of the gold price, manufacturing activity could contract, placing negative pressure on silver, while gold prices continue to rise. That could send the gold-to-silver ratio higher.

Source: Bloomberg, OECD, WisdomTree. OECD Composite Lead Indicator is a gauge of economic activity designed to provide early signals of turning points in business cycles. Correlations based on monthly returns. January 2012 to April 2022. Historical performance is not an indication of future performance and any investments may go down in value.

Conclusions

Gold and silver are facing headwinds from higher bond yields and an appreciating US Dollar, but stubbornly high inflation should see their prices continue to rise.

To stress, a recession is not our base case scenario, but markets are increasingly worried about the economy tipping over. Gold could outperform silver in such a scenario.

Disclaimer: This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

[2] Source: Bloomberg, 24/05/2022

[3] Source: Bloomberg, 24/05/2022

[4] Source: Bloomberg, 24/05/2022

[5] Source: Bloomberg, 24/05/2022

[6] Gross Domestic Product

[7] Source: Bloomberg

[8] Source: Bloomberg

[9] Although the economy was decelerating, the US only fell into the technical definition of a recession in 1980 (that is, with two consecutive quarters of real GDP decline)

[10] Source: Bloomberg, 24/05/2022

[11] Is more than a standard deviation above the average since 1990