The seaborne trade in dry bulk commodities provides a strong indication of the changing dynamics in global commodity demand. The import of dry bulk commodities (iron ore, coal, grains and minor bulks such as fertiliser) by ship accounts for approximately one-third of overall dry bulk trade, with the rest being transported across land across fixed routes borders (for example, by truck and rail).

The seaborne trade gives a strong indication of who the marginal buyer in the market is. That kind of information is important to know if you want to understand the motivations of different physical commodity market participants, and how committed they are.

Iron ore is the most important driver of dry bulk shipping demand, estimated to account for around 29% of demand by weight. Coal (both thermal and coking) is in second place with 17%, followed by grains (including corn, wheat, oilseeds and sugar) with 13%. The remaining 41% includes commodities such as steel products, forest & agricultural products, fertiliser, cement and petroleum coke among others, and are covered under the umbrella term of minor bulk commodities.

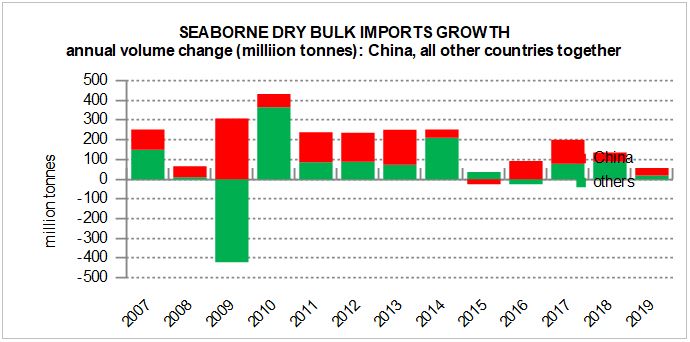

The chart below shows the annual incremental growth in dry bulk imports between 2007 and 2019 with China in red and the Rest of the World (RoW) in green. During that period China accounted for 55% of growth in global dry bulk commodity imports.

Apart from the disruption to global trade in the aftermath of the Great Financial Crisis (2009-10), the last time that China played the role of the marginal dry bulk importer was in 2014. Growth in fixed asset investment slumped to a 13 year low, while agricultural demand also slowed weighing on seaborne dry bulk commodity imports.

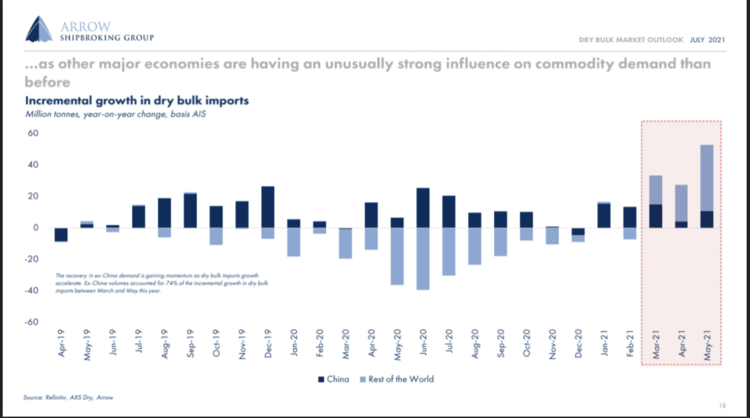

However, since the end of Q1 2021, it has been RoW that is in the driving seat accounting for almost 75% of incremental growth in dry bulk commodity demand.

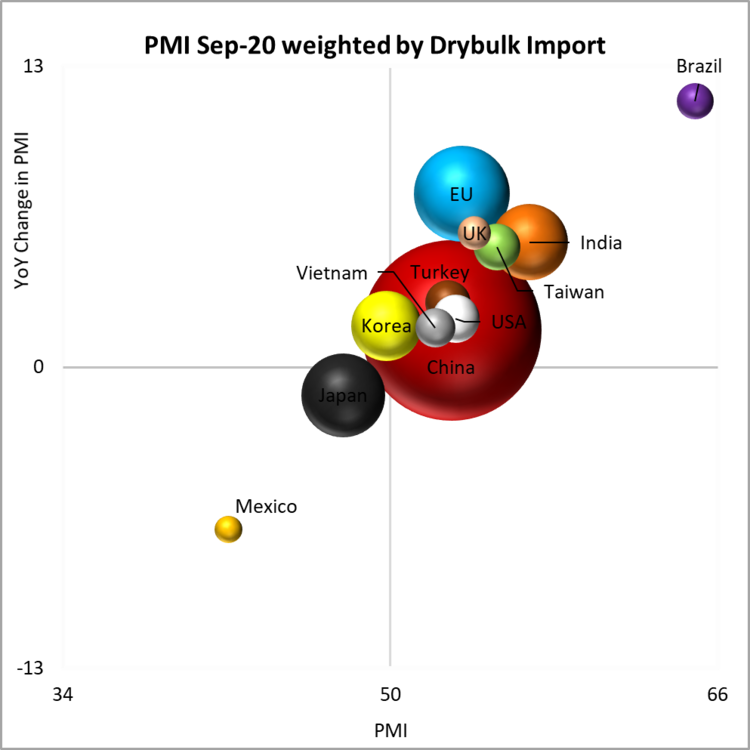

Who are the main countries outside of China driving seaborne dry bulk commodity demand? The chart below shows the main dry bulk importing countries during 2019 – the bigger the circle, the higher their seaborne dry bulk imports. Excluding China the biggest sources of dry bulk demand in 2019 were the EU, Japan, India and South Korea.

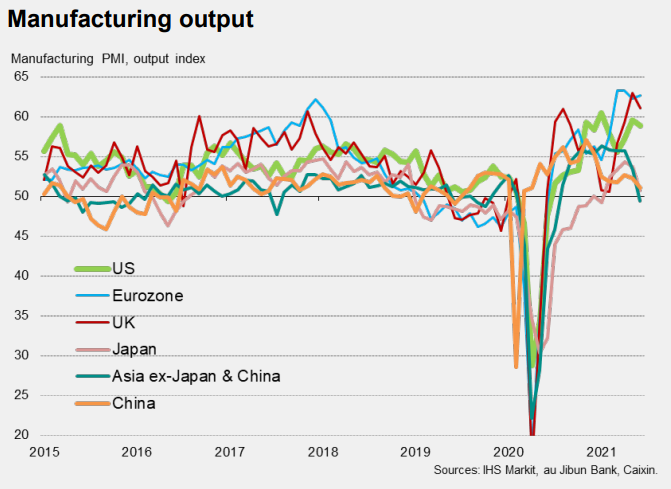

But recent trends in manufacturing output suggests that it is the UK and the rest of Europe that are the marginal drivers of seaborne dry bulk commodity demand. While European manufacturing activity has surged since the start of 2021, other countries vital to dry bulk demand have faltered. Japan, India and to a lesser extent South Korea have all seen marked declines in activity in recent months.

Overall then it is Europe that is the marginal driver of dry bulk commodities. Any slowdown in Europe – perhaps due to a faltering vaccination campaign, or the emergence of more virulent strains – is something to watch out for in coming months.