Has the price of gold had an overreaction?

The US Federal Reserve (Fed) just completed its fourth Federal Open Market Committee (FOMC) meeting of the year, an event that is beginning to garner increasing amounts of attention from market participants. Following the meeting’s conclusion on Wednesday, 16 June, the central bank has now signalled that its first interest rate hike may come in 2023 instead of 2024.

So, has the Fed now adopted a hawkish stance? Should markets be spooked? At WisdomTree, we don’t think so. What the central bank has done amounts to forward guidance, a mechanism for managing market expectations. This was extremely important for the Fed to do to maintain its focus on stabilising prices and maximizing employment without risking becoming the cause for major market volatility. Monetary accommodation from the central bank remains at crisis levels – something that is no longer required for an economy that is starting to find its footing.

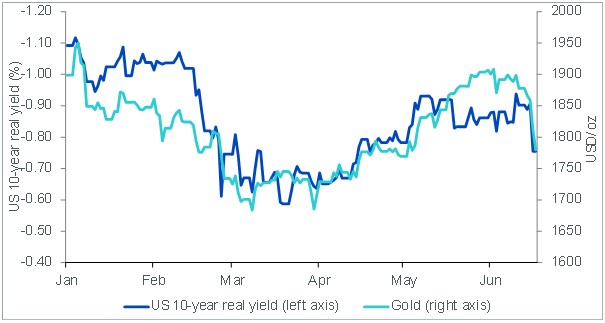

Figure 1: Gold and real rates have both responded strongly to the Fed's latest meeting

Source: WisdomTree, Bloomberg. Data as of 17 June 2021. Historical performance is not an indication of future performance and any investments may go down in value.

Now, it is hard to disentangle any discussion on inflation with what is happening in the world of gold. Since the start of the second quarter, gold has been upwardly mobile, responding favourably to rising levels of inflation (see Figure 1). Most recently, annual inflation in the US came out at 5% for May, up from 4.2% in April, and well above consensus estimates1. In Have we entered ‘The Great Inflation 2.0’?, we discussed how some of the forces driving inflation are unlikely to be transitory. If inflation is here to stay, hedges against it are also likely to be strategic, rather than tactical, in nature.

In the blog, we also argued that markets, on aggregate, endorse the view that inflation is likely to be higher for longer. This is evident from the sustained increases in breakeven rates in recent months. Despite this, gold prices have fallen sharply following the Fed’s latest meeting. If we were to anthropomorphise markets, this seems like cognitive dissonance. If long term inflation expectations have risen significantly, the actions from the Fed should not come as a surprise. Markets should be prepared for the Fed to at least start considering tapering unprecedented levels of monetary support unless markets are counting on the central bank to make policy errors.

But short-term bouts of irrationality tend to get corrected. Such is the wisdom of the ‘invisible hand’. If inflation numbers continue to be high in the coming months, markets may come to terms with the Fed doing what it must to fulfil its mandate. Gold’s price decline following the central bank’s latest meeting may seem like an overreaction in hindsight.

Sources:

- Trading Economics

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance