Dichot(econ)omy: Can inflation be deflationary? Of course, demand destruction is part of the cycle. But also yes in a more immediate sense depending on which basket of goods or services you are looking at. A few weeks back I commented that “core inflation is minded to backslide when real wages lower and non-core is ripping because of inelasticity of demand for food and energy….core was a measure for pre-pandemic not now”.

Now the proof from Walmart (NYSE:WMT): “Food inflation is double digits and higher than at the end of Q1. This is affecting customers’ ability to spend on general merchandise categories and requiring more markdowns to move through the inventory, particularly apparel.” Right, so high food and energy prices means you have less money to spend on discretionary items. No way, who could have predicted this...? WMT shares plunged 9% in after-hours trading as it said this impact would lower its Q2 and full 2023-year forecasts. We knew that working through all that inventory was not going to be easy, but it seems to have been harder than expected for Walmart and suggests consumers are not wearing higher prices so well anymore.

Obviously, it’s easy to see why this happens. But it also highlights the problem in measuring economic growth today post-COVID. A lot depends on who you talk to, and what you use to measure it. An example is internet search: free but fundamental to the economy. How do you measure its impact? And we know that the labour market was upended in ways not seen before – getting workers to the right parts of the economy will take time. Stimulus has filled consumers’ pockets but earnings are not keeping pace – when does this mean people stop spending? Walmart suggests this is happening now.

US GDP data comes out this week and it’s anyone’s guess. Economists see +0.4% annualised growth quarter on quarter. The Atlanta Fed’s GDPNow model sees -1.6%. Meanwhile the White House is quietly trying to redefine what a recession looks like. In a blog last week, the administration argues that “it is unlikely that the decline in GDP in the first quarter of this year—even if followed by another GDP decline in the second quarter—indicates a recession”. This is kind of interesting, as apart from the obvious gaslighting that has become the new normal from this administration (and many other governments), it points to a genuine dichotomy. How can the US economy be in a recession when the labour market is strong and inflation is running at around 9%?

The Dallas Fed economic survey was an interesting snapshot of the US economy right now – it either going great guns or it’s a recession depending on who you talk to. Comments from the survey respondents showed a very wide variation. For example, whilst one respondent said: “Consumer goods demand continues to drop dramatically. I have been forced to temporarily close one production site,” another respondent noted: “We have gotten stupid busy and will stay this way through July and August. We have some really large jobs coming up, making for hectic times on the plant floor.”

Even within one sector, chemicals, businesses are seeing different things. “The concerns of a looming recession have increased over the last month,” says one, while another says: “Business activity and sales remain solid. Our focus is pushing prices to recover margin.”

The general business activity index declined five points to -22.6, but the outlook improved, and inflation moderated. US consumer confidence data comes out today. Ultimately, it’s all about inflation – is the economy larger or small in real terms, allowing for inflation. This is all that matters, and strong labour markets can easily mask the fact that whilst people are holding onto their jobs (unlike in past recessions), they are not feeling good since wages are not keeping pace.

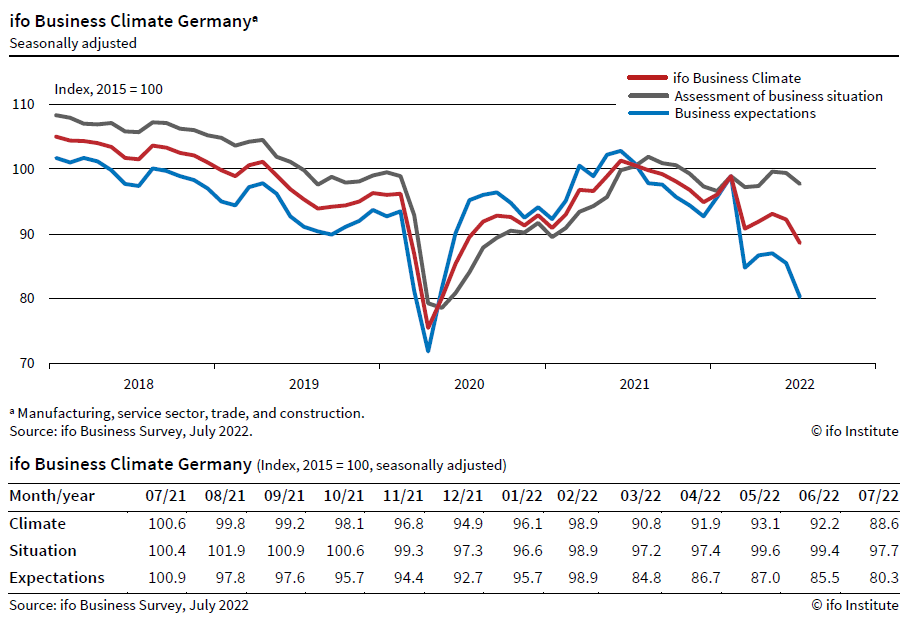

Across the pond, the German economy looks to be on the brink of recession. Yesterday’s Ifo Business Climate Index fell to 88.6 points in July, down from 92.2 points in June. Higher energy prices and the threat of a gas shortage continue to weigh on the economic outlook and the figures underscore the downbeat mood among businesses highlighted by last week’s PMI surveys. Meanwhile, there are murmurings about Italy’s access to the EU’s €800 billion COVID recovery fund – of which Italy has €200 billion earmarked – being under threat with the departure of Mario Draghi. The worry – as noted after last week’s ECB meeting – is that structural reforms required to get access to funds will be delayed or scrapped, which could put further pressure on Italian debt and prevent the country from being eligible for the TPI regime...doom loop.

Elsewhere, Alibaba (NYSE:BABA) shares jumped 5% overnight as it announced plans for a dual primary listing in Hong Kong. Unilever (LON:ULVR) shares rose as it revealed it has increased prices 11% to cope with higher cost input inflation. Underlying sales growth hit 8.1%, with 9.8% from price and –1.6% contribution from volume. Amazon (NASDAQ:AMZN) also said it will increase the cost of its Prime membership.

Energy lifted the FTSE 100 to its best in a month at 7,350 as oil prices bounced. Front month WTI and Brent have both climbed around $5 from yesterday’s lows and virtually closed the Sunday night open gap lower. US said to end SPR releases in the autumn…presumably the day after the mid-terms?

European bourses are down – Russian gas shenanigans not helping sentiment on the continent. Gazprom (MCX:GAZP) said supplies through Nord Stream 1 would drop to 20% of capacity. US futures are lower after a mixed session on Wall Street saw the S&P 500 almost flat, the Dow up a bit and the Nasdaq lower by 0.43% as tech fell again post Snap (NYSE:SNAP) earnings. Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL) today are looking to steady things.

Compass Group (LON:CPG) +10% this year and another strong report as travel, leisure and sport return. Indeed, it’s not just back but booming: underlying revenue at 109% of 2019 levels and margins improved despite inflationary pressures. With the good performance the company is increasing FY 2022 organic revenue growth guidance from around 30% to around 35%. Management also confirmed operating margin guidance of over 6% and now expects exit margin to moderate slightly from around 7% “due to the strong net new performance and ongoing inflationary pressures”.