The consequences for economic activity from a change in the price of natural gas will depend on its cause. If the price of natural gas is driven higher by an increase in demand, then the economy is likely to continue to expand, and perhaps at a fast pace. On the flipside, an increase in the price of natural gas that is driven by a reduction in natural gas supply will unequivocally lower productive potential around the world.

High natural gas prices observed in 2021 are the result of a combination of demand and supply side factors. On the demand side, there has been a rebound in manufacturing output, higher aircon consumption due to recent heatwaves and high carbon prices incentivising the burning of gas rather than coal. On the supply side flows of natural gas from Russia have been lower than normal, while LNG cargoes have been diverted to Asia where prices have been even more attractive than in Europe.

Although commentary about the impact of higher natural gas prices tends to focus on electricity generation and heating, its worth noting that natural gas demand from business is equally important. In 2016 industry accounted for around one-quarter of European gas demand while consumption by commercial end users accounted for around 12%. Meanwhile, residential and power generation each represented around one-third of overall natural gas demand. Arguably its C&I users of natural gas where the biggest adverse economic impact will be felt.

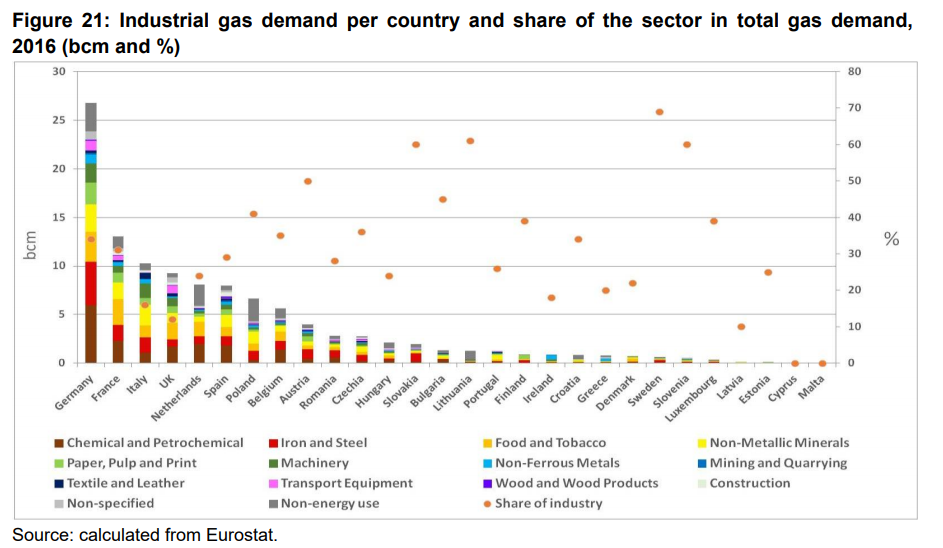

Absolute levels of natural gas demand are heavily concentrated in a small group of countries across the EU + UK; 8 countries accounted for 80% of industrial gas demand in 2016. However, the overall share of gas consumption from industry varies significantly between countries according to analysis by OIES. While industry accounts for less than 15% in the UK, Italy and Latvia, it accounts for 60-70% in Slovakia, Lithuania, Sweden and Slovenia. This suggests that high natural gas prices are likely to be of much greater concern in the capitals of these latter four countries.

The demand for natural gas tends to be very price inelastic in the short term. This means that end users need to see a period of sustained high prices before they are able or willing to entertain changing their consumption patterns. Businesses typically cannot react quickly enough to a sudden spike in gas prices, either by reducing consumption or switching to an alternative. In contrast, gradual increases in natural gas prices tend not to be so damaging to economic growth; businesses may be able to adjust more smoothly.

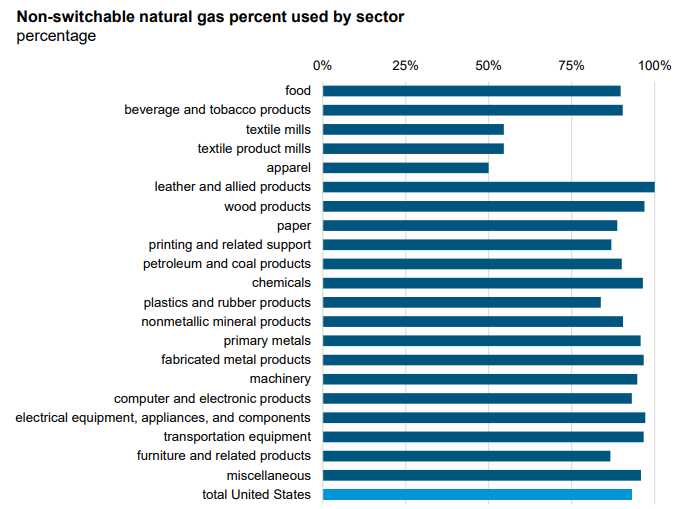

Although not directly comparable to the situation in Europe, evidence from the US EIA 2018 Manufacturing Energy Consumption Survey shows how difficult it can be to switch to alternative fuels. Overall, the percentage of natural gas demand by US industry that could not be switched to an alternative fuel source was 93% in 2018. Apparel, textile mills and textile product mills reported that only around 50-55% of their natural gas usage could not be switched. The most common explanation given by US manufacturers for why they could not switch was that their equipment is not capable of using another fuel. Depending on their pricing power, industries affected by higher gas prices may not be able to pass on the higher costs onto their consumers. If they are unable to they will face a negative hit to their profit margins.

Major C&I consumers of natural gas tend to be insulated from the spot price of gas, at east for a time. Long-term contracts (mainly one year, but often longer) reduce their exposure to high and volatile natural gas prices. Some natural gas supply contracts (~20% in Europe) are linked to the price of oil rather than natural gas, further reducing their exposure. Overall though, businesses whose natural gas contracts are coming up for renewal ahead of winter (October is the main contracting date in the UK) are likely to be shocked at the degree to which prices have increased. Expect many manufacturers to be signalling that price increases are on the way, while others – where their survival is at stake – will be screaming for governments to do something, anything to relieve the pressure.