GBP/USD Above 1.40 After Encouraging UK Employment Data

It’s been a relatively busy start to trading on Wednesday, with data from the UK and eurozone dominating so far and giving investors there cause for optimism.

The pound is flying against the dollar again, aided by some more encouraging labour market data out of the UK. Unemployment remained at 4.3% in the three months to November, with overall employment rising by more than 100,000 as the economy continues to shrug off Brexit-related headwinds even against the backdrop of lower growth. There was also encouraging news on earnings, with basic wage growth edging up to 2.4%, although this is still well below inflation meaning consumers continue to experience negative real growth.

Once again this leaves the Bank of England in a difficult position because the labour market is clearly tightening and wages are improving which would typically warrant higher interest rates but this is being accompanied by decelerating growth and huge economic uncertainty, not the ideal environment in which to hike. The central bank may have raised rates last year but this was when inflation was at its peak and it’s not expected to go higher. There may have also been a desire to remove the post-Brexit stimulus as the economy proved more resilient than expected. Policy makers may adopt a more cautious approach this year.

Eurozone PMIs Lift EUR/USD to Three Year Highs

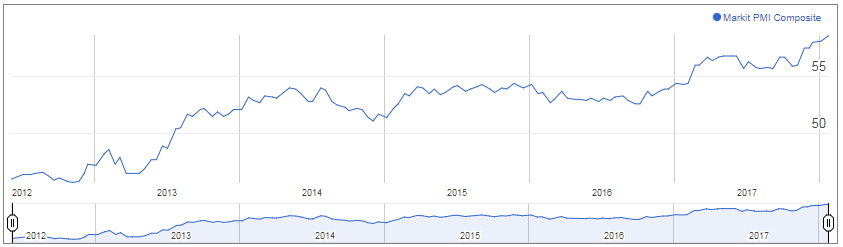

The euro is also making solid gains against a flagging dollar, with the pair now trading at more than three year highs, which has been aided by another batch of encouraging flash PMIs from the eurozone for January. The flash composite PMI rose to a 139-month high this month, with both the manufacturing and services sectors signalling strong optimism, providing further evidence that the region is going from strength to strength.+

The region has benefited from the improved global economic environment and a weaker euro and the latter could be a challenge for it over the course of this year. The ECB is going to be very aware of this but will also be under pressure to remove further monetary support even as it brings an end to new bond purchases later this year. Traders are clearly already anticipating further tightening measures including at least one rate hike in 2019, which may be much earlier than many expected a year or two ago.

USD Looking For a Lift From US PMIs and Housing Data

The gains we’re seeing in the pound and euro isn’t helping European stocks this morning, with the FTSE off around half a percent and the DAX down a few points. US equity markets are eyeing a positive start to trading on Wednesday, with more data on the agenda including manufacturing and services PMIs as well as existing home sales and crude inventories.

Disclaimer: This article is for general information purposes only. It is not investment advice, an inducement to trade, or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. Ensure you fully understand all of the risks involved and seek independent advice if necessary. Losses can exceed investment.