Yesterday has been a negative day for the Nasdaq but the other two big US indexes have reported profits.

The S&P 500 finished at +0.16%, the Nasdaq ended the trading session at -0.47% and the Dow Jones closed at +0.60%.

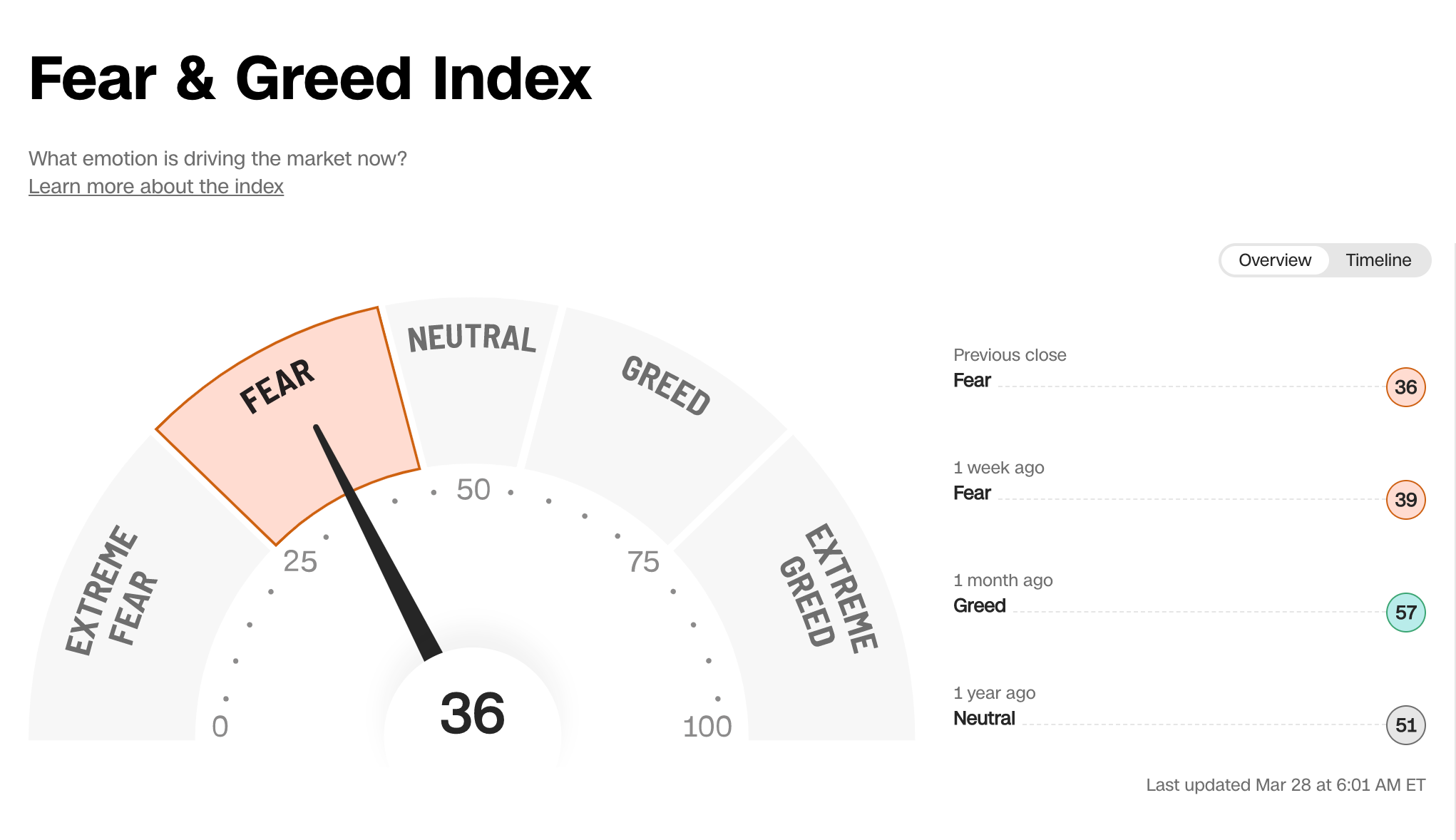

The investors' sentiment is Fear, as indicated in the graph below:

Sentiment indicator - Fear & Greed Index

The market sentiment is 36, in “Fear” mode, the same as last week.

First Citizens Bank to buy SVB

Silicon Valley Bank collapsed after its emergency moves to handle a wave of withdrawal requests and a huge loss on its securities holdings.

That was the biggest banking failure in the US after the financial crisis of 2008.

Last Friday, the Treasury Secretary called an emergency meeting of the Financial Stability Oversight Council, to discuss the US banking system and they reassured the public with a clear statement: "the U.S. banking system remains sound and resilient".

On Monday, First Citizen Bank (in coordination with the FDIC, part of the Financial Stability Oversight Council) announced its willingness to buy e failed Silicon Valley Bank.

The news had a positive impact on the banking shares, in particular, the share price of First Citizen Bank jumped 44%.

US and China governments are on different paths

We all know that the Federal Reserve is implementing a historically restrictive monetary policy to bring down too high inflation.

At the same time, however, in China is happening exactly the opposite.

The Chinese government is trying to stimulate its economy after the prolonged lockdowns, by providing funds to businesses so they can grow and hire more people.

There is clearly a different policy approach between the major world economies.

What to watch today

At 3:00 GMT, the US consumer confidence index for March will be released.

It is forecasted to decline to 101.

Financial markets could be volatile.

Follow me

If you find my analysis useful, and you want to receive updates when I publish them in real-time, click on the FOLLOW button on my profile!

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US and China are implementing opposite monetary policies

Published 28/03/2023, 12:44

Updated 28/07/2023, 11:55

US and China are implementing opposite monetary policies

Wall Street finished mixed on Monday

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.