Tinexta provides IT solutions, information and consulting services in niche markets, predominantly to corporate clients. It has leading or strong market positions in the majority of its businesses, which have structural growth drivers. Management’s strategy of diversifying its services and geographic expansion via M&A and subsequent organic growth has generated improving financial metrics, while remaining shareholder friendly with respect to cash returns and a robust balance sheet. Our discounted cash flow (DCF)-based valuation is c €41 per share.

Share price performance

Business description

Tinexta has four divisions: Digital Trust, solutions to increase trust in digital transactions; Credit Information & Management, services to manage credit; Innovation & Marketing Services, services to help clients develop their businesses; and Cyber Security, services to help digital transformation.

Structural growth drivers

Tinexta is exposed to favourable growth trends, including the transition to a digital economy with a requirement for enhanced online security; governments’ desires to stimulate innovation and growth; and the internationalisation of trade. Management’s strategy is to further develop the group by expanding domestically and/or internationally, and to offer more services in ‘highly innovative areas’ to existing and potential new clients, while seeking cross-selling opportunities between the business units. As a result, Tinexta is likely to make further acquisitions. To date, management’s strategy has proven to be very beneficial to its growth prospects, profitability, free cash flow generation and ROIC.

Strong organic growth for revenue and profits

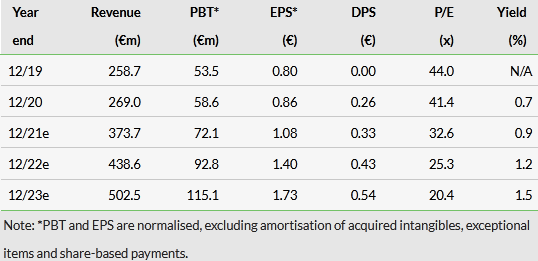

We are introducing forecasts for FY23 to be consistent with management’s customary three-year business plan, and to include the medium-term growth of a new venture with Intesa Sanpaolo (MI:ISP) that increases distribution of services and other M&A. For FY21–23, we forecast an organic revenue CAGR of c 12% and a reported EBITDA CAGR of c 21%. This compares favourably with Tinexta’s historical growth due to its greater exposure to higher growth markets. Following H121 results, we upgrade our FY22 EBITDA forecast by c 6%, due mainly to M&A. Underlying positive free cash flow supports a dividend pay-out ratio of c 33% and leaves plenty of headroom for likely strategic acquisitions. Excluding future potential acquisitions, we see the balance sheet (end FY21e net debt to EBITDA 2.6x due to recent M&A) de-gearing quickly (we forecast 1.0x by end FY23).

Valuation: DCF-based valuation of c €41 per share

Tinexta’s prospective EV/EBITDA multiples (19.2x, 15.5x and 12.9x) and P/E multiples (32.6x, 25.3x and 20.4x) for FY21e, FY22e and FY23e are at a premium to historical multiples, reflecting an improving business mix, growth rates and profitability. Our DCF points to a valuation of c €41 per share.

Click on the PDF below to read the full report: