- Benjamin Dean, Director, Digital Assets, WisdomTree

On August 23, 2021 Visa (NYSE:V) announced, “As we enter a new era of non fungible tokens (NFTs)-commerce, Visa welcomes CryptoPunk #7610 to our collection. Visa bought it for the equivalent of USD$150,000. Setting social media alight – a nice marketing move – this is far from the most expensive purchase made across thousands of newly ‘minted’ non-fungible tokens .What does the recent craze in NFTs tell us about the current and future opportunities presented by the digital asset space?

Pictured: CryptoPunk #7610

Non-fungible tokens is a term used to refer to the latest craze in digital assets. In essence NFTs are non physical digital collectibles – similar to baseball cards or stamps.

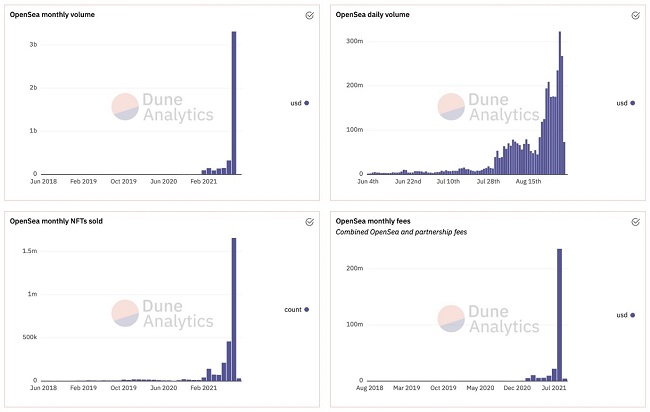

At a technical level, NFTs have been possible for a long time. Ethereum Improvement Protocol 721 was released in 2017 and allowed people to create unique (‘non-fungible’) tokens on the Ethereum network. Over the years teams and companies have been experimenting on and iterating around ideas and concepts built using this standard. Most NFTs are traded via online marketplaces such as OpenSea or Veve. In a bumper August OpenSea saw USD$3.4 billion dollars in trading, which was 10 times more than the previous month. When people want to buy items on these platforms they must first purchase a coin or token. These platforms tend to be interoperable with a variety of digital asset networks: those who use Ethereum buy ETH, for Polygon they buy MATIC or if they use Solana then SOL. The market prices of these tokens have also risen over recent months, partly as a consequence of the NFT boom.

Source: Dune Analytics

Historical performance is not an indication of future performance and any investments may go down in value.

But who makes these NFTs? Individuals or teams of people typically write computer code that generates a collection (commonly 10,000) of images with a set of probabilistically determined attributes. Some of these attributes are rarer than others – some are more desirable. In other cases artists or photographers post their original works in the hopes of taking advantage of the reach of the internet-wide customer base. If purchased sometimes the physical works of art are also shipped to the purchaser.

A striking element about this space is the extent to which projects, companies and teams engage with communities for creation, curation and publicity. The artists collaborate with communities of potential buyers as they come up with sometimes zany concepts like CryptoPunks, Boneheads or Art Blocks.

Moreover consumers that have bought a unique character, create their own back story or personality around their newly acquired digital collectible. These consumers hope that their creations will catch-on, similar to the way that comic book writers did in the past, and that the value of their creation (i.e. intellectual property) will subsequently increase.

This community creation and promotion dynamic, coupled with the perception of some NFT collections as being a status symbol amongst the community, has led to some eye-popping prices. At the same time, most purchases on OpenSea via the Matic network were less than USD$100 equivalent during August.

Major brands have taken notice and have been piling on board. For instance, the Chicago Bulls have created their own ‘legacy series’ of digital collectibles. Marvel is on board with VeVe to distribute their own NFTs based on their extensive libraries of characters. La Liga has recently signed a deal with Sorare to post NFTs of their players. These brands see an opportunity to monetise their existing intellectual property in a new way via NFTs.

Going forward, Keep your eye on two emerging trends. The first is whether these brands can harness the open-source, community-led creation process and get a cut of the novel IP that results from it. The second is the convergence of the NFT with video games. Any gamer will tell you that they have been buying what are essentially NFTs for years – special items like rare swords. Watch as the NFT space is woven into the coded fabric of major video games, which have been much bigger than Hollywood in terms of revenue for years. Axie Infinity has already discovered this business model and clocked the equivalent of USD$485m in revenue during August 2021. The game is particularly popular in the Philippines, which points to the global potential of this nascent market.

While the NFT craze will eventually cool down, the process of iterative, entrepreneurial experimentation could lead to new business models, which would enable the funding and creation of new intellectual property. Now that it has been shown that the technology works – other use cases beyond art could emerge in traditional finance. This could help form the next wave in digital assets over the coming years.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.