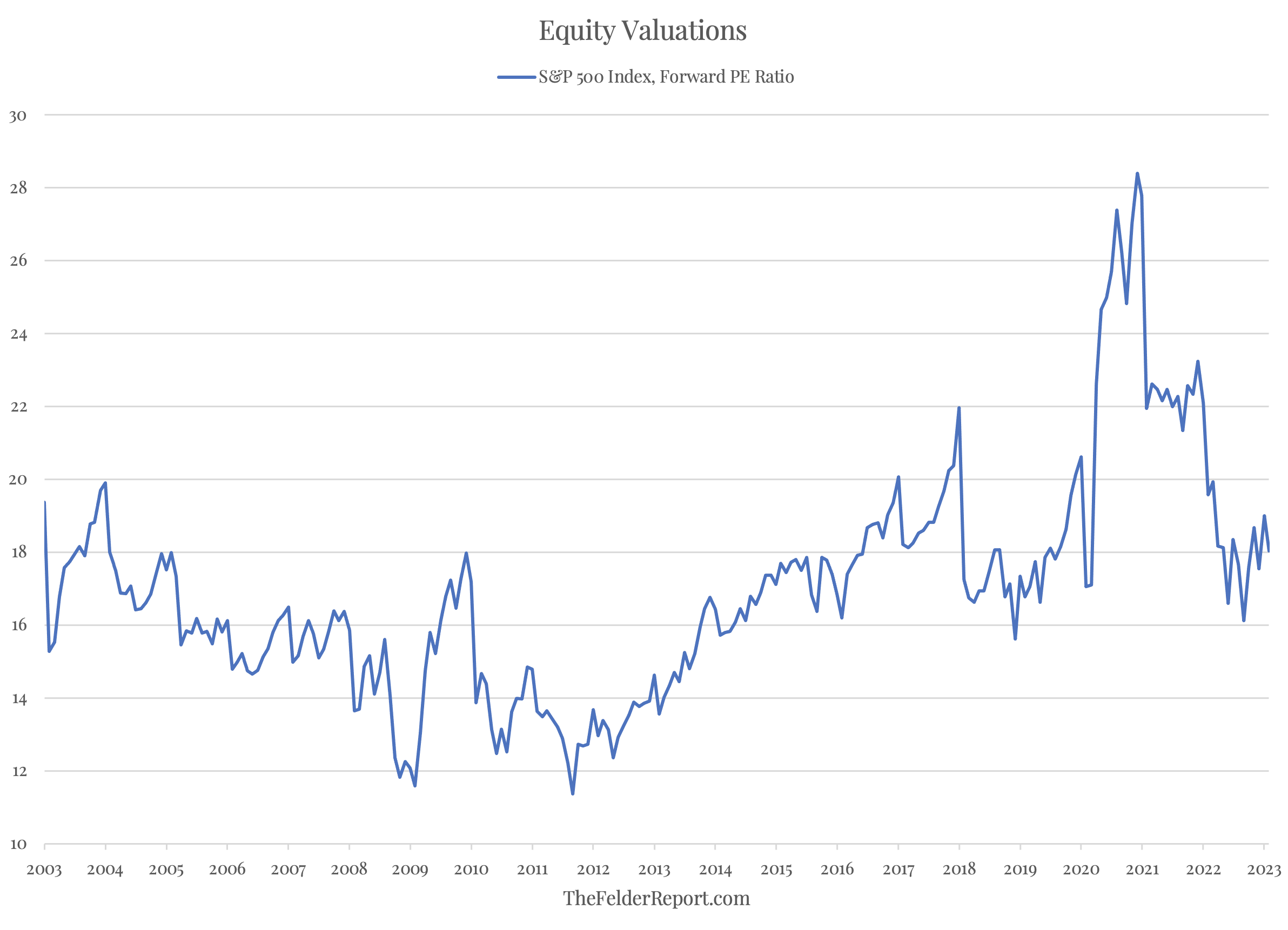

After the painful decline in stock prices last year, many investors have concluded that this now represents another terrific buying opportunity. And if you look just at earnings-based valuation measures, you could be forgiven for thinking that, while they may not be inordinately cheap, equity valuations are no longer extreme.

The forward price-to-earnings ratio shows the S&P 500 trades at a multiple of around 17, near its average over the past two decades.

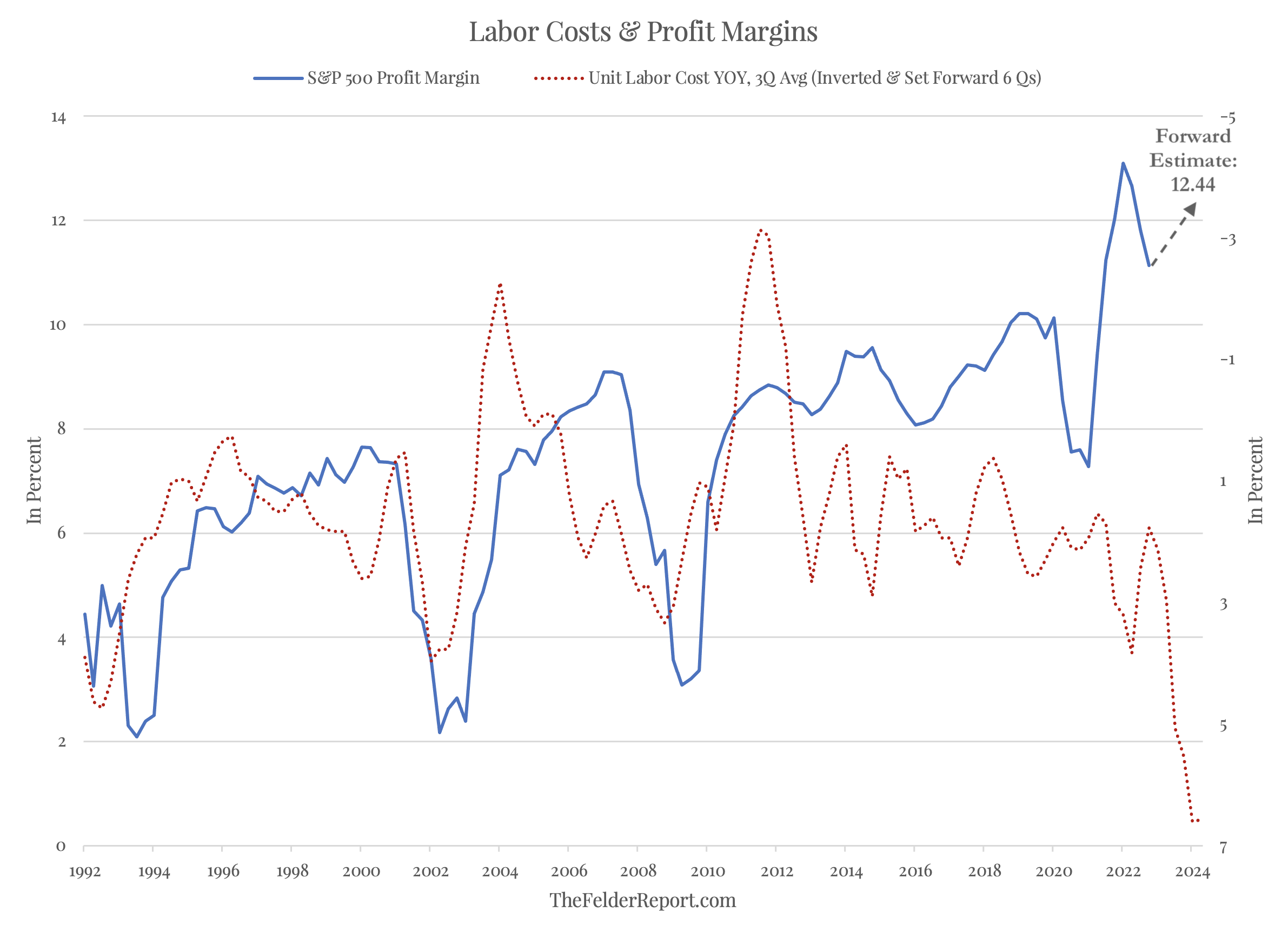

What this measure obscures, however, is the fact that the profit margins supporting those earnings are still obscene. Moreover, estimates assume the recent decline in margins will soon reverse and that they will return nearly to record highs.

Certainly, there are at least a few reasons (like the strength in the dollar, interest rates, and oil prices over the past couple of years) to be skeptical of this optimistic analysis. Rapidly rising labor costs typically lead to margin declines greater than that we have already seen, and labor costs have already risen faster than at any point in the past thirty years.

If profit margins continue to fall over the course of this year rather than reverse higher as expected, the denominator in those forward price-to-earnings ratios could decline dramatically, revealing the fact that equity valuations were never really all that reasonable in the first place.

They only appear that way today as the result of some specially heroic assumptions on the part of equity analysts.