So much for a quiet start to a busy week!

With more than 30% of the companies that make up the S&P 500 reporting earnings this week alone, stock traders knew it would be a hectic one, and some no doubt hoped they could cruise uneventfully through at least the first session of the week before the pandemonium kicked off.

It was not meant to be however, as Tesla (NASDAQ:TSLA), potentially the most actively-traded stock on the planet, absolutely exploded higher on news that rental company Hertz is ordering 100,000 vehicles to build out its EV fleet by the end of 2022. At $4.2B, this marks the single-largest purchase of EVs in history. Some analysts believe this lays the groundwork for other rental companies to make similarly large purchases, paving the way for more adoption of the brand among the general population. Separately, Elon Musk’s company was boosted by an upgrade at Morgan Stanley (NYSE:MS) and news that its Model 3 was the first EV to top new car sales in Europe last month.

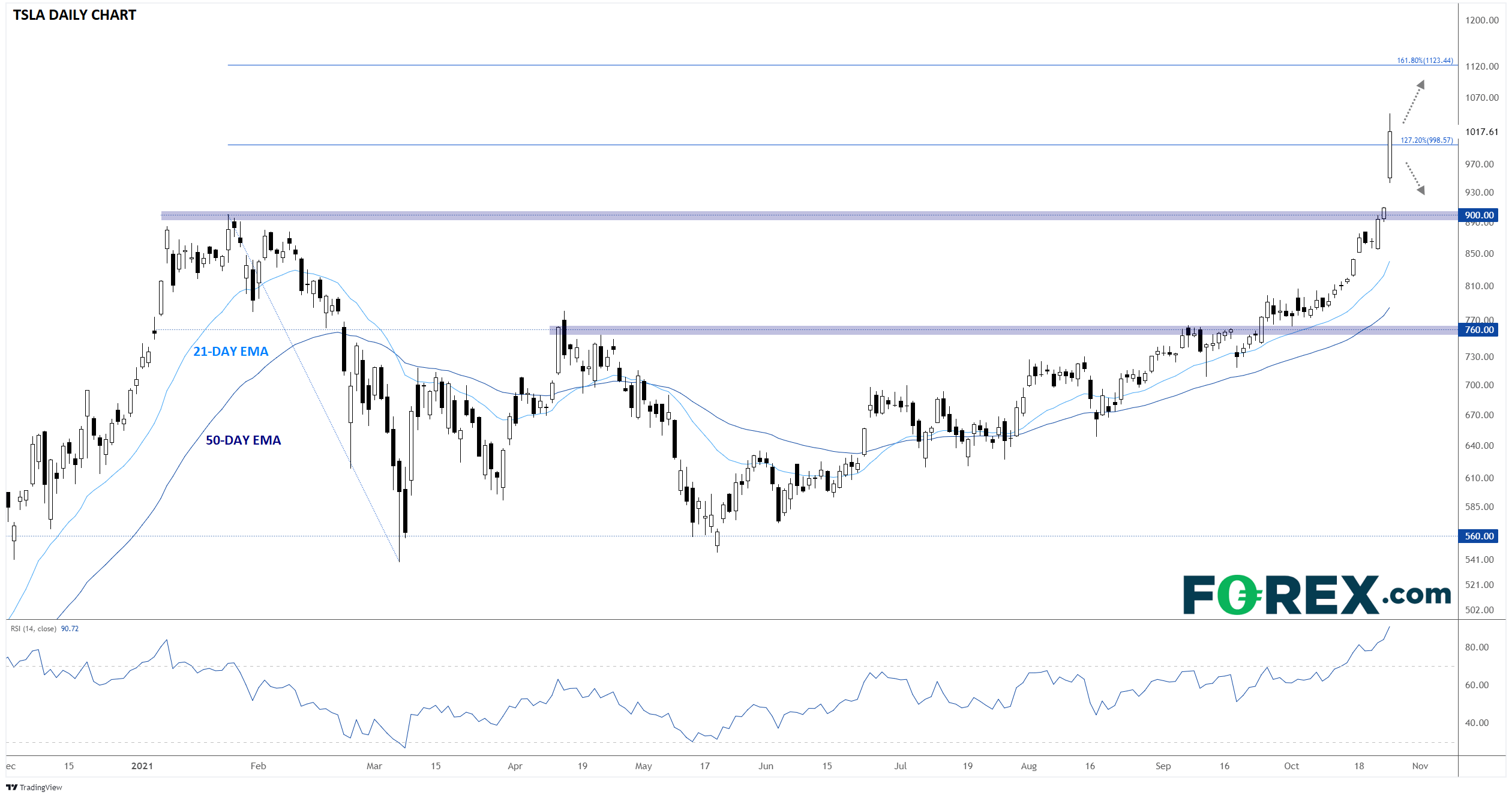

Speaking of Musk, today’s big rally in Tesla (see chart below) has led to a surge in his net worth, making him arguably the richest person to ever walk the planet at roughly $250B. As for the company itself, today’s move has driven Tesla’s market capitalization above $1T, putting in the rarified “quadruple comma” club with (only) Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Google (NASDAQ:GOOGL), and Amazon (NASDAQ:AMZN) as other such members.

Looking at the stock, it's clear that the $1,000 level served as a big psychological target once we closed above $900 for the first time on Friday. Moving forward, it will be critical to watch whether shares can hold above the key $1,000 level this week, an area that coincidentally also marks the 127.2% Fibonacci extension of this year’s biggest dip. Above $1,000, the next level to watch from a technical perspective will be the 161.8% Fibonacci extension near $1,125; meanwhile a break back below previous-resistance-turned-support at $900 would throw the near-term bullish bias into question.

Source: TradingView, StoneX