The S&P 500 closed out November on a record high as the month becomes the best performing of 2024, up 5.7%.

S&P 500 monthly chart

Past performance is not a reliable indicator of future results.

The post-election rally did a lot to help the index push to record highs as Donald Trump’s pro-business stance saw investors start of the month with a positive note, which was carried through till the end.

That said, investors have also been cautious of Trump’s tariff policies and how that could impact inflation and growth in the future. But for now, concerns seem to have been put on the back burner. In fact, Trump’s selection of nominees with more moderate profiles seems to have calmed some of the nerves, hoping that perhaps his policies will be softer.

This week, market attention will turn to the US jobs data on Friday and Jerome Powell’s speech on Wednesday. Markets continue to monitor the expected path of interest rates over the coming 6-12 months and this week could set up the playing field for December’s meeting. Current pricing shows a 60% chance of a 25 basis point cut on December 18th but we could see the odds shift this week.

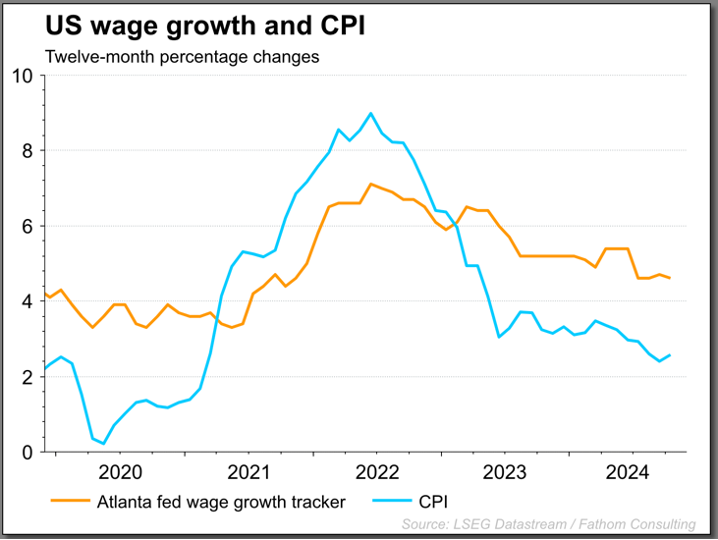

The latest Consumer Price Index readings have shown inflation has stopped falling whilst some areas of the economy are seeing an uptick in price pressures. This has led to a re-pricing of rate expectations in markets, with up to 150bps of cuts priced in for the first nine months of 2025, to just 67bps as of now. This has led to expectations of a higher terminal rate which can affect growth and company productivity in the future.

However, the Federal reserve has a double mandate. Alongside inflation, the jobs market plays a key role in determining monetary policy. The tightness in the labour market seen in the post-pandemic era has started to unwind, but there is still residual strength in the economy, which is preventing rates from coming down quicker. The latest job report saw the unemployment rate remain unchanged at 4.1% but the number of jobs added in October was significantly lower than anticipated, which was in part attributed to external shock events.

A key reading in Friday’s data will be the wages component. Average hourly earnings measure the change in the amount of money businesses pay for labour, and it can have a significant impact on overall inflation. Earnings have come in higher than expected in the past three months which has helped to derail expectations of rate cuts. Forecasts show a decrease in the monthly reading is expected so another strong print could push the rate expectations for December back towards a 50/50 split.

Past performance is not a reliable indicator of future results.

Rate expectations will also be influence by Jerome Powell’s speech on Wednesday. Investors will likely be playing close attention to try and figure out if there are any further clues about the Fed’s expected rate path given the latest events. In the past, Powell has been careful to not give too much away as he intends to give the central bank enough margin to operate and adapt if things change, and it is likely that this time will be no different.

As for markets, US stocks look to start the week a little softer after the Thanksgiving holiday weekend. The major equity indices are seeing some selling pressure in the European session, but the momentum could change once the US traders come online.

On the daily chart, the S&P 500 has started a bearish divergence with the price and RSI. Whilst the price saw a new high on Friday, the RSI posted a lower high, which suggests the short-term momentum could change as buying has slowed. A key level to watch out for could the 5,855 level where the 50-day SMA converges with the October highs and the November lows.

S&P 500 daily chart

Past performance is not a reliable indicator of future results.

Capital Com is an execution-only service provider. The material provided in this article is for information purposes only and should not be understood as investment advice. Any opinion that may be provided on this page does not constitute a recommendation by Capital Com or its agents. We do not make any representations or warranty on the accuracy or completeness of the information that is provided on this page. If you rely on the information on this page, then you do so entirely at your own risk.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

S&P 500 Closes at Record High in November, Us NFPs, Powell Speech in Focus

Published 02/12/2024, 14:28

S&P 500 Closes at Record High in November, Us NFPs, Powell Speech in Focus

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.