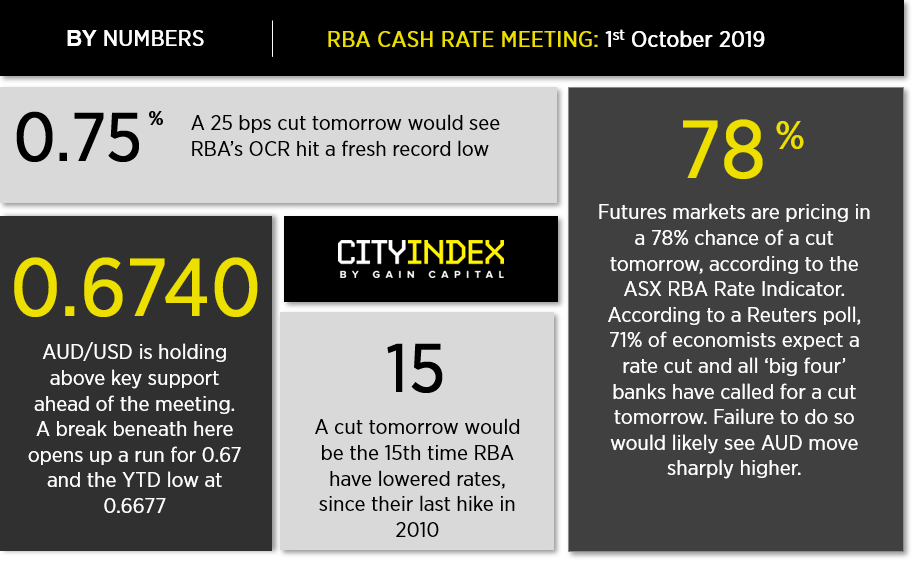

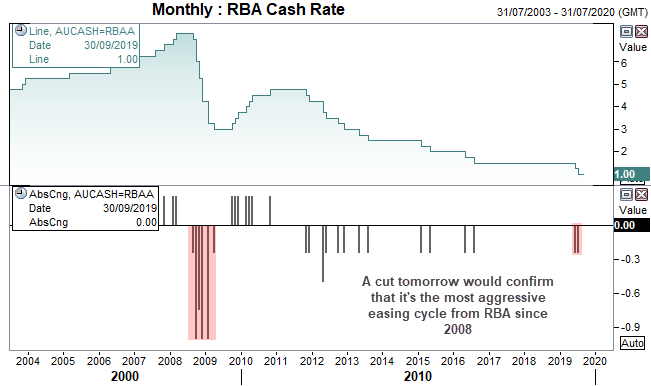

RBA are expected to cut rate tomorrow by 25 bps, to a new record low of 0.75%. RBA last cut rates back in July, having already done so in June to shave 50 bps over the two months, which takes the total amount of cuts to 14 since their last hike in 2010. Interestingly, if RBA are to cut again tomorrow, it will be the first time they have cut three or more times over 5-month period since 2008.

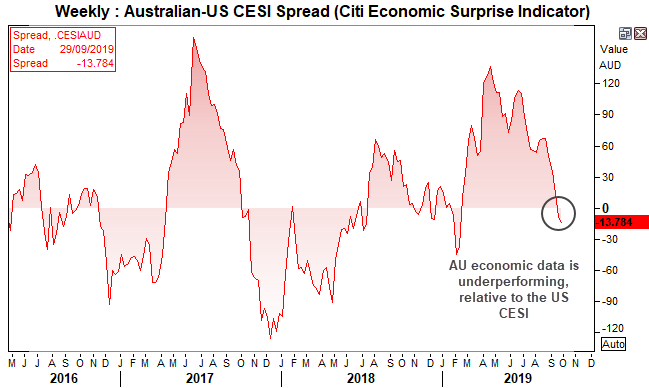

And this could well be the case after unemployment rose. The CESI indicator shows that economic data has underperformed relative to expectations these past two weeks, so there does appear to be a case for another cut. And futures markets an economists agree, with a 78% probability of a cut tomorrow being implied by the ASX RBA Rate Indicator and 71% of economics polled by Reuters also on board with this outcome. If we look at the 1-year OIS, it suggests a 92% chance of rates being at 0.5% in 12 months which leaves room for one more cut. Of course, we don’t expect RBNZ to want to have a higher cash rate, so any movement from RBA increases the likelihood of another cut or two from RBNZ.

As we noted on Friday, several AUD pairs sit at key levels ahead of tomorrow’s RBA meeting. With markets expecting a cut, it may be down to whether RBA signal further easing in their statement which help decides whether we see a bearish follow-through on AUD. Obviously, the biggest upside threat for the Aussie is if RBA hold rates and refrain from a dovish statement, although we suspect this is a low probability outcome given they’ve remained dovish when speaking publicly. So if they opt to effectively confirm a cut in Q4, it should see AUD spike lower, at least temporarily.

The analysis remains unchanged since Friday; the daily trend remains bearish, so the bias is for a downside break whilst it remains beneath the 0.6806 high.

AUD/CAD has seen an intraday breakout from compression ahead of the UK open. The dominant trend remains bearish and the cycle highs sit around 0.8978 and 0.9020. Following the completion of an ABC correction at 0.9144, we now expect AUD/CAD to head for (and possibly break beneath) the 2010 low. We doubt it will break upon first attempt but it makes a suitable interim target for bears.

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient.

Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.