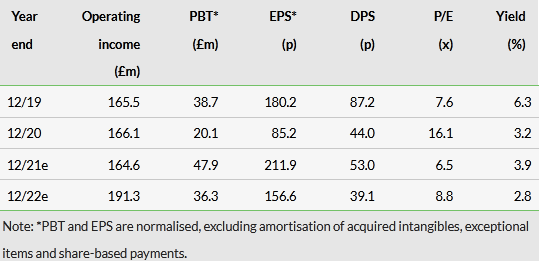

Secure Trust Bank (LON:STBS) (STB) reported H121 PBT of £30.7m, boosted by a net impairments reversion of £1.1m (vs a net charge of £19.8m in H220). The good news on provisions had been previously flagged by management. Loan arrears have remained lower than expected and most borrowers have returned from payment holidays. Loan demand is picking up and loans grew 1.3% (core division loan growth of 2.6%) in the six months to 30 June 2021. STB also announced a new 25% payout dividend policy along with a surprise 20p interim dividend. This policy better matches the bank’s growth strategy of organic and opportunistic acquisitions. We have raised our FY21 earnings forecasts to reflect lower impairments while trimming FY22 EPS by 11% (ROE forecast 9.5%) to reflect higher costs as the bank expands. Our fair value has edged to 2,234p from 2,163p per share.

Share Price Performance

H121: Significant impairment reversions

The impairment reversions were centred in the motor finance and retail finance segments, which are STB’s higher-margin businesses. The impact was most significant in motor finance, which had a 7.1% charge as a percentage of average loans in FY20 and there was a net reversion of 3.4% of loans in motor finance in H121. We are forecasting a 3% charge in FY21 (as UK government economic support measures are tapered) followed by 4% in FY22.

Optimism leads to a new dividend policy

Despite some words of caution by management in its statement regarding pandemic economic risks, the bank is optimistic about growing its balance sheet. STB is well capitalised with a CET1 ratio of 14.2% in H121, but the new dividend policy seems well balanced by allowing for a good dividend stream while giving management comfortable flexibility to expand. We forecast 24% growth in loans for FY22 after a more modest 2% this year.

Valuation: Fair value of 2,234p per share

We obtain a fair value (FV) of 2,234p per share using a net asset value (NAV) approach. We continue to assume a sustainable return on equity (ROE) of 13.5%, a 10% cost of equity (COE) and 2% annual growth. The FV is the present value (PV) of the (ROE-g)/(COE-g) formula at end 2022 discounted to FY21. The 2,234p value implies an FY21e P/BV of 1.4x; STB is currently trading on a 0.8x P/BV ratio. A slightly higher forecast book value (dividends and slightly higher FY21–22 combined earnings) led to the small upgrade in fair value.

H121: Turning the corner

Impairments reversal

The highlight of the H121 numbers was the significant reversion of provisions that led to a net provisions release of £1.1m (0.1% of average loans). The impairment charge had been 1.7% of average loans in H220 and we were estimating a 1.6% charge for FY21 (£38m). We note that the significant release of provisions in the first half of 2021 is not unique to STB, as other British and European banks have also done so as asset quality has remained better than envisaged when making impairments under the IFRS 9 forward looking provision rules.

Loan arrears have remained low during the first half of 2021 and most of the borrowers that had not already returned from payment holiday at the end of FY20 did so during H121. The extension of the furlough system into H221 by the government along with other support measures have been very helpful.

As a result, the reported PBT of £30.7m in H121 is significantly boosted by this unusual impairment level. The pre-provision profit line was down -28% to £28.9m y-o-y and down 16% on the previous six months. The decline in pre-provision profitability has been due to still depressed activity levels (less fees) but also due to higher expenses. Operating costs have been affected by STB investing to start growing again and because some costs that had been postponed from the peak of the crisis in FY20. The reported cost to income ratio of 64% in H121 was above the average level for STB. We estimate it to decline to 59% in FY22 as the bank expands and revenue picks up. STB’s interest margins have remained resilient with the bank able to further reduce its cost of borrowing in H121.

STB’s capital position remains quite comfortable with a CET1 of 14.2% at the end of H121.

Click on the PDF below to read the full report: